Harvard, a Media Company 媒体公司哈佛

Harvard Business Review is a surreptitious media giant.

哈佛商业评论》是一家神秘的媒体巨头。

Actionable insights 可行的见解

If you only have a couple minutes to spare, here’s what investors, operators, and founders can learn from Harvard, as a media company.

如果您只有几分钟时间,那么作为一家媒体公司,投资者、经营者和创始人可以从哈佛学到什么。

There are different paths to success. The Harvard Business Review (HBR) was founded in 1922 and struggled to breakeven for more than 25 years. Today, it’s one of the world’s most impactful media organizations.

成功之路各有不同。哈佛商业评论》(HBR)创刊于 1922 年,在超过 25 年的时间里一直在为盈亏平衡而挣扎。如今,它已成为全球最具影响力的媒体机构之一。Media can turn expenses into revenue. Plenty of businesses devote time to content marketing. But by building a media arm worth paying for, companies are able to turn marketing expenses into a revenue stream.

媒体可以将支出转化为收入。很多企业都在内容营销上投入时间。但是,通过建立一个值得付费的媒体部门,企业能够将营销支出转化为收入来源。The next HBR could be built by a startup. Edtech companies and fundraising platforms look well-positioned to run the Harvard playbook and create a durable, valuable media arm.

下一个《哈佛商业评论》可能由一家初创公司打造。教育科技公司和筹款平台看起来完全有能力效仿哈佛的做法,创建一个持久、有价值的媒体部门。Adapt or die. HBR adapted its content and form multiple times over its history to appeal to contemporary readers. It did so while preserving its foundational value.

要么适应,要么死亡。哈佛商业评论》在其历史上曾多次调整其内容和形式,以吸引当代读者。在保持其基础价值的同时,它也做到了这一点。

Harvard Business School is a bigger media company than Forbes.

哈佛商学院是一家比《福布斯》更大的媒体公司。

Though best known as a home for higher learning, America’s most prestigious scholarly institution is sneakily, surreptitiously also a publisher par excellence with financials to match.

这所美国最负盛名的学术机构虽然是最著名的高等学府,但同时也是一家出色的出版商,其财务状况与之不相上下。

Since its founding in 1922, the Harvard Business Review (HBR) has become a defining voice in the media landscape, bolstering the authority and reputation of its parent organization, while simultaneously bringing in hundreds of millions in revenue.

自 1922 年创刊以来,《哈佛商业评论》(HBR)已成为媒体领域的一个重要声音,在提高其母公司的权威性和声誉的同时,也为其带来了数以亿计的收入。

It begs the question: is Harvard Business School a media company in disguise? And if it is, who else might unknowingly be a publisher, wrapped in another business?

这就引出了一个问题:哈佛商学院是否是一家伪装的媒体公司?如果哈佛商学院是媒体公司,那么还有谁会在不知情的情况下成为被其他业务包裹的出版商呢?

We’ll interrogate these questions in today’s piece. In particular, we’ll touch on:

我们将在今天的文章中探讨这些问题。我们将特别探讨

HBR’s long road to success.

HBR 的漫长成功之路How the Review compares to other publishers.

评论》与其他出版商的比较。The case for Harvard as a media company.

哈佛作为一家媒体公司的理由。Other media empires in the making.

正在崛起的其他媒体帝国

Let’s begin. 让我们开始吧。

History: A Slow Burn 历史缓慢燃烧

Arch Shaw thought it was a terrible idea. Five dollars? Five?

Arch Shaw 认为这是个糟糕的主意。五块钱?五块钱?

No one would pay that much for a magazine, he was certain. Especially one designed to bring business knowledge to the masses.

他确信,没有人会花那么多钱买一本杂志。尤其是一本旨在向大众普及商业知识的杂志。

Wallace Donham, Dean of Harvard Business School, had reason to trust Shaw. Not only had the Michigan native made his name in the media industry, he’d done so in business. Founded in 1900, Shaw’s Spectrum was known as “the magazine for business” and boasted a robust readership. It didn’t hurt that he’d both attended and lectured at Harvard in the years since.

哈佛商学院院长华莱士-多纳姆有理由相信肖。这位密歇根人不仅在媒体行业声名鹊起,在商业领域也是如此。肖的《光谱》杂志创办于 1900 年,被誉为 "商业杂志",拥有众多读者。此后几年,他还在哈佛大学进修和讲学,这对他的事业也不无裨益。

Those qualities had convinced Donham to make Shaw the official printer for his new initiative: the 1922 launch of the Harvard Business Review. But the two men had reached an impasse — precisely the sort that would be covered by the publication in years to come — before it had gotten off the ground: pricing.

这些品质说服了唐纳姆,让肖成为他新计划的官方印刷商:1922 年创办《哈佛商业评论》。但是,在《哈佛商业评论》起步之前,两人就陷入了僵局--这也正是该刊物在未来数年中要面对的问题:定价。

In the end, the Dean won out, convincing Shaw to stay on as publisher despite their differing viewpoints. Though Donham agreed that $5 was a premium for an annual subscription ($81.42 today), he believed HBR would merit it. After all, who else was opening up the school’s incipient “case methodology” for public consumption?

最后,尽管两人观点不一,院长还是说服肖继续担任出版人。虽然唐纳姆也认为每年订阅费 5 美元(现在是 81.42 美元)有些贵,但他相信《哈佛商业评论》值得这样做。毕竟,还有谁会将学校刚刚起步的 "案例方法论 "公之于众呢?

So ended the first strategic quandary of HBR — solved through intuition rather than incisive research.

就这样,《哈佛商业评论》的第一个战略难题--通过直觉而非精辟的研究解决了。

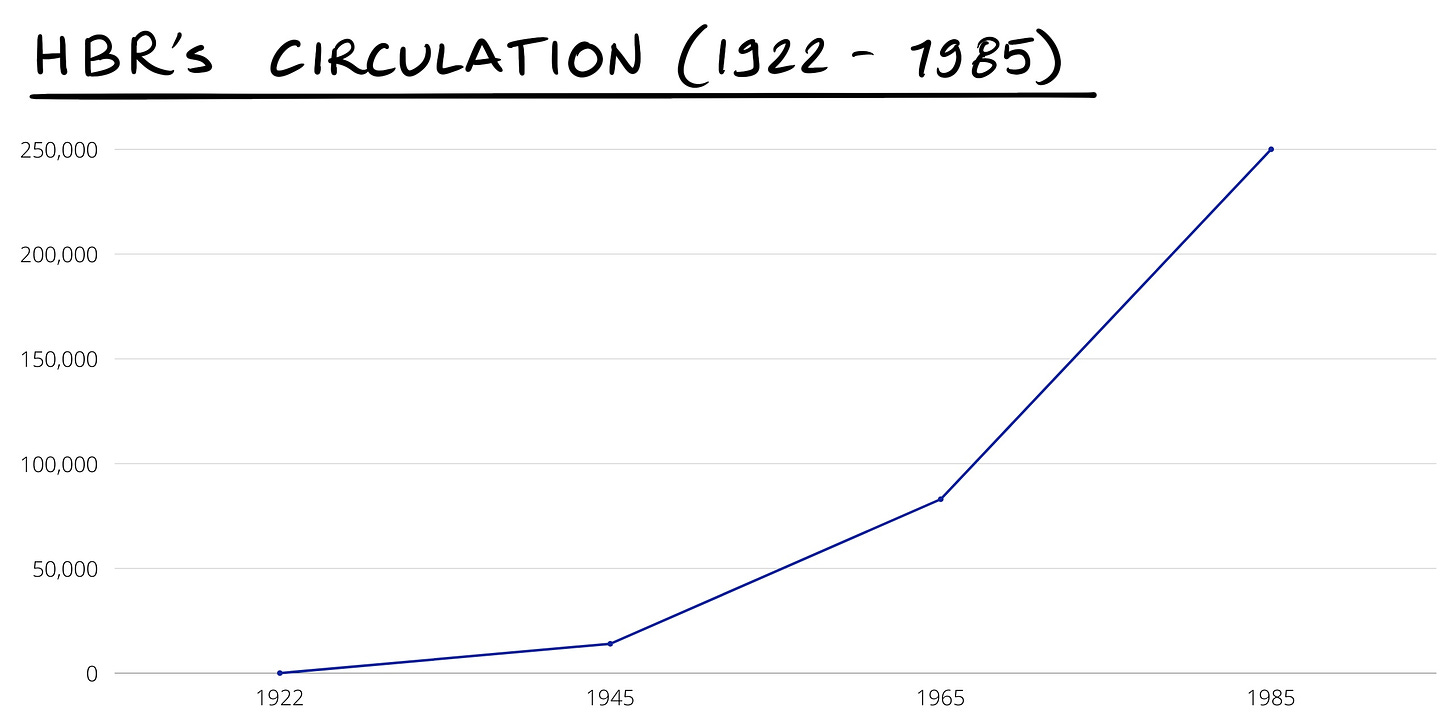

Over the following years, the wisdom of Donham’s decision would be called into question. By 1945, HBR had racked up just 14,000 subscribers, a rate of 600 new customers a year. Unsurprisingly then, the publication struggled to keep the lights on.

在接下来的几年里,唐纳姆的决定是否明智备受质疑。截至 1945 年,《哈佛商业评论》的订户数量仅为 14,000 个,每年新增订户 600 个。不出所料,该刊物难以为继。

That wasn’t to say the offering wasn’t valuable or influential. Indeed, even at a small circulation, HBR showed a willingness to talk about business issues with real impact. In 1935, for example, one piece highlighted the role of women in the workplace. In tandem with such topics, theorists like Donham used the Review’s pages to advance their views on management, contributing to an increasingly sophisticated field.

这并不是说《哈佛商业评论》没有价值或影响力。事实上,即使发行量很小,《哈佛商业评论》也愿意谈论具有真正影响力的商业问题。例如,在1935年,有一篇文章强调了女性在职场中的作用。在讨论这些话题的同时,像唐纳姆(Donham)这样的理论家也利用《哈佛商业评论》的版面发表他们对管理的看法,为这一日益成熟的领域做出了贡献。

The acuity and rigor of the product paid off in the aftermath of World War II. With the US economy undergoing hypergrowth, and consumer culture entering the foreground, HBR was well-positioned to serve a budding generation of business leaders set on finding fortune.

产品的敏锐性和严谨性在二战后得到了回报。随着美国经济的超速增长,消费文化进入人们的视野,《哈佛商业评论》已做好准备,为新一代致力于寻找财富的商业领袖提供服务。

By 1965, HBR’s circulation had reached 83,000 and by 1985, the magazine reached nearly a quarter of a million readers.

到 1965 年,《哈佛商业评论》的发行量已达 83,000 册,到 1985 年,该杂志的读者已接近 25 万。

Though its influence swelled, the core of HBR’s offering stayed the same during this period. While Donham had been wrong to price the product at such a premium, his instinct about the value of case studies had been dead on.

在此期间,虽然《哈佛商业评论》的影响力不断扩大,但其核心内容却保持不变。虽然唐纳姆错误地为产品定价,但他对案例研究价值的直觉是正确的。

Ted Levitt would help modernize that premise. Joining as editor-in-chief in 1985, the marketing professor helped create the foundations for the HBR we see today, eschewing the drab design borrowed from academia in favor of a slick, consumer-friendly offering. That was coupled with a sense of fun with cartoons adorning pages, and increasingly provocative pieces taking center stage. One particularly controversial piece argued that women in the workplace should be treated differently depending on whether or not they were parents — a view with which many disagreed.

泰德-莱维特帮助《哈佛商业评论》实现了现代化。这位市场营销教授于 1985 年加入《哈佛商业评论》并担任主编,为我们今天看到的《哈佛商业评论》奠定了基础,他摒弃了从学术界借鉴的单调设计,转而采用光滑、消费者友好的风格。与此同时,《哈佛商业评论》还加入了趣味元素,以漫画装饰版面,并将越来越多的挑衅性文章置于中心位置。其中一篇特别有争议的文章认为,职场女性是否为人父母,应该受到不同的对待--很多人不同意这种观点。

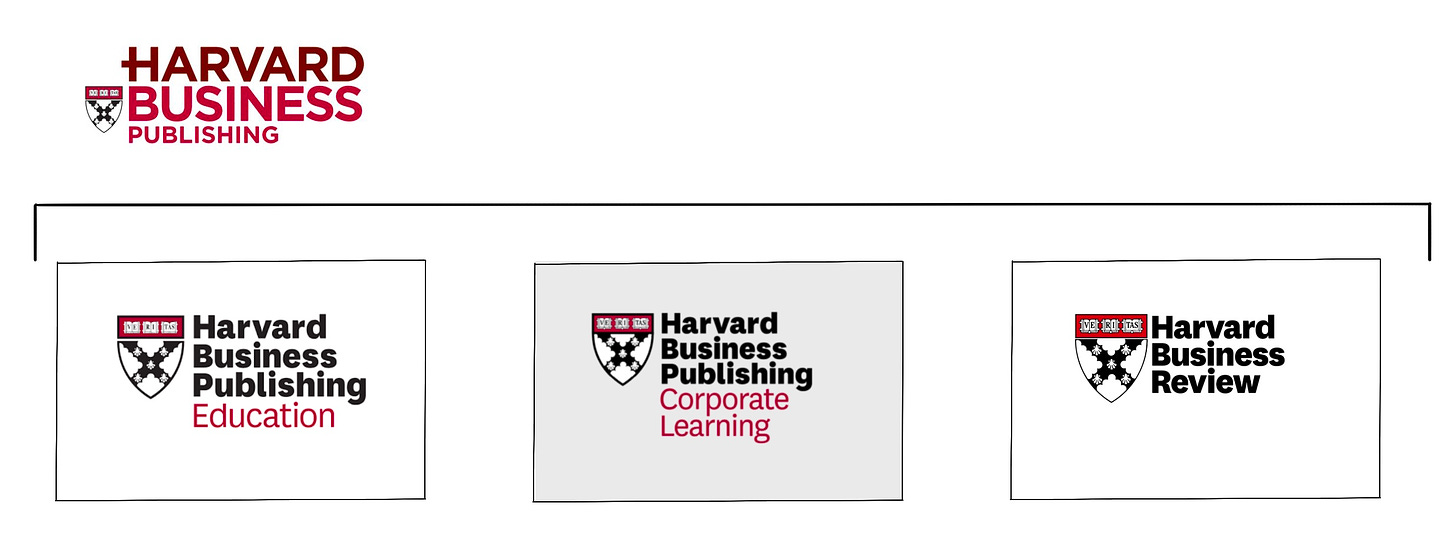

In spite (or because) of such controversy, HBR continued to grow. Its next significant change arrived in 1994, as Harvard Business formed Harvard Business Publishing (HBP) to house its media activities. This supra-division included HBR, book publishing, seminars, and other related activities, and was wholly owned by the university.

尽管(或因为)存在这些争议,《哈佛商业评论》仍在继续发展。1994 年,《哈佛商业评论》发生了下一个重大变化,哈佛商业成立了哈佛商业出版公司(HBP),以开展媒体活动。这个超部门包括《哈佛商业评论》、图书出版、研讨会和其他相关活动,由哈佛大学全资拥有。

The advent of the tech revolution prompted HBR’s most recent reinvention. Starting in 2010, the publication began to embrace more current topics of conversation as well as new modalities. Though one editor famously proclaimed “HBR will not blog” in 2004, it did eventually begin to publish its work online. That process was managed by Adi Ignatius who remains in his role as Editor in Chief.

科技革命的到来促使《哈佛商业评论》进行了最新的革新。从 2010 年开始,该刊物开始采用更多的时事话题和新的模式。尽管一位编辑曾在 2004 年宣称"《哈佛商业评论》不会写博客",但该刊物最终还是开始在网上发表作品。这一过程由阿迪-伊格内修斯(Adi Ignatius)负责,他目前仍担任总编辑一职。

Today, HBR cuts an unusual figure in the media landscape. Though well-known and respected, it often feels overshadowed by younger and buzzier offerings. As we’ll discuss, the numbers suggest HBR is not to be underestimated.

如今,《哈佛商业评论》(HBR)在媒体界的地位非同一般。尽管《哈佛商业评论》广为人知,备受推崇,但它常常被更年轻、更热门的产品所掩盖。正如我们将要讨论的,数据表明《哈佛商业评论》不容小觑。

The Modern HBR: A Media Empire

现代《哈佛商业评论》:媒体帝国

As alluded to, the Review is just one component sitting beneath the HBP umbrella. It is joined by online courses, curricula available for purchase, “podcases,” and even simulations (essentially business-themed games). These products are housed under three categories: “Higher Education,” “Corporate Learning,” and the “Harvard Business Review Group.”

如前所述,《评论》只是 HBP 伞下的一个组成部分。此外,还有在线课程、供购买的课程、"podcases",甚至模拟(本质上是以商业为主题的游戏)。这些产品分为三类:"高等教育"、"企业学习 "和"《哈佛商业评论》集团"。

This organization gives fitting credence to HBR’s leading role. With 340,000 annual magazine subscribers and 8.5 million - 10 million monthly web visitors, the Review is the clear star product. That’s been aided by its own product development.

这个组织恰如其分地证明了《哈佛商业评论》的领导地位。哈佛商业评论》每年有 34 万杂志订户,每月有 850 万至 1000 万网络访问者,是当之无愧的明星产品。这得益于其自身的产品开发。

Specifically, HBP has developed the Review into a true multi-media machine. Visitors to HBR.org can find short-form articles, long-form think pieces, videos, a series of podcasts, a “visual library,” seminars, a store, and more. Newer mediums show particular vitality, supporting younger, fresher voices. Of course, these products are joined by HBR’s original incarnation, a physical magazine.

具体来说,《哈佛商业评论》将《哈佛商业评论》打造成了一台真正的多媒体机器。访问者可以在 HBR.org 上找到短篇文章、长篇思想文章、视频、一系列播客、"视觉图书馆"、研讨会、商店等。较新的媒介显示出特别的活力,支持更年轻、更新鲜的声音。当然,这些产品还有《哈佛商业评论》最初的实体杂志。

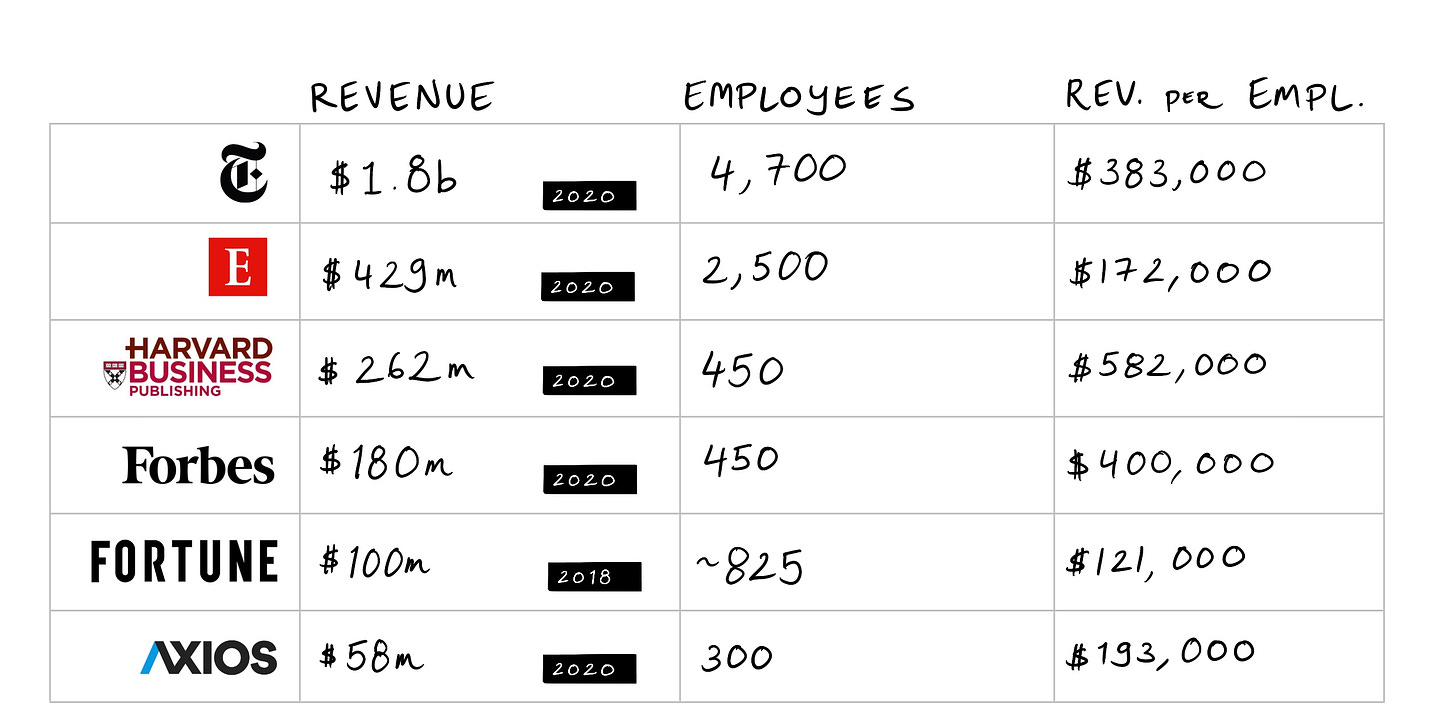

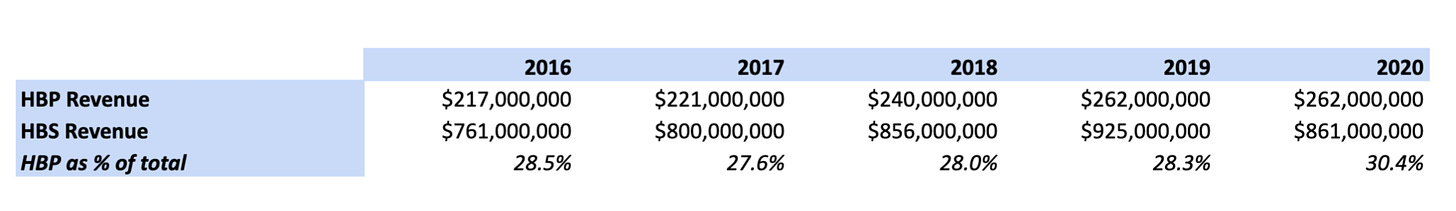

The offering appears to be working. In 2020, Harvard Business Publishing brought in $262 million in revenue, flat from the year prior. Though disappointing in isolation, that unglamorous performance looks much better when compared to the beatings many other media outlets suffered during the coronavirus lockdown. Over a five year period, revenue grew at a 3.8% CAGR.

这种发行方式似乎奏效了。2020 年,哈佛商业出版社的收入为 2.62 亿美元,与前一年持平。虽然单看这一数字令人失望,但与冠状病毒封锁期间许多其他媒体遭受的打击相比,这一不光彩的业绩要好得多。在五年的时间里,收入的年复合增长率为 3.8%。

HBP’s figures put the organization within the orbit of luminaries like The Economist while simultaneously positioning peers like Forbes, Fortune, Axios, and others in the rearview mirror. Remarkably, HBP has managed this with a considerably leaner staff, employing just 450. That gives it much better leverage than other organizations.

HBP 的数据使该机构跻身《经济学人》等著名杂志的行列,同时也将《福布斯》、《财富》、《Axios》等同行置于后视镜中。值得注意的是,HBP 的员工人数少得多,只有 450 人。这使它比其他机构更有优势。

It’s worth adding that the NYT is currently valued at close to $8.2 billion, 4.5x of last year’s revenue. If HBP were a public, for-profit organization traded on equivalent multiples, it would be valued at $1.2 billion.

值得补充的是,《纽约时报》目前的估值接近 82 亿美元,是去年收入的 4.5 倍。如果 HBP 是一家上市的营利机构,以同等倍数进行交易,其估值将达到 12 亿美元。

Credit should be given to Adi Ignatius for HBP’s performance, but of course much is owed to its business model. Like few others, HBR has nailed a “make once, sell infinitely” approach. Case studies and courses are able to command a high price (can you imagine spending $18 for a single NYT article?), require little to no added maintenance, and are of effectively evergreen relevance. While most media companies struggle to monetize their backlog, HBR’s continues to earn.

HBP 的业绩应归功于阿迪-伊格内修斯,但当然,它的商业模式也功不可没。与其他几家公司一样,《哈佛商业评论》也采用了 "一次制作,无限销售 "的方式。案例研究和课程能够卖出高价(你能想象花 18 美元买一篇《纽约时报》的文章吗?当大多数媒体公司都在为积压文章的盈利而苦苦挣扎时,《哈佛商业评论》却在不断盈利。

From a rather inauspicious beginning, HBP have landed on a powerful business model going from strength to strength. Its success may provoke its parent entity to entertain more existential questions.

HBP 从一个相当不吉利的开端,发展成为一个强大的商业模式,并不断壮大。它的成功可能会促使其母公司考虑更多的生存问题。

Harvard: The Consequences of Redefinition

哈佛大学重新定义的后果

Is Harvard a media company?

哈佛是一家媒体公司吗?

Before we can answer that question, we must first manage something rather trickier — defining what a “media company” is.

在回答这个问题之前,我们必须先解决一个比较棘手的问题--定义什么是 "媒体公司"。

That query is one debated by academics and operators with varying levels of complexity. Some will point to the distribution of content as the salient characteristic, others, the creation. The best, not-perfect-but-good-enough definition I can come up with is as follows:

学术界和运营商对这一问题争论不休,复杂程度不一。有些人认为内容的传播是突出特点,有些人则认为内容的创造是突出特点。我所能想到的最好的、并不完美但足够好的定义如下:

A media company is an organization that directly makes money by creating and distributing content for an audience, at a reliable, regular cadence.

媒体公司是一家通过为受众创造和传播内容,以可靠、固定的节奏直接赚钱的机构。

Is a company blog a media company? No. Not if it doesn’t earn money in its own right, directly. Are social media companies also media companies? Not unless they begin to create their own content. Is a novelist a media company? Only if they publish at a reliable, regular cadence.

公司博客是媒体公司吗?如果它本身不直接赚钱,就不是。社交媒体公司也是媒体公司吗?除非它们开始创造自己的内容。小说家是媒体公司吗?只有当他们以可靠、固定的节奏出版作品时才是。

This description will not withstand too much scrutiny; each element can be picked apart. But I think it does a sufficiently solid job of excluding critical edge cases, and more importantly, is no less flawed than other options.

这样的描述经不起过多的推敲,每个要素都可以被挑出毛病。但我认为,它在排除关键的边缘案例方面做得足够扎实,更重要的是,它的缺陷并不比其他选项少。

So, by this categorization, is Harvard — and specifically, Harvard Business School — a media business?

那么,按照这样的分类,哈佛--特别是哈佛商学院--是媒体企业吗?

Via its publishing arm, Harvard certainly has a vehicle that makes money by putting out analysis to a large audience, frequently. Interestingly, this subsidiary seems to be an increasingly significant part of the larger organization with HBP driving 30% of all business school revenue, a figure that rose during the pandemic. As noted earlier, a public market investor might value HBP north of $1 billion, a figure that looks significant, even when placed next to the business school’s $4 billion endowment.

通过其出版部门,哈佛无疑拥有了一个通过经常向广大读者发布分析报告来赚钱的工具。有趣的是,这家子公司在哈佛的地位越来越重要,HBP 的收入占到商学院总收入的 30%,这一数字在大流行病期间还有所上升。如前所述,公开市场投资者对 HBP 的估值可能会超过 10 亿美元,即使与商学院 40 亿美元的捐赠基金相比,这个数字也显得相当可观。

Perhaps a better question is, what benefit does Harvard receive by thinking of itself through this lens? What can reconceptualization unlock?

也许一个更好的问题是,哈佛从这个角度思考自己,会得到什么好处?重新概念化能带来什么?

Above all, scale without brand dilution.

最重要的是,在扩大规模的同时不削弱品牌。

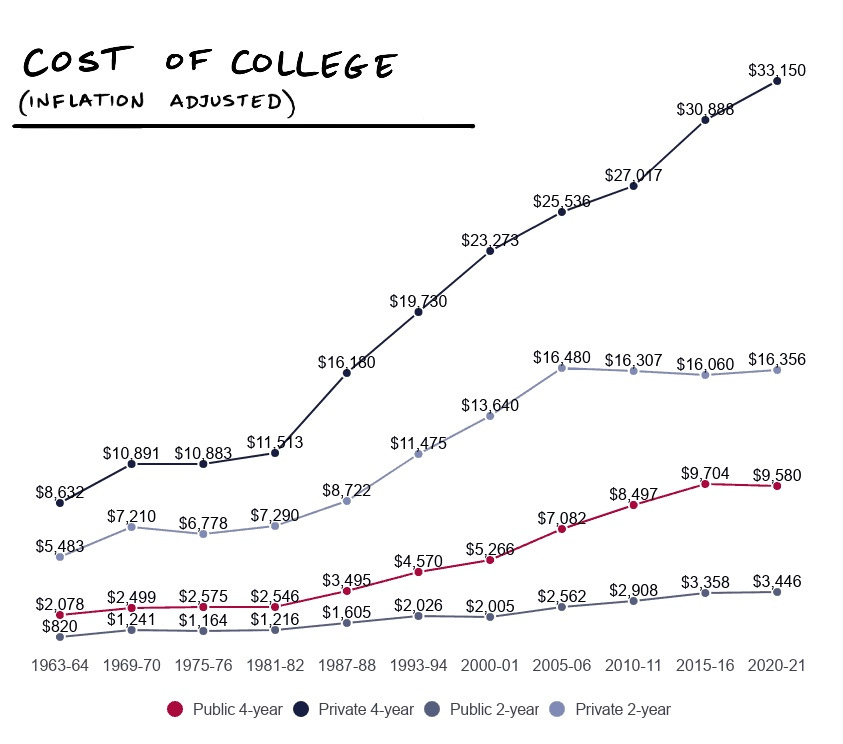

In some respects, this is the holy grail of institutes of higher learning: earning more without actually accepting more (and losing their rarified luster). Over the past forty years, most universities seem to have solved this problem by radically increasing pricing — a move that both relies on and fortifies brand power. (There’s a sort of tautology here: Harvard is worth $250,000 because it’s Harvard, and it’s Harvard because, in part, it costs $250,000.)

从某些方面来说,这是高等学府的圣杯:在赚取更多收入的同时,不会实际接受更多的东西(也不会失去其稀有的光彩)。在过去的四十年里,大多数大学似乎都是通过大幅提高定价来解决这一问题的,这种做法既依赖于品牌力量,又强化了品牌力量。(这里有一种同义反复:哈佛之所以值 25 万美元,是因为它是哈佛,而它之所以是哈佛,部分原因在于它的学费是 25 万美元)。

This cannot continue indefinitely though, particularly in a world that seems more volatile. Paying a cool quarter-million for a degree delivered in person is one thing; doing so for a Zoom room surely makes even the most affluent balk. Without continuing to increase pricing, what options do schools like Harvard have to scale without diluting their own brands?

但这种情况不可能无限期地持续下去,尤其是在一个似乎更加动荡的世界里。花 25 万美元获得一个亲自颁发的学位是一回事,但在 Zoom 房间里这样做肯定会让最富裕的人也望而却步。如果不继续提高定价,像哈佛这样的学校又有什么办法在不削弱自身品牌的情况下扩大规模呢?

Arguably, media presents the best opportunity. It is both extensible and, if done correctly, reputation enhancing; few could convincingly argue that HBR has not been a magnificent advertisement for its parent. It is also well-suited to scholastic environs. Though HBR draws its contributors from many institutions, corporations, and backgrounds, it benefits from having a sterling faculty to draw upon.

可以说,媒体提供了最好的机会。它既具有扩展性,如果操作得当,还能提高声誉;很少有人能令人信服地认为,《哈佛商业评论》没有为其母公司做一个出色的广告。它也非常适合学术环境。虽然《哈佛商业评论》的撰稿人来自许多机构、公司和背景,但它得益于拥有一支优秀的师资队伍。

What would HBS look like if it began to act like a media company? What could it do?

如果 HBS 开始像一家媒体公司一样行事,它会是什么样子?它能做什么?

Opportunities abound. For one thing, HBR’s offering is still very focused on general business. Content is broad in scope, though the publication has made efforts to expand its coverage of DEI initiatives. It’s easy to imagine a future in which HBR segments further, moving horizontally to cover different sectors explicitly. Should there be a tech-centric offering? An AI-focused sub-publication? A CPG weekly?

机会比比皆是。首先,《哈佛商业评论》仍然非常关注一般商业。尽管该刊物已努力扩大其对 DEI 计划的覆盖范围,但其内容范围仍然很广。不难想象,未来《哈佛商业评论》将进一步细分,横向发展,明确覆盖不同领域。是否应该推出以技术为中心的产品?以人工智能为重点的子刊物?一份CPG周刊?

To test out this concept, HBR could borrow from its podcasting model and embrace external talent. Distinct newsletters could be helmed by experts and creators that meet Harvard’s quality bar but bring greater freshness and ingenuity to the form. Given Harvard’s brand power, the Review should have the ability to draw some exceptional names. What if an HBR Crypto newsletter was managed by Paradigm’s Dan Robinson? Or its gaming publication starred Matthew Ball?

为了测试这一概念,《哈佛商业评论》可以借鉴其播客模式,并吸纳外部人才。不同的时事通讯可以由符合哈佛大学质量标准的专家和创作者掌舵,并为这种形式带来更多的新鲜感和独创性。鉴于哈佛的品牌影响力,《哈佛商业评论》应该有能力吸引到一些杰出人才。如果《哈佛商业评论》的加密通讯由Paradigm公司的丹-罗宾逊(Dan Robinson)管理会怎样?或者其游戏出版物由马修-波尔(Matthew Ball)主演呢?

As other media companies duke it out to woo elite creators, Harvard’s position as an educational institution may offer unique allure.

在其他媒体公司竞相争取精英创作者的时候,哈佛大学作为教育机构的地位可能具有独特的诱惑力。

Beyond segmenting and leaning into the creator movement, it would be exciting to see HBR experiment with novel formats. For example, what would an AMA product look like on the Review? Able to draw exceptional business leaders and a sophisticated audience, the crowdsourced Q&A format on HBR could be unique.

除了细分市场和向创作者运动靠拢之外,《哈佛商业评论》尝试新颖的形式也会令人兴奋。例如,《评论》上的AMA产品会是什么样子?能够吸引杰出的商界领袖和资深受众,《哈佛商业评论》的众包问答形式可能是独一无二的。

Could this, in turn, herald a more open, engaged member’s only community? Though it would bring complexities, particularly with regard to moderation, a modern HBR forum could be an intriguing experiment. Part user-generated platform, part professional network, such an addition could give HBR a way to gather more information on its audience, offer greater value, and upsell its readership.

反过来,这能否预示着一个更加开放、参与性更强的会员制社区?虽然这会带来一些复杂的问题,尤其是管理方面的问题,但现代的《哈佛商业评论》论坛可能是一个引人入胜的尝试。它既是一个用户生成平台,又是一个专业网络,《哈佛商业评论》可以借此收集更多受众信息,提供更高的价值,并向读者兜售更多产品。

These suggestions are just the tip of the iceberg. Across writing, podcasts, and video, HBR has room to be much more aggressive; permission that has to come from the top.

这些建议只是冰山一角。在写作、播客和视频方面,《哈佛商业评论》都有更大的发展空间,但这必须得到高层的许可。

With so impressive a publishing entity under its auspices, a reimagination of Harvard could create extraordinary, outsized value. But institutions move slowly and are loathe to change; Harvard is unlikely to ever think of itself as a media company. That presents an opportunity for a wave of well-positioned businesses to capitalize.

哈佛大学旗下有如此令人印象深刻的出版实体,对哈佛大学的重新构想可能会创造出非同寻常的巨大价值。但机构行动缓慢,不愿改变;哈佛不太可能把自己当成一家媒体公司。这就为一大批定位准确的企业提供了利用机会。

The Next HBR: Sneaky Media Businesses

下一本《哈佛商业评论》:狡猾的媒体企业

In “Whose Story Wins?” we surveyed the state of “soft power” in tech, concluding that few organizations have truly understood the potential of owning and exercising a narrative, via media. Robinhood, Andreessen Horowitz, and Stripe are among an elite few.

在《谁的故事赢了?》一文中,我们对科技领域的 "软实力 "现状进行了调查,得出的结论是,很少有组织能够真正理解通过媒体拥有和行使叙事的潜力。Robinhood、Andreessen Horowitz 和 Stripe 属于少数精英。

Perhaps partially because of that, it feels like there’s still an opportunity for someone to build “HBR 2.0” — a subsidiary that extends an existing brand by providing deep, definitive business analysis. It’s worth noting that succeeding in such an endeavor is not only potentially financially beneficial, nor is it just a reputational benefit. Rather, it represents that niftiest of business tricks: the transformation of cost into revenue. Instead of spending money on performance marketing or sponsorships, organizations can earn by selling themselves, and the content produced under their banner.

也许正因为如此,人们感觉仍有机会打造"《哈佛商业评论》2.0"--一家通过提供深入、权威的商业分析来扩展现有品牌的子公司。值得注意的是,这种努力的成功不仅仅是潜在的经济利益,也不仅仅是声誉利益。相反,它代表了最精妙的商业技巧:将成本转化为收益。组织可以通过销售自己以及在自己旗下制作的内容来赚钱,而不是把钱花在绩效营销或赞助上。

Such a prize is worth fighting for. Those best-positioned include insurgent edtech startups, fundraising platforms, and venture funds.

这样的奖励值得为之奋斗。最有条件的机构包括崛起的教育科技初创企业、筹款平台和风险基金。

Edtech 教育技术

HBR’s successor may come from the same sector: education. Just as Harvard leveraged its intellectual reputation to build a publisher, modern edtechs focused on business may seek to do the same.

哈佛商业评论》的后继者可能也来自教育领域。正如哈佛大学利用自己的知识声誉建立了一家出版商一样,专注于商业的现代教育科技公司可能也会寻求这样的机会。

Of those, Reforge is arguably best positioned. Though narrowly focused on growth, the company has established itself as an impressive educator, attracting many medium-to-high level tech workers, and earning a favorable reputation. It’s easy to envision a “Reforge Growth Review” spinning out of that, with content sufficiently valuable to merit payment. A Reforge blog provides a rough foundation for a much more ambitious push.

在这些公司中,Reforge 可以说是定位最准确的一家。虽然 Reforge 专注于增长,但它已成为一家令人印象深刻的教育机构,吸引了许多中高级技术人员,并赢得了良好的声誉。我们不难想象,"Reforge 成长评论 "将由此产生,其内容价值足以值得付费。Reforge 博客为更雄心勃勃的发展提供了一个粗略的基础。

On Deck may be able to attempt this move, too. Though its broader scope may complicate matters, the cohort-based course company has succeeded in creating a brand known by most in the industry, and trusted by many. Compared to Reforge, On Deck seems to attract a slightly younger and more junior customer base, and caters to a variety of different interests from podcasting to product, angel investing to longevity.

On Deck 或许也可以尝试这一举措。虽然范围更广可能会使问题变得复杂,但这家基于群组的课程公司已经成功创建了一个为业内大多数人所熟知的品牌,并得到了许多人的信任。与 Reforge 相比,On Deck 似乎吸引了更年轻、更初级的客户群,并迎合了从播客到产品、从天使投资到长寿的各种不同兴趣。

Still, a successful general business publication seems plausible, and would fit the company’s stated aim of becoming the “Stanford of the internet.” Perhaps it can become the HBR, too.

不过,一份成功的综合性商业刊物似乎还是可行的,而且也符合该公司宣称的成为 "互联网上的斯坦福 "的目标。也许它也能成为《哈佛商业评论》。

Fundraising platforms 筹款平台

Though seeking a different end, fundraising platforms look equally capable of producing a strong tech and business publication. Not only do companies like AngelList and Republic have good reputations (and seem to be expanding quickly as private investment markets boom), but both should boast access to unique, relevant data.

虽然追求的目标不同,但筹款平台看起来同样有能力制作一份强有力的科技和商业出版物。AngelList和Republic等公司不仅拥有良好的声誉(随着私人投资市场的蓬勃发展,它们似乎也在迅速扩张),而且这两家公司都能获得独一无二的相关数据。

This is likely particularly true of AngelList, given the company’s long history. Since launching in 2010, Naval Ravikant’s platform has operated as an informal hub for off-piste venture financing, involving firms, angel investors, founders, and operators. It could draw on more than a decade of data to augment its stories.

鉴于AngelList的悠久历史,该公司的情况可能尤其如此。自 2010 年推出以来,纳瓦尔-拉维坎特(Naval Ravikant)的平台就一直是一个非正式的非主流风险融资中心,涉及公司、天使投资人、创始人和经营者。它可以利用十多年的数据来充实自己的故事。

There’s also a clear, virtuous tie-in for these platforms: by telling the tales of exceptional businesses, readers are likely to find themselves persuaded to invest in future opportunities, handled on AngelList or Republic’s platform. There may be legal ramifications of directly tethering these two functions, but even an oblique link could prove powerful.

对于这些平台来说,还有一个明显的良性联系:通过讲述杰出企业的故事,读者很可能会发现自己被说服投资于未来的机会,在 AngelList 或 Republic 的平台上处理。将这两项功能直接联系在一起可能会有法律后果,但即使是间接联系也会被证明是有力的。

Owning the narrative engine for private financing and the platform on which such transactions are conducted would represent a potent combination.

拥有私人融资的叙事引擎和进行此类交易的平台将是一个强大的组合。

Venture capital 风险资本

Of course, at least one venture firm has explicitly staked out a claim as the new HBR: First Round, the fund behind the “First Round Review.”

当然,至少有一家风险投资公司明确宣称自己是新的《哈佛商业评论》:First Round,即 "First Round Review "背后的基金。

In almost all respects, FRR feels spiritually aligned with HBR. It embodies an elegant, minimalist aesthetic, features high-quality writing, and often focuses on case-study-style practitioner stories. If someone were seeking to build a tech-focused HBR from scratch today, it would, in all likelihood, look a lot like First Round’s creation.

几乎在所有方面,《第一轮评论》都与《哈佛商业评论》在精神上不谋而合。它体现了优雅、简约的美学风格,以高质量的文章为特色,并经常关注案例研究式的从业者故事。如果今天有人想从零开始打造一本以技术为重点的《哈佛商业评论》,那么它很有可能与 First Round 的作品非常相似。

Unlike Harvard, First Round doesn’t charge for its publication, though it may still meet our definition of a “media company” in that certain deals could perhaps be linked to FRR, which in time, make the fund money. It is certainly more tenuous, and closer to content marketing, not that it should matter to the firm.

与哈佛不同的是,First Round 不收取出版费用,尽管它可能仍然符合我们对 "媒体公司 "的定义,因为某些交易可能与 FRR 相关联,而这些交易最终会为基金带来收益。当然,这也更微妙,更接近于内容营销,但这对该公司来说并不重要。

As discussed in the soft power piece, a16z has also made a play in the space, though the focus of “Future” feels more abstract. In that respect, it seems less of a successor to HBR than a reincarnation of an actual academic journal; heady ideas and formulations rather than tactics and takeaways.

正如在软实力一文中所讨论的,a16z 也在这一领域有所作为,不过 "未来 "的重点感觉更为抽象。在这方面,它似乎不是《哈佛商业评论》(HBR)的继承者,而是一本真正的学术期刊的翻版;是令人兴奋的观点和提法,而不是战术和收获。

Beyond these two firms, it’s hard to identify others that are exceptionally well-poised to create an iconic publisher. That doesn’t mean an insurgent couldn’t catch up; the incipience reflects that we are still in the early days of comprehensive tech coverage.

除了这两家公司之外,很难找到其他特别有条件创建标志性出版商的公司。但这并不意味着后起之秀无法迎头赶上;这种萌芽反映出我们仍处于全面科技报道的早期阶段。

To avoid competing head-to-head with a16z or First Round, firms may seek alternatives. One avenue might be for a coalition of funds to create a shared “Venture Business Review.” Though such a manifestation wouldn’t give as much brand value to a single firm, it would present an opportunity for funds to build shared distribution, benefit from shared expertise, and present a publication that feels further from content marketing. Of course, coordination would be more difficult and it’s easy to imagine how cross-firm politics might meddle in matters.

为了避免与 a16z 或 First Round 正面竞争,企业可能会寻求其他途径。其中一个途径可能是基金联盟创建一个共享的 "风险投资商业评论"。虽然这种形式不会给单个公司带来那么大的品牌价值,但它将为各基金提供一个机会,建立共享的发行渠道,从共享的专业知识中获益,并推出一份感觉更接近内容营销的出版物。当然,协调工作会更加困难,而且不难想象跨公司的政治因素会如何插手其中。

Crypto funds may also want to get in on the action, dedicating serious resources to media efforts ahead of mainstream adoption. What would a Paradigm Crypto Review or a Multicoin Review look like? Accessible case studies could prove an effective way to spread the sector’s gospel and highlight the impact of new projects. Though several excellent crypto media outlets and research firms exist, there’s room for a slower, more deliberate offering.

加密货币基金可能也想参与其中,在主流应用之前投入大量资源开展媒体工作。Paradigm Crypto Review》或《Multicoin Review》会是什么样的呢?易读的案例研究可能是传播该行业福音和突出新项目影响的有效方式。虽然目前已有几家优秀的加密货币媒体和研究公司,但仍有空间推出更慢、更深思熟虑的产品。

“A diamond is just a lump of coal that stuck to its job.”

"钻石只是一块坚守岗位的煤炭"

Though those words are attributed to Malcolm Forbes, one-time steward of the eponymous magazine, they feel particularly well-suited to the Harvard Business Review and the school’s broader publishing arm. From modest beginnings in 1922, HBR has taken the long path to brilliance, reinventing itself frequently, but preserving what makes it special.

虽然这句话出自马尔科姆-福布斯(Malcolm Forbes)之口,他曾是《哈佛商业评论》(Harvard Business Review)杂志的管理者,但这句话却特别适合《哈佛商业评论》和该校更广泛的出版机构。1922 年,《哈佛商业评论》创刊之初并不显赫,但它走过了一条漫长的辉煌之路,经常自我革新,但始终保留着自己的特色。

In that respect, it represents a different, rarely-seen value creation story: the academic spin-out that challenges the supremacy of its parent organization. Not only does that make it worthy of the kind of thoughtful study the publication popularized, but an intriguing model for a wave of content marketers on the cusp of maturation.

在这方面,它代表了一个与众不同、鲜有人见的价值创造故事:从学术机构分拆出来,挑战其母公司的至高无上地位。这不仅使它值得进行该刊物所倡导的那种深思熟虑的研究,而且也为处于成熟期的内容营销人员树立了一个引人入胜的典范。

The Generalist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. You should always do your own research and consult advisors on these subjects. Our work may feature entities in which Generalist Capital, LLC or the author has invested.

The Generalist 的作品仅供参考,不应被视为法律、商业、投资或税务建议。在这些问题上,您应始终自行研究并咨询顾问。我们的作品可能介绍 Generalist Capital, LLC 或作者投资的实体。

Subscribe to The Generalist

订阅《通才

Learn what matters in tech, AI, and venture capital – for free.

免费了解科技、人工智能和风险投资领域的重要信息。