美國聯準會(Fed)9月降息50個基點,幅度超出市場預期,使得市場更加確信美國經濟能避免衰退,並實現溫和的軟著陸。瑞士百達資產管理公司公布10月市場展望報告,調升風險資產類別評級,將股票調升至加碼,同樣將新興市場股票和債券的評級調升至加碼。

The U.S. Federal Reserve ( Fed ) cut interest rates by 50 basis points in September, exceeding market expectations, making the market more confident that the U.S. economy can avoid recession and achieve a moderate soft landing. Swiss Pictet Asset Management released its October market outlook report, raising the rating of risk asset classes and raising stocks to overweight. It also raised the ratings of emerging market stocks and bonds to overweight.

報告指出,「新興市場資產尤其具有吸引力,因為該地區最能從美國降息政策和全球貿易的復甦中受益。」此外,瑞士百達資產管理將現金的評級調至減碼。

The report pointed out that "Emerging market assets are particularly attractive as the region is best positioned to benefit from U.S. interest rate cuts and the recovery of global trade." In addition, Swiss Pictet Asset Management raised its rating on cash to underweight.

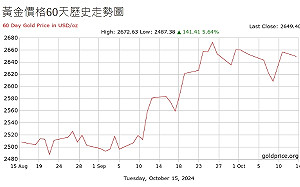

然而,瑞士百達資產管理公司指出,根據多個模型評估分析,目前已開發國家的公債殖利率過低,除非出現經濟衰退,然而這種情況不太可能,否則報酬可能會令投資人失望。如下圖一所示,債券市場對2025年的降息幅度預期,比聯準會9月公布的點陣圖更為鴿派。「我們對已開發國家的債券評級維持中性。」

However, Switzerland's Pictet Asset Management pointed out that based on multiple model assessments, public bond yields in developed countries are currently too low. Unless there is an economic recession, which is unlikely, returns may disappoint investors. As shown in Figure 1 below, the bond market’s expectations for an interest rate cut in 2025 are more dovish than the dot plot released by the Federal Reserve in September. "We maintain our neutral rating on developed countries' bonds."

該報告指出,商業週期指標顯示全球經濟活動有所減速。美國經濟在過去八季中,有七個季度表現出超出潛力的成長,但目前出現放緩跡象,未來幾個月中,尤其是服務業,占GDP達一半以上的消費預計將放緩,進而導致整體經濟增速放緩。

The report noted that business cycle indicators point to a slowdown in global economic activity. The U.S. economy has grown above potential in seven of the past eight quarters, but is now showing signs of slowing. In the coming months, consumption, especially in the services sector, which accounts for more than half of GDP , is expected to slow. leading to a slowdown in overall economic growth.

聯準會目前關注的焦點是勞動力市場情況,當前條件與GDP年化成長率約2%相符,接近長期潛力水準。

The Fed's current focus is on labor market conditions. Current conditions are consistent with an annualized GDP growth rate of about 2%, which is close to long-term potential.

瑞士百達資產管理公司指出,「我們觀察到歐洲經濟進一步走弱,能源價格下跌未能刺激更多投資。淨出口作為歐洲目前的經濟增長引擎正面臨風險,因為中國作為歐洲主要商品和服務出口國,正面臨復甦的挑戰。」

Swiss Pictet Asset Management pointed out, "We observe further weakening of the European economy, with falling energy prices failing to stimulate more investment. Net exports, Europe's current economic growth engine, are at risk because China is Europe's main exporter of goods and services. The country is facing the challenge of recovery.”

然而在英國方面,瑞士百達資產指出,「我們對其持正向的態度,因為英國受益於強勁的服務業和工業產業,且預計英國央行將在今年降息兩次,這將進一步改善經濟前景。」

However, in the UK, Swiss Pictet Asset pointed out, "We have a positive attitude towards it because the UK benefits from strong service and industrial industries, and the Bank of England is expected to cut interest rates twice this year, which will further improve the economic outlook. .

再來看看日本發展,瑞士百達資產指出,預計在2025年,日本將是唯一一個主要已開發經濟體,成長超過潛力水準,這要歸功於消費。這將使日本央行能夠繼續實施貨幣政策的正常化。

Let’s look at the development of Japan. Swiss Pictet Asset pointed out that it is expected that in 2025, Japan will be the only major developed economy to grow beyond its potential, thanks to consumption. This will allow the Bank of Japan to continue normalizing monetary policy.

在新興市場中,報告指出,中國的經濟成長仍然疲弱,預計第三季年化GDP成長率為0.4%,與今年前兩季的4-5%的年增率形成鮮明對比。如果中國人民銀行的最新寬鬆措施,伴隨同樣強有力的財政措施,將更有效地改善市場情緒。

In emerging markets, the report pointed out that China's economic growth remains weak, with an expected annualized GDP growth rate of 0.4% in the third quarter, in sharp contrast to the 4-5% annual growth rate in the first two quarters of this year. If the People's Bank of China's latest easing measures are accompanied by equally strong fiscal measures, it will be more effective in improving market sentiment.

然而,其他新興市場的經濟活動令人鼓舞,開發中國家應該利用全球貿易的復甦,因為該地區對世界貿易增長的敏感性是已開發經濟體的兩倍。

However, economic activity in other emerging markets is encouraging, and developing countries should take advantage of the recovery in global trade, as the region is twice as sensitive to world trade growth as developed economies.

瑞士百達:美日股市吸引資金、股票昂貴、但未進入泡沫

Swiss Patek: The U.S. and Japanese stock markets attract funds and stocks are expensive, but they have not entered a bubble

瑞士百達資產指出,流動性指標支持加碼股票。隨著佔全球GDP超過三分之二的國家央行啟動降息,貨幣政策正變得更加寬鬆,這將有助於支撐風險較高的資產類別的表現。

Pictet Asset noted that liquidity indicators support overweighting stocks. Monetary policy is becoming more accommodative as central banks accounting for more than two-thirds of global GDP cut interest rates, which will help support the performance of riskier asset classes.

根據瑞士百達資產的預測,聯準會還會再降息五次,這是相當大的降息幅度,但比市場目前預期的降息幅度要少。預計歐洲央行將會跟上其他央行降息步調,在接下來每次會議都實施降息,以達到2%的終端利率。

According to the forecast of Swiss Pictet Asset, the Federal Reserve will cut interest rates five more times. This is a considerable rate cut, but it is smaller than the rate cut currently expected by the market. The European Central Bank is expected to follow the pace of other central banks in cutting interest rates and implement interest rate cuts at each subsequent meeting to reach a terminal interest rate of 2%.

瑞士百達估值指標顯示,債券正在變得昂貴,美國經濟實現軟著陸的可能性提高,使得市場目前對降息幅度的預期過於激進。股票仍然昂貴,但估值尚未進入泡沫區域。

Switzerland's Pictet valuation indicator shows that bonds are becoming expensive and the possibility of a soft landing for the U.S. economy has increased, making the market's current expectations for interest rate cuts too aggressive. Stocks are still expensive, but valuations haven't entered bubble territory yet.

瑞士百達指出,技術指標顯示,股票有望在2024年底獲得支撐,這是由於季節性因素,股票在年底的幾個月中通常表現較好。動能指標也呈現正向的趨勢,美國股市吸引資金流入;日本股市也吸引資金流入,但主要來自國內投資者,外國投資者則呈現流出。

Pictet pointed out that technical indicators show that stocks are expected to find support at the end of 2024. This is due to seasonal factors, and stocks usually perform better in the months at the end of the year. Momentum indicators also show a positive trend, with the U.S. stock market attracting capital inflows; the Japanese stock market also attracting capital inflows, but mainly from domestic investors, while foreign investors show outflows.

不過,在固定收益方面,隨著聯準會啟動降息,新興市場強勢貨幣債券開始吸引資金流入。

However, in terms of fixed income, as the Federal Reserve started to cut interest rates, emerging market bonds in strong currencies began to attract capital inflows.

市場預期降息幅度更大。資料來源:彭博、瑞士百達資產管理。 圖:擷取自瑞士百達資產管理報告

The market expects a deeper rate cut. Source: Bloomberg, Pictet Asset Management. Picture: Extracted from Swiss Patek Asset Management report

如審查為不實檢舉,則檢舉人會被停權。

無暱稱

0 分鐘前

-樓

Newtalk新聞網提供大家的全新討論區(下稱「本平台」),為了維護友善的討論區環境,開話題前請您務必詳閱並遵守以下規範,如果您有違反本管理規章的情形,我們可能會終止您一部分或全部的服務(包括但不限於暫停您開話題的功能、限制帳號部分或全部功能、永久終止契約等),並且可能會採取適當的法律途徑救濟。

若您違反本管理規章而引起第三人申訴或訴訟索賠,您應自行處理並承擔相關責任;若因您的行為導致本平台遭第三人請求賠償或受國家機關處罰,您應賠償因此所受到的損失(包括但不限於商譽損失、經濟損失、裁判費、律師費等)。

您不得利用或對本平台服務及進行任何危害電腦網路安全或其他侵權違法的行為,包括但不限於:

您利用本平台開話題、留言時,應明白本平台是一個開放的空間,您發表的內容應遵守法律規範、並且不違反社會公序良俗,否則本平台會立即終止您一部或全部的服務。您的言論或行為,應不得有下列的情形:

如我們認為您發表的內容違反了Newtalk討論區平台的條款規範(含本規範),您同意我們得於未事先告知的情況下移除、刪除、取消、編輯、改變、修改封鎖您的帳號及您發表的內容。您應對於您發表的內容及於本平台其他使用者的互動負完全的責任。

若您因違反本規章,我們會依照情節不同限制您一定的權利。若您遭暫時停權累計達「三」次,我們可能會終止與您之間的使用者契約,不再提供您任何服務。

行使限制如下:

第一次:禁止使用10天,並移除相關內容。

第二次:禁止使用30天,並移除相關內容。

第三次:終止契約,並移除相關內容。

(違反情節嚴重者,將處以「終止契約」處置。)

您同意配合本平台的智慧財產權政策(https://newtalk.tw/privacy):

本討論區管理規章可能會依照法令、社會風氣的變更而調整,請您隨時注意官方網站的公告,並且於使用前請詳閱相關規範。

上限 0 / 500 個字

留言規章