How should we think about “macro” in this current environment?

The Upshot

When we wrote “Global Macro Trading for Idiots: Part 4” in July 2024, we commented that the traditional macroeconomic indicators of a recession within the next year (the Sahm Rule, the Fed’s yield-curve based model and inversion of the yield curve, etc.) all meant that if we were going to have a recession, it was going to come in the next 12 months.

We’re nearing the end of that window, but we’re hardly out of the woods given the policy curveballs that have been thrown into the mix. Still, outside of the downward pressures created by the tariffs, the US economy continues a trend of further cooling labor market and further disinflation.

While tariffs create enormous bimodal uncertainty, could there be sufficient resiliency in the US economy to withstand tariff shocks long enough to get through to the other side? Could a sudden reversal of trade policies also reverse gloomy growth expectations as the Fed’s jumbo cut in 2024 Sep did?

We lean towards the view that recession risks are at present overstated, based on the current macro and micro data. While some level of economic slowdown is almost guaranteed, certain corners of the markets may have priced in even more.

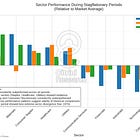

However, there is a large disparity between the pricing of a recession in areas like bonds (especially the front end of the curve) and oil vs. equities. On equities broadly, we see a sideways trend emerging for indices that will be marked by rapid overreactions in both directions and extreme dispersion.

The enormous uncertainty of tariffs ultimately stems from a geopolitical realignment shock that is at least in the short term determined in the mind of a man and a tweet. In his book “Geopolitical Alpha”, Marko Papic says that predictions are better made from the perspective of “constraints” rather than “preferences”.

We all know what President Trump’s preferences are, but what are his constraints? We would lay them down as the following three categories:

- Debt refinancing needs and the “moron risk premium” originally observed in the UK;

- Tax bill passage and preservation of political capital;

- Recession risk and “don’t want to be Hoover”.

President Xi has constraints too, notwithstanding the wolf warrior bravado, China is indeed under serious economic pressure to find an off-ramp. This likely explains China’s recent exemption of certain US imports as well as the overtures to open trade talks, but we’ll focus on the US and macro in this piece.

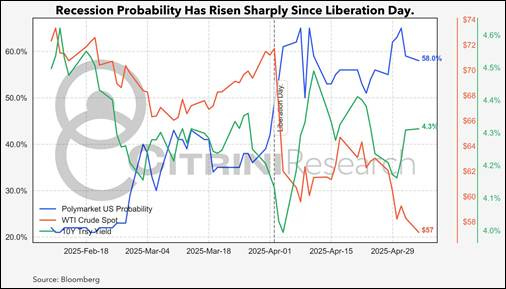

Since Liberation Day, recession odds have sharply risen, pro-cyclical assets such as crude oil have sold off but stocks have returned to levels from before the event.

Meanwhile, the continued heightened recession risks are clearly a concern for the administration notwithstanding their claims to the contrary. The White House does not want the US economy to sink into a deep recession, which puts Republican control of Congress hence their support in peril and their rest of their legislative agenda in jeopardy. Collectively, this guides us towards thinking that the administration, spearheaded by Treasury Sec Bessent, would be eager to pursue off-ramps on the trade war.

There is a lot of noise and speculation about what the tariffs may cause businesses to do and how they may usher in devastating rolling bankruptcies and a deep recession. For example, we’ve seen the deck from Apollo painting compellingly a rather bleak picture of an impending Voluntary Trade Reset Recession.

In this piece, we’ll to focus on the data points that have guided us well up during this cycle up to this point to help cut through the noise and get to a balanced assessment of where we are and where we will likely be over the next few months. Our takeaway is a bit more constructive than where we think consensus is.

Here’s how we see it:

The Labor Market and Rising Recession Risks

By almost all accounts, the US labor market has unmistakably cooled. This is the clearest and most diagnostic signal that we have been emphasizing over the last two years as the noise about inflation lurched. Softened labor market, slower wage growth, lower rent inflation, continued services disinflation, which means inflation overall is pointed downwards. This has been the economic mechanism guiding us the last two years. So far, the cooling in the labor market represents a continuation rather than a clear response to any tariffs, which may yet come.

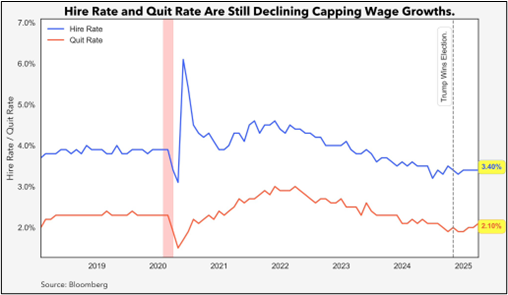

The softening of the job market during this cycle has been almost exclusively accomplished by a drop in job openings rather than outright involuntary job losses. At present, we see a continued acceleration downward of new job postings. The private job posting website Indeed’s index is a faster private data point that has historically indicated where job openings will be. The current job opening rate of 4.5% was the threshold beyond which Fed Governor Chris Waller had warned of the risk of accelerating unemployment. Hire and quit rates, which are our favorite metrics to track, interestingly have gone sideways or even ticked up slightly.

Wage growth, which also captures the tightness and the health of the labor market, continues to show a steady decrease and normalization to pre-COVID levels, a temporary bump in the H2 of 2024 into the election notwithstanding. The pattern is consistent across nearly all different measures of wage growth. We do not see any obvious impact of the tariffs yet.

Some Cracks Begin to Show

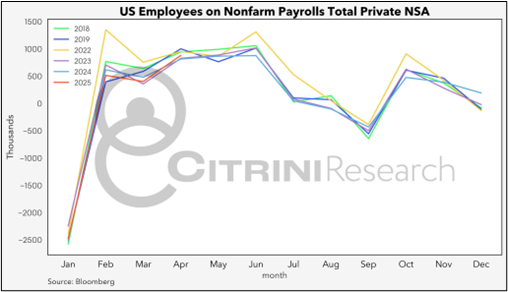

We are starting to see some small cracks in the labor market. Based on Chris Waller’s historical observation, a job openings rate under 4.5% and trending lower should be followed by higher unemployment. Indeed we see that job claims and unemployment rates have ticked up unseasonably ever so slightly, but job number growth remains well within seasonality trends. However, it's unclear if any of these reflects the impact and uncertainty of tariffs at all.

Bleak Expectations

There has been a lot of reporting of weak sentiments. The vibes are indeed very bad. Depending on the survey, consumer confidence is at the bottom lows of 2020 or even 2008 GFC. (Personally, I find it hard to take the UMich survey too seriously given the frequency at which it reaches the 2008 lows.) Regardless, consumer confidence seems highly correlated with the (perceived) strength of the labor market, which is indeed soft, but not collapsing by any means with still decent wage growth, low unemployment, and robust monthly net new jobs added.

Nevertheless, the bad vibes extend from job seekers to job holders. Across the income spectrum, survey respondents are expecting higher odds of losing their jobs. However, it is very hard to know how much if any comes from actual personal job risks versus simply reporting what they’ve heard in the news.

Consumer Resiliency

Surveys are tricky and have been tricking us for most of the last three years with a vibescession.

That’s why we prefer to “watch what they do, not what they say”. So far real time consumer spending does not seem to have had an overall slowdown, however there are signs of moderation.

Card transaction data has been disparate - with Visa showing that consumer spending growth, which has been flat since the election, in fact picked after Liberation Day and Fiserv’s SpendTrend showing a moderation YoY from 3.67% in March to 2.76% in April.

The growth categories seem broadly consistent with a pull-forward of tariff sensitive consumer goods, while there has been an unmistakable cutback of categories of discretionary services consumption and big ticket durable items such as furniture. All in all, this speaks to the continued US consumer resiliency while exercising increasing caution.

The Bloomberg Second Measure card data, which biases towards lower middle income households in the US Midwest, agrees with data from payment processors like Visa/Mastercard, which report resiliency too.

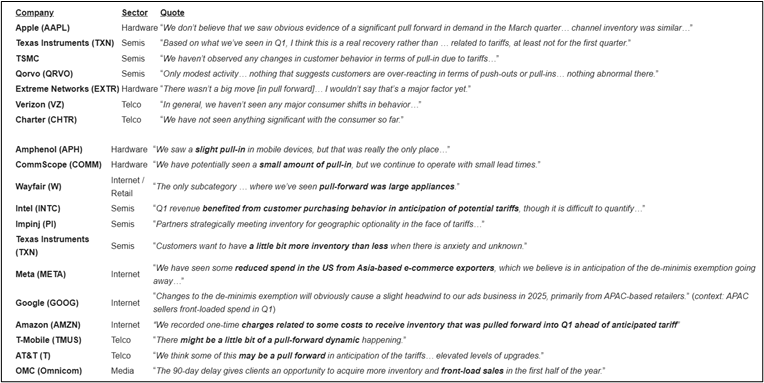

Meanwhile, McDonald's reports that lower and middle income customers are cutting back while top income customers are still spending. Finally, we have the commentary from Q1 earnings calls that seems to suggest that even the recent accelerated purchase may not have been tariff pull-forwards.

Again, that’s the beauty of this game. Lots of mixed signals, unclear if people are being honest, or even understand correctly what they are seeing. However, the overall impression we gather is that there doesn’t seem to yet be any panic among US consumers in response to the tariffs.

Are Companies Prepared?

Some have made the comparison of the Liberation Day shock to the COVID shock: hard economic data seemed just fine, maybe slightly slowing in Feb 2020, but all hard data just became completely irrelevant as companies scrambled to stock up inventory amidst a global supply chain disruption. This time too we hear news of mass cancellations of cargo ships, empty ports and impending shelves. However, there’s an unmistakable air of companies and consumers attempting to “get ahead of it”.

As we observed in 2022, recessions become less likely when everyone is prepared for them.

It seems reasonable to expect that companies have been preparing for tariffs and supply chain disruptions even if not to the same extent as was announced on Liberation Day. One reason for incremental bullishness now may be that companies knew they were going to have to be nimble, liquid, and reactionary for FY25.

We believe companies’ advanced planning, whether it’s anticipating longer lead times or rightsizing regional sales teams, likely helps extend a cushion period, during which trade deals may be struck or policies unwound, so that the uncertainty and frozen trade alone do not cause irreversible damage and guarantee a bad recession. However, like everything this has dispersion.

U.S. Import data released this morning only shows up to March, but gives us a better idea of the areas where companies were aggressively front-running tariffs by stocking up inventory and those that weren’t.

Key Import Data Observations (Country-Agnostic)

Pharmaceutical Products (HS 30): +71 percent Mo-M, +$13 bn

○ Biggest single line-item jump in dollar terms.

○ Suggests drug distributors and hospital systems accelerated orders ahead of an expected duty—especially on generics and active ingredients where pass-through pricing is tough.

Organic Chemicals (HS 29) & Lead Articles (HS 78): triple-digit pct gains

○ Critical feedstocks for downstream manufacturing; easy to store, high tariff sensitivity.

Luxury/seasonal goods show no front-run

○ Cut flowers, pearls, and furs all fell 25-40 percent. Either buyers assume carve-outs or can switch sourcing/channel quickly, so they didn’t stockpile.

Everyday consumer categories (textiles, footwear) are only mid-single-digit movers

○ Implies retailers remain inventory-heavy from 2024, so less urgency to pull forward.

US companies likely have a 2 month inventory buffer to weather through the trade negotiations. Orders for the holidays that would be typically placed now could still potentially be made and expedited for the holiday season, should “temporary trade deals” or de-escalation materialize in the coming weeks to bring down the effective tariff rates, particularly those on China, to much lower practical levels.

We believe this is part of the understood calculus for both the administration and the CEOs of big box retailers, who visited President Trump in the Oval Office.

This would mean that we’ve got until the beginning of June to start seeing truly negative economic impact in the areas that have least prepared, even if there are numerous trade deals announced in the interim we will still see impacts from the 10% ad-valorem tariff placed during the pause on all countries ex-China.

Trade Ideas off US Import Data:

Long long-haul, tariff-agnostic wet (product tankers) and ro/ro tonnage / Short time-definite, tariff-sensitive parcel networks on de-minimis repeal on China/HK parcels

Oil and auto cargos still move, they just take longer & more expensive routes - tankers and car carriers price off voyage distance and scarcity. Meanwhile, small-value parcels have lost their tax shield and the de-minimis kill hits cross-border gadgets. Long the corners of shipping where the new trade regime prolongs voyage distances and scarcity pricing.

Long: HAUTO NO, HAFNI NO, STNG US, INSW US

Short: UPS US, FDX US, EXPD US, CHRW US

DHL seems better prepared than these peers through mix, ability to pass through cost and exposure to the 145% tariff lane, so we don’t include them.

Micro to Macro: Ford’s 2025Q1 Earnings Call

Ford has pulled all guidance except for the $1.5 billion net EBIT impact figure. However, the company reports continued strong demand for vans and trailers and highlights a 10% increase in the reliability of its new full-sized SUVs for this model year, a factor we've been tracking regarding aftermarket parts LTVs. Additionally, Ford notes that telematics is driving 40% of unit revenue in their pro segment, with costs appearing to be under control in the March quarter. These new full-sized SUVs are achieving 18-23% higher average prices and have an average of only nine days on retail dealer lots. Production will be ramped up following the reset of production lines for the 2025 (or 2026) model generation. In a separate update, Ford indicates that its finance business remains strong, with robust used car auction results suggesting continued tightness in used vehicle inventory, a trend worth noting. No mention was made of delinquencies.

This sounds like a company that is reasonably experiencing an enormous degree of uncertainty and has every incentive to broadcast its plight under such macroeconomic and policy uncertainty. However, once again watch what they do. From the current demand for their products to their actual business investment plans, Ford does not sound like a company in sheer panic as were companies at the onset of COVID.

So does all this mean that the US/President Trump have unlimited economic cushion hence negotiating leverage because US consumers are not in a panic, are in good financial health, and US companies have made certain preparations? No, we believe this simply means that the US negotiating team still has enough time to negotiate trade deals, declare (maybe pyrrhic) victories, and not be “too late” as to cause so much damage that a recession is fait accompli. In fact, we believe that all sides (the US, China, and in fact the Fed as we will touch on later) have a strong incentive to find an off ramp during the general pause period.

President Trump’s Constraints

"The objective is not free or fair trade to lower tariffs everywhere. Trump is also not fundamentally motivated by the so-called Thucydides trap. His objective is simply tariff revenue to aid the growing federal deficits. That's why the trade war started with the tax cuts and the first round of tariffs was on steel and aluminum. That's also why Vietnam will eventually be on the top of the list."

-Chinese IR scholar Di Dongsheng in 2019

The US economy coming into Liberation Day had been progressing as we had expected in the March Macro update: the rockiness of the stock market heading to our SPX 5600 Q1 price target by the end of March. The decline in the 10Y yield due to the fading of economic growth optimism and the underestimated disruptiveness of Trump’s agenda.

Since Liberation Day’s aggressive rollout of Trump’s “reciprocal tariffs”, however, the picture has been much more unclear - dominated by “what-ifs” rather than “what the data currently shows”.

It’s possible that the “reciprocal tariffs” were always what behavioral economists call a “Decoy Effect” or an Overton window, where a 3rd less appealing extreme option is added to make the less unappealing option, in this case a global universal 10% tariff, more palatable, the same way nomination of Matt Gaetz for attorney general may have helped with the rest of the cabinet nominations.

What matters here is that the Trump admin appears to have underestimated the blowback and pushback from both US trade partners against the extortions and domestic CEOs against the disruptiveness of the tariff rollout. And finally, the most important pushback may be the surging US bond yields despite the clear chilling effect of the tariffs on US growth. Instead of dropping amidst a flight to safety, US 10Y yield surged upwards after Liberation Day while the US dollar plummeted, breaking a robust correlation. Dario Perkins of TS Lombard coined the term “moron risk premium” to describe a sustained elevation of long term (US) risk free government bond yields despite a general risk off and recession fears due to incompetence.

We know now where the “Trump Put” is, and it’s much more centered in credit and rates than in equities. That’s a durable effect - if rates were to start soaring again on poor progress or no hint of walking back tariffs, it would immediately spur the admin to action again.

Recession Risks are Rising:

We have already discussed extensively in the previous section about the genuine rising odds of recession. In fact, the odds of a devastatingly bad global recession if the whole gamut of tariffs as announced on Liberation Day were implemented in earnest are quite high. President Trump does not want to cause a deep recession in the US despite their explanations of “detox” or “taking medicine”. The fact of the matter is the US electorate is unforgiving and the incumbent political leader overseeing a bad recession will be punished and their legacy and reputation tarnished.

As early as Jan 2024, Trump said: “And when there’s a crash — I hope it’s going to be during this next 12 months because I don’t want to be Herbert Hoover. The one president I just don’t want to be, Herbert Hoover.” Whether the tariffs can actually wreck such severe damage is almost besides the point, as long as there’s broad consensus including the administration that they can, the recession constraint will be real.

Of course, most including those in the Trump administration and President Trump himself think those tariffs are little more than a shock factor to get everyone’s attention and to gain some sort of negotiating leverage. A reminder: USTR has until 9 Jul to ink “reciprocity” MOUs; skeptics note 75+ simultaneous talks are a logistical fantasy

However, in this game of chicken, where every major player is keen to look strong and save “face” in front of a domestic political constituency, once the stakes are raised, it’s awkward and hard to climb down without off ramps. That’s why we believe the administration is currently highly motivated to find an off ramp.

Tax Bill and “Three-Legged Stool” Constraint

Secretary Scott Bessent has been adamantly arguing that the Trump administration’s economic policy represents a three-legged stool approach: tariffs, tax cuts, and deregulation. In his latest WSJ op-ed published on Sunday (May 4, 2025), Bessent predicts that the overall economic policy will lead the US economy to re-accelerate in the second half of 2025 that “the American people should expect to hear the engine humming during the second half of 2025.”

How plausible is it that an economic slowdown/recession that is triggered and exacerbated by a full-blown trade war and tariffs will be fully offset by tax cuts and deregulations? Most reasonable minds are highly skeptical. However, Scott Bessent being a Wall Street veteran trained in classical economic theory, his confidence for a “humming engine” is unlikely to be driven entirely by fantastical illusion. So the likeliest explanation is that Bessent expects that the tariffs will not continue to occupy center stage before he makes progress on the major tax cut bill and other deregulation efforts, now that his nemesis Elon Musk and the deeply unserious DOGE effort are finally out of the way.

To make progress on tax cut legislation and significant deregulation, the administration cannot rely on executive orders but must rely on Republicans in Congress to unite and pass legislation. This means that the administration must make significant and highly visible progress on trade deals to lift downward economic pressure and policy uncertainty. This means that the Republicans in Congress, some of whom have been quietly if not openly unhappy with the tariff rollout, will have leverage versus the President. We anticipate significant “progress” on the trade talks in the coming weeks, including a potential significant de-escalation between US and China.

Just because President Trump has constraints, it doesn’t mean that we’ll see an immediate full capitulation on trade deals of course. No where is the concept of reflexivity demonstrated more clearly this year. Trump retreated on reciprocal tariffs because “people were getting the yips”, by which he referred to the markets, especially the bond market. But, Trump certainly noticed the sharp stock market sell-off, whose recovery over the past two weeks he also celebrated. The bounce back of the stock market will likely give Trump and his team renewed confidence and ammunition to take a harder line on trade policies. The push and pull may continue for a while. However, we expect not for too much longer. During this period, President Trump will also want the Fed’s help to relax some of these three constraints for him as he attempts to reach his goals.

Bessent’s Op-Ed and Comments @ Milken

We have recently discussed that the economy is not a speedboat, it’s more like an aircraft carrier that turns slowly and can’t be maneuvered quickly. However, it seems that Bessent has taken the (potentially too sanguine) view that they can combat the drag from tariffs during the negotiations with the stimulatory effects of their domestic plans.

Reading his recent OpEd and comments at Milken, we come away with the following takeaways on his beliefs:

The Fed’s “Dilemma”

As the FOMC convenes on May 6 Tue and announces a rate decision on May 7 Wed, the Fed is grappling with extraordinary difficulties. On the one hand, the Fed sees the same murky and highly uncertain if not outright confusing macro picture and feels uncertain about what to do. On the other hand, with President Trump having returned to attacking Powell and the Fed’s independence, the Fed grapples with how a move to ease right now may be perceived by the market.

If we put our pretend Fed hat on and based our analysis exclusively on the data on inflation and growth, there is actually ample reason for the Fed to resume cutting rates as disinflation has resumed. The stickiest categories of inflation have continued to go down as well. With core CPI and core PCE having resumed declining, reaching 2.8% and 2.65% respectively, with further services disinflation to come, inflation is practically a solved problem.

Some may point to the recent rise in goods inflation, including for example the hotter than expected ISM Services Prices Paid print. But, if we plot core inflation alongside core services, core goods and services prices paid. We see that goods have been in deflation recovering and services prices paid correlate much more with goods inflation. In a dominantly services economy, we are just not that worried about goods inflation dominating. While it is theoretically possible that a full-blown escalating global trade war could set off another episode raging goods inflation a la COVID in 2020, the realistic likelihood seems quite remote.

Taking a step back, if we look at nominal and real GDP in the long run, the US economy has basically fully normalized. Long run inflation expectations remain well anchored as well, ideology-plagued unreliable UMich survey notwithstanding. Barring tariffs, there is indeed a good argument to resume cutting rates based on favorable inflation and “preservation of a good thing” that is the US economy, which is the same argument the Fed used for cutting last year. Chris Waller has been arguing in favor of resuming rate cuts as well.

So why is the Fed hesitant and mentioning the risk of “stagflation” at every turn as Powell did in recent interviews? Does the Fed not see the same balance of evidence as we do? Of course they see it.

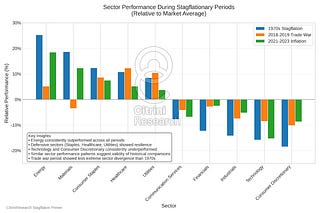

However, stagflation is the only politically correct answer even if the Fed believes tariffs were ultimately not inflationary but recessionary. We outlined the path by which tariffs (if they were unchanged from Liberation day and we did not get a pause) would lead to stagflation in “Seeing the Stag.”

If the Fed accepts that tariffs are strictly a supply shock that’s ultimately recessionary, it’s supposed to look through and preemptively ease. But because the Fed cannot pre-judge the economic outcome of the tariffs which are currently highly uncertain, the tariffs must be stagflationary to justify inaction.

Another reason for the Fed’s hesitation, albeit a smaller one, is of course President Trump’s nonstop public haranguing of Chair Powell and the Fed and the threat to the Fed’s perceived independence from political interference. However, Central Bank independence is ultimately a modern political construct and a gentleman’s agreement between good faith political branches. We are not in that era anymore and the Fed/Powell understands that very well. They will make an attempt to keep up the appearance but it ultimately cannot get in the way of setting the correct economic policy for too long if easing was indeed the correct policy but also happens to coincide with what President Trump wants. The Fed just needs a graceful off-ramp or some time so it appears plausible they had arrived at the easing decision independent of political pressure. President Trump has for now laid off threatening to fire Powell or intervening with the Fed’s decision, but he’s definitely not helping himself here.

Taking all of this together, we believe that the Fed is actually likelier than the market currently believes (27% chance) to cut at the next month (Jun) FOMC meeting.

In short: The Fed is currently frozen, but is unlikely to stay that way for long.

China’s Pain Points

China has pain points too. President Xi has his own set of constraints. However, we will not go into details in this piece. It suffices to say that despite public pronouncements, bravado, and genuinely greater pain tolerance at national level, the trade war puts enormous unemployment pressure on China’s one remaining shining economic engine: the export sector. China does want to find an off-ramp too and reach a trade deal even if both sides understand that a looser economic relationship is eventually inevitable.

China does have an enormous positive trade balance despite export having fallen as a share of GDP. This is largely a consequence of its import having fallen even more as a share of GDP, both of which stem ultimately from the weakness of Chinese domestic consumption demand. China needs to reignite its domestic economic engine, which is presently plagued by the massive debt overhang accumulated over the past two decades. The rebalancing is painful, slow but necessary. Learn more about our perspective on China from our China piece.

If all the major actors in this play take their self-interested off-ramps, we believe that the market has priced too high a probability for recession this year. We may see a short-term (quarterly) economic slowdown or even technical negative growth, and rising unemployment, however, we quite likely will not experience an actual recession before the economy re-accelerates on another set of growth catalysts. Since the start of last year, we’ve swung from one extreme to another every quarter. A quarter ago, we were all worried about a potentially overheated US economy and inflation, now recession risk has dominated. We suspect things will look yet again very differently in a quarter’s time.

Some Analogs

Presented without comment, as analogs tend to make people testy

Choose your own adventure here - we simply believe that viewing similar periods of price action offers an interesting framework and makes you more open to the possibilities:

Needless to say, the rejection off of the 200 day moving average is slightly concerning. Still, this isn’t something to base a decision off of entirely and the rest of the picture lends itself to a more bullish resolution.

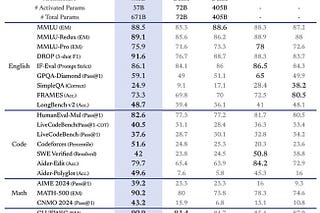

My Current High Level Views; Macro-and-Otherwise

● AI will continue to be the defining technology of this decade, driving massive innovation in healthcare, labor, the way we think about data etc. It will increase productivity massively. In the event of a recession, it will make any fiscal response to improve the labor market potentially more difficult and drawn out. This will branch into robotics/automation, agentic assistants & employees, etc etc. You can own secular stories and trade tactically around them to generate consistent and compounding returns (a core view regardless of the market we’re in).

● The economy has been stronger over the past 2 years than it has been in a while, certainly stronger than any period during the 2010s. That has a lot of momentum, despite worsening sentiment (we are still deeply in the dynamic of soft surveys / strong hard data). The largest risk to the economy is the trade war.

● In a somewhat reassuring turn, that risk seems to be more appreciated by the administration currently than it was in the first couple weeks following the announcement on April 2nd.

● The trade war’s actual impact on the economy can go ignored for a maximum of 2 months by the market, but the pressure to resolve is mounting and the possibility of a resolution that is constructive for equities is possible. Only during this pre-china trade talk stage is there infinite room for upside and the climbing of a wall of worry.

● Because of that, marrying long term views right now is very stupid. Unless you are Trump or able to read his mind (and don’t get confused here - literally only him), this is the part of the cycle to be reactive rather than proactive. You simply don’t have enough data right now and both outcomes are plausible - while it’s tempting to assume this will result in a deep recession, that’s not dissimilar to how the situation looked in the first 12 months of Reagan’s term. People thought his strategies were stupid and were widely bearish because of it as well. Outcomes can surprise, so we stay nimble.

Our Current & New Macro Trades

Updating our trades from our last Macro Memo “After the Trump Bump”

We are currently out of our FX Basket (which, as of March 4th, was Long 50% EUR 50% JPY and Short 100% USD).

In commodities, we are exiting our natural gas long and entering long crude oil and copper.

In STIR, we are fully exiting two of our plays and putting on a new one.

First, our SFRM6 long (which began as an M5M6 flattener, but had the short M5 leg covered in our last update)

We fully exit this, above our original price target of 96.60 at 96.825. Additionally, we exit our SOFRZ5 / EURIBORZ5 spread for a modest gain.

The Fed is currently frozen but will not stay that way for long. I like selling the belly on the m5z5m6 fly (long SFRM5/short 2x SFRZ5/long SFRM6), currently pricing 31bps more cuts into the second half of this year vs the first half of next year.

I’d like to play for that to be ~0 or even go positive. If this play seems like a bunch of gibberish to you, but you’re interested in making that not the case, check out Global Macro Trading for Idiots: Part Three (STIR).

In FX, my longer term view on the dollar is bearish - I’m not currently short USD as positioning got stretched but I’m a seller of rallies (probably very soon).

We are still positioned net long equities in our thematic portfolio (which has a longer-term view than our macro trades) on the fact that what is widely perceived as “complacency” is actually the old school macro axiom of “bad news, good action”. Dips get bought and risks provide fuel higher.

However, we see the risk in the near term from a Fed that could be perceived as too hawkish and wild fluctuations in market perception of a recession - so, while we think the worst of the sell-off is currently over, we hedge against continued volatility with 30-90dte SPX puts.

Currently, we hold 2% of our NAV in index hedges (SPX June 5200p and August 4800p). We believe that if the market were to unwind, it would do so in a unidirectional large move, making it compelling to own downside optionality rather than delta 1 as we position for larger trends.

The signal to flip short meaningfully is simple to us; when the market begins treating bad news as bad news we will begin shorting in earnest (not just taking on 3-6mo puts to hedge our net long). As long as we are trading below the 200 day moving average (~5750 on SPX), we will remain somewhat paranoid and continue increasing the size of our equity index put options, but not get outright short.

Current Macro Positioning

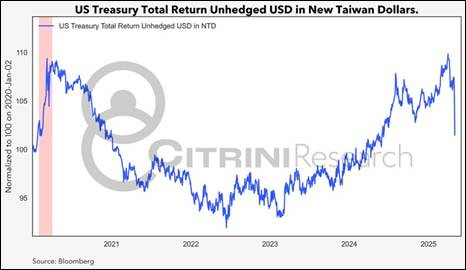

Bonus Macro Content (Yay): WTF IS UP WITH TAIWAN?

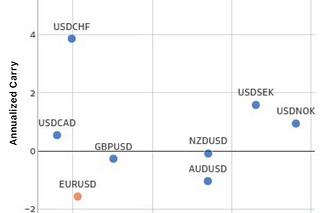

In our second installment of “Global Macro Trading for Idiots” detailing foreign exchange, I explained that exchange rate movements are pretty much just interest rate differentials and expectations thereof.

But, of course, there are exceptions that prove the rule. And we have a great one in USDTWD’s *NINETEEN STANDARD DEVIATION MOVE*.

The basics are similar to SVB - financial institutions not hedging because it seems counterintuitive and expensive. A tale as old as time (or at least, the time cost of money).

Taiwan’s dollar should be a textbook “strong-surplus” currency: the island rings up a current-account surplus near 8 percent of GDP, piles its reserves beyond $560 billion, and never met a semiconductor it couldn’t sell.

Yet for years the central bank quietly leaned on the exchange rate, letting interest-rate differentials shoulder the load while exporters and insurers enjoyed a cheap TWD. That’s driven flows that are extremely outsized relative to Taiwan’s small size - with Taiwanese life insurers holding $300B of USTs and Taiwanese foreign assets held >$1T.

That policy crumpled last week. At a time when life insurers in Taiwan are the least hedged vs dollar weakness than they’ve been in the last seven years.

Negotiators in Washington have hinted that a visibly weak TWD is no longer “polite.” Taipei has stopped leaning so hard on the bid, and the market pounced. Spot USDTWD slid 10 percent in two sessions—the sharpest Taiwan-dollar jump since 1992.

A bigger trade surplus now matters more directly for FX strength than rate differentials and is supported by frenzied hedging by exporters and life insurers (who act more like banks than life insurers in the west). And this is primarily why the usual interest rate differential maths dictating the carry trade just broke.

Why does this matter for anyone besides Taiwan?

Taiwanese life insurers have built a $1.7 trillion offshore book, roughly 70 percent in USD assets. That is more than twice domestic GDP and five times the size of the local bond market. Most of those positions remain only partially hedged, a conscious bet that TWD weakness was structural. Check out what your return looks like if you’re a degen Taiwanese lifer stuffed to the gills with unhedged USTs:

The analogy to SVB is uncomfortably neat - where SVB was irrationally comfortable with the assurance that rates would stay low forever, Taiwanese lifers were comfortable that the exchange rate would stay favorable. They’ve got tons of long-duration US bonds funded by liabilities callable in local currency. A 10 percent rally in the TWD torches capital ratios and, thanks to the liquidity features of Taiwanese life insurance products being more similar to banks’ demand deposits than western life insurance products, their solvency now hinges on how fast they can slap on hedges or dump Treasuries.

Some lifers are rumored to be short KRW or INR as a rough proxy for TWD weakness. Correlation trades work until they don’t: Korea’s and India’s balance sheets look nothing like Taiwan’s, and liquidity mismatches multiply under stress. If those proxies blow out, forced unwinds could amplify regional FX volatility.

This introduces another issue for the administration - besides recession risk, President Trump faces another hard constraint as some 6-9 Trillion of US federal debt comes due between Apr and June this year. Meanwhile, traditionally reliable price insensitive foreign buyers like East Asian (Japan, China, and Taiwan) Central Banks and financial institutions are pulling back from buying US Treasuries, wary of heavy capital losses resulting from USD depreciation. The US government faces a debt demand problem. Further, we are in a generally unfavorable environment about debt financing with the stock-bond correlation having flipped positive.

While I have traded TWD and spoken previously about this risk, I am nowhere near an expert. I highly recommend following Brad Setser (@brad_setser) on X (and reading his/Josh Younger/Robin Wigglesworth’s FT pieces about this) to continue to gauge the potential for contagion.* If you’re trading US bonds, keep an eye on TWD cross-currency basis; a sudden widening would signal real money exiting.

Some articles here:

How Taiwan became a quiet bond market superpower

Thanks for your great commentary and well-reasoned report.

While there are some constraints -- the bond market for one and the Republican Congress in theory -- Trump 2.0 has seemed much less constrained by conventional forces than Trump 1.0. Bessent is smart and well meaning, but others in the White House seem to have Trump's ears as much as Bessent. Trump has some political constraints but he's not facing a reelection ever again (presumably) and probably doesn't expect to get a lot done via Congress after the midterms in any event.

The April 2 tariffs were huge and a negative surprise to Wall Street, and it seems like there is a risk that Trump is less than willing to back down and accommodate "deals" -- spurred on by his most hawkish trade advisors. Trump has gone well beyond what is legal with his executive orders and even is ignoring a Supreme Court order on facilitating the return of a legal resident from an El Salvador prison. There is certainly a significant risk that he might choose to ignore economic constraints that a more reasonable politician wouldn't.

His love of tariffs goes back several decades. While he doesn't want to be considered another Hoover (there is a case that Hoover is unfairly blamed, but still he is blamed) it might take quite a lot of compelling evidence to persuade him things are going south or Trump may judge he can blame whatever happens this year on Biden or on a short-term pain for long-term gain.

I certainly hope your optimistic view is right, but there are risks in the other direction.

Banger!!