Key Events This Week: GDP, Core PCE, Durables, Powell And Fed Speakers Galore

本周重点事件:GDP、核心 PCE、耐用品、鲍威尔及众多美联储官员讲话

There’s a lot going on this week but the latest developments in the Israel-Iran conflict will clearly dominate, especially now the US is involved. Against this backdrop, the NATO summit will be held in The Hague tomorrow and Wednesday. It seems all members will agree to a 5% of GDP defense spending plan apart from Spain who will get an exemption. The latest draft appears to be - what else - a delay of the full spending spree until 2035 rather than the initial 2032 that Secretary General Rutte was aiming towards (and which sparked the rabid move higher in European stocks at the start of the year which has all but fizzled now). Note 3.5% would be core military spending, and 1.5% would be defense related areas such as infrastructure and cybersecurity.

本周有许多重要事件,但以色列-伊朗冲突的最新进展显然将成为焦点,尤其是在美国介入的情况下。在此背景下,北约峰会将于明天和周三在海牙举行。看来除了西班牙将获得豁免外,所有成员国都将同意将国防开支定为 GDP 的 5%。最新草案似乎——还能是什么呢——是将全面开支计划的实施推迟到 2035 年,而非最初秘书长鲁特所期望的 2032 年(这一目标曾在年初引发欧洲股市的狂热上涨,但现在几乎已消退)。需注意的是,3.5%将用于核心军事开支,1.5%则用于基础设施和网络安全等国防相关领域。

Elsewhere Fed's Chair Powell's semi-annual testimonies to Congress on Tuesday and Wednesday are usually key events but note that this comes shortly after last week’s FOMC so maybe they’ll be less additive information this time. There is also lots of Fedspeak this week that will be in the day-by-day calendar but Waller speaking again today will be of note given his dovish speech on Friday where he all but confirmed that he was one of the two members who have three cuts this year in the dots. He didn’t rule out a July cut and markets are trying to handicap what it would mean if he became the next Fed chair. In a speech earlier today, Fed vice chair Michelle Bowman joined Waller in calling for a July rate cut, sending the dollar plunging.

此外,美联储主席鲍威尔周二和周三向国会的半年度证词通常是关键事件,但请注意,这次证词紧随上周的 FOMC 会议之后,因此这次可能提供的信息增量较少。本周还有大量美联储官员讲话,将列入每日日程,但鉴于沃勒周五发表的鸽派讲话几乎确认他是点阵图中今年支持三次降息的两名成员之一,他今天再次发言值得关注。他没有排除 7 月降息的可能,市场正试图评估如果他成为下一任美联储主席将意味着什么。在今天早些时候的一次讲话中,美联储副主席米歇尔·鲍曼加入沃勒的行列,呼吁 7 月降息,导致美元大幅下跌。

Staying in the US, the Senate will continue its mark-up of the “One Big Beautiful Bill Act” (OBBBA) with potential for a vote by the end of the week. However, several substantial policy debates remain – namely, Medicaid, SALT cap reform and repeal of clean energy tax credits. Though many details remain in flux, from what our economists know at present, their expectations for 6.5 – 7.0% deficits as a share of GDP over the next three years has remained largely unchanged.

继续关注美国,参议院将继续对“一项大型美好法案”(OBBBA)进行修订,预计本周末可能进行投票。然而,仍有几项重大政策辩论悬而未决——主要是医疗补助、州和地方税(SALT)上限改革以及清洁能源税收抵免的废除。尽管许多细节仍在变化,但根据我们经济学家的最新了解,他们对未来三年赤字占 GDP 比例在 6.5%至 7.0%之间的预期基本保持不变。

Outside of the big NATO meeting, China will hold its NPC Standing Committee meeting from tomorrow through to Friday. There will also be an EU-Canada summit today, with Canada's Prime Minister Carney attending. Finally, EU leaders will hold a summit in Brussels on Thursday/Friday.

在大型北约会议之外,中国将从明天起至周五召开全国人大常委会会议。今天还将举行欧盟-加拿大峰会,加拿大总理卡尼将出席。最后,欧盟领导人将于周四和周五在布鲁塞尔举行峰会。

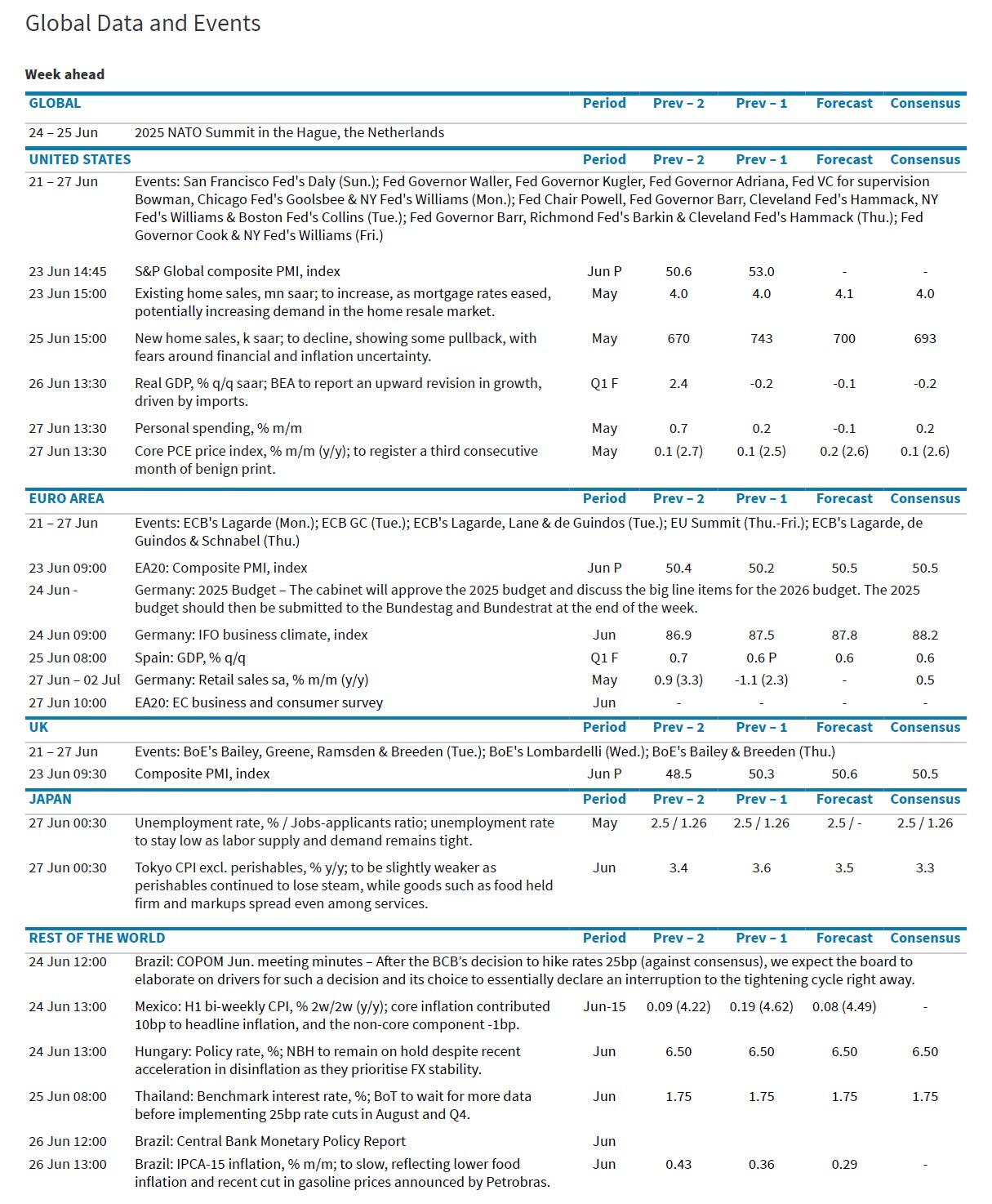

In terms of the other highlights we have preliminary June PMIs, US existing home sales and Lagarde speaking today; US consumer confidence, the German Ifo and Canadian CPI tomorrow; US new home sales, Japanese PPI, Australia CPI and a 5yr UST auction on Wednesday; final US Q1 GDP, US durable goods, the Chicago Fed, the US trade balance, jobless claims, and a 7 yr UST auction on Thursday; and core US PCE, US personal spending/income, Chinese Industrial profits, Tokyo CPI, and French and Spanish CPI. There are more in the calendar at the end but of these the core US PCE is the most interesting.

其他重点包括初步公布的 6 月 PMI、美国现有房屋销售以及拉加德今天的讲话;明天将公布美国消费者信心指数、德国 IFO 指数和加拿大 CPI;周三有美国新屋销售、日本 PPI、澳大利亚 CPI 以及 5 年期美国国债拍卖;周四公布美国第一季度最终 GDP、美国耐用品订单、芝加哥联储指数、美国贸易余额、失业救济申请数据以及 7 年期美国国债拍卖;还有核心美国 PCE、美国个人支出/收入、中国工业利润、东京 CPI 以及法国和西班牙 CPI。日程表末尾还有更多数据,但其中最值得关注的是核心美国 PCE。

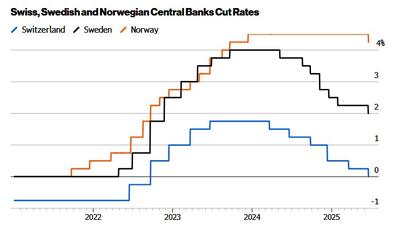

Courtesy of DB, here is a day-by-day calendar of events

感谢 DB,以下是逐日的事件日历

Monday June 23 6 月 23 日,星期一

- Data: US, UK, Japan, Germany, France and the Eurozone preliminary June PMIs, US May existing home sales

数据:美国、英国、日本、德国、法国和欧元区初步 6 月 PMI,美国 5 月现有房屋销售 - Central banks: Fed's Waller, Bowman, Goolsbee, Williams and Kugler speak, ECB's President Lagarde and Nagel speak

央行:美联储的 Waller、Bowman、Goolsbee、Williams 和 Kugler 发表讲话,欧洲央行行长 Lagarde 和 Nagel 发表讲话 - Other: EU-Canada summit 其他:欧盟-加拿大峰会

Tuesday June 24 6 月 24 日,星期二

- Data: US June Conference Board consumer confidence index, Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index and business conditions, April FHFA house price index, Q1 current account balance, Germany June Ifo survey, Canada May CPI

数据:美国 6 月 Conference Board 消费者信心指数,费城联储非制造业活动指数,里士满联储制造业指数及商业状况,4 月 FHFA 房价指数,第一季度经常账户余额,德国 6 月 IFO 调查,加拿大 5 月 CPI - Central banks: Fed's Chair Powell testifies to the House Financial Services Committee, Fed's Hammack, Williams, Collins and Barr speak, ECB's President Lagarde, Guindos and Lane speak, BoE's Governor Bailey, Greene, Ramsden and Breeden speak

央行:美联储主席鲍威尔在众议院金融服务委员会作证,美联储的哈马克、威廉姆斯、柯林斯和巴尔发表讲话,欧洲央行行长拉加德、金多斯和莱恩发表讲话,英格兰银行行长贝利、格林、拉姆斯登和布里登发表讲话 - Earnings: FedEx, Carnival

财报:联邦快递,嘉年华 - Auctions: US 2-year Notes ($69bn)

拍卖:美国 2 年期国债(690 亿美元) - Other: NATO summit through June 25, China's NPC Standing Committee meeting through June 27

其他:北约峰会持续至 6 月 25 日,中国全国人大常委会会议持续至 6 月 27 日

Wednesday June 25 6 月 25 日,星期三

- Data: US May new home sales, Japan May PPI services, France June consumer confidence, EU27 May new car registrations, Australia May CPI

数据:美国 5 月新屋销售,日本 5 月生产者物价指数(PPI)服务业,法国 6 月消费者信心,欧盟 27 国 5 月新车注册,澳大利亚 5 月消费者物价指数(CPI) - Central banks: Fed's Chair Powell testifies to the Senate Banking Committee, BoJ's summary of opinions from the June meeting, Tamura speaks, BoE's Lombardelli speaks

央行:美联储主席鲍威尔向参议院银行委员会作证,日本银行公布 6 月会议意见摘要,田村发言,英格兰银行隆巴代利发言 - Earnings: Micron Technology

财报:美光科技 - Auctions: US 2-year FRN (reopening, $28bn), 5-year Notes ($70bn)

拍卖:美国 2 年期浮动利率国债(重开,280 亿美元),5 年期国债(700 亿美元)

Thursday June 26 6 月 26 日,星期四

- Data: US May durable goods orders, Chicago Fed national activity index, pending home sales, advance goods trade balance, wholesale inventories, June Kansas City Fed manufacturing activity, initial jobless claims, Germany July GfK consumer confidence

数据:美国 5 月耐用品订单,芝加哥联储全国活动指数,待售房屋销售,初步商品贸易差额,批发库存,6 月堪萨斯城联储制造业活动,初请失业金人数,德国 7 月 GfK 消费者信心指数 - Central banks: Fed's Barkin, Hammack and Barr speak, ECB's Schnabel and Guindos speak, BoE's Governor Bailey and Breeden speak

央行:美联储的 Barkin、Hammack 和 Barr 发言,欧洲央行的 Schnabel 和 Guindos 发言,英格兰银行行长 Bailey 和 Breeden 发言 - Earnings: Nike, H&M 财报:耐克,H&M

- Auctions: US 7-year Notes ($44bn)

拍卖:美国 7 年期国债(440 亿美元) - Other: European Council in Brussels through June 27

其他:欧洲理事会布鲁塞尔会议至 6 月 27 日

Friday June 27 6 月 27 日星期五

- Data: US May PCE, personal income, personal spending, June Kansas City Fed services activity, China May industrial profits, Japan June Tokyo CPI, May jobless rate, job-to-applicant ratio, retail sales, France June CPI, May PPI, consumer spending, Italy June consumer confidence index, economic sentiment, manufacturing confidence, May PPI, April industrial sales, Eurozone June economic confidence, Canada April GDP

数据:美国 5 月 PCE、个人收入、个人支出,6 月堪萨斯城联储服务业活动,中国 5 月工业利润,日本 6 月东京 CPI、5 月失业率、求职者与职位比率、零售销售,法国 6 月 CPI、5 月 PPI、消费者支出,意大利 6 月消费者信心指数、经济情绪、制造业信心、5 月 PPI、4 月工业销售,欧元区 6 月经济信心,加拿大 4 月 GDP - Central banks: Fed's Williams, Hammack and Cook speak, ECB's Rehn speaks

央行:美联储的 Williams、Hammack 和 Cook 发表讲话,欧洲央行的 Rehn 发表讲话

* * *

Finally, turning to the US, Goldman writes that the key economic data releases this week are the durable goods and advance goods trade balance reports on Thursday and the core PCE inflation report on Friday. There are many speaking engagements by Fed officials this week, including Chair Powell's semiannual Congressional testimony on Tuesday and Wednesday.

最后,转向美国,高盛写道,本周的关键经济数据发布包括周四的耐用品订单和初步商品贸易差额报告,以及周五的核心 PCE 通胀报告。本周美联储官员有多场演讲活动,包括鲍威尔主席周二和周三的半年度国会证词。

Monday, June 23 6 月 23 日,星期一

- 03:00 AM Fed Governor Waller speaks: Federal Reserve Governor Christopher Waller will give opening remarks at the 2025 International Journal of Central Banking Conference. Speech text is expected. On June 20, Waller said, "I think we’ve got room to bring [the funds rate] down, and then we can kind of see what happens with inflation,” and that the FOMC “could [lower interest rates] as early as July.”

凌晨 3:00 美联储理事沃勒发言:美联储理事 Christopher Waller 将在 2025 年《国际中央银行杂志》会议上发表开幕词。预计将公布演讲稿。6 月 20 日,沃勒表示,“我认为我们有空间降低[联邦基金利率],然后我们可以观察通胀的变化”,并且 FOMC“可能最早在 7 月降息”。 - 09:45 AM S&P Global US manufacturing PMI, June preliminary (consensus 51.0, last 52.0); S&P Global US services PMI, June preliminary (consensus 52.9, last 53.7)

上午 9:45 标普全球美国制造业 PMI,6 月初值(市场预期 51.0,前值 52.0);标普全球美国服务业 PMI,6 月初值(市场预期 52.9,前值 53.7) - 10:00 AM Existing home sales, May (GS +1.5%, consensus -1.3%, last -0.5%)

上午 10:00 5 月现有住宅销售(高盛预测+1.5%,市场预期-1.3%,前值-0.5%) - 10:00 AM Fed Governor Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will speak at the 2025 International Journal of Central Banking Conference. Speech text and a webcast are expected.

上午 10:00 美联储理事鲍曼发言:联邦储备副主席兼监管主管米歇尔·鲍曼将在 2025 年《国际中央银行杂志》会议上发表讲话。预计将提供演讲稿和网络直播。 - 01:10 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will participate in a moderated Q&A at the Milwaukee Business Journal Mid-Year Outlook 2025 in Milwaukee, Wisconsin. On June 3, Goolsbee said, "The answer to the question of where interest rates will go depends on what will happen in the next three months to the data on inflation and employment." He went on to say, "Personally, I’m a little gun shy about making the argument [that the inflation shock from tariffs will be transitory] before we know how big the shock is going to be."

01:10 PM 芝加哥联储主席古尔斯比(FOMC 投票成员)发言:芝加哥联储主席 Austan Goolsbee 将参加在威斯康星州密尔沃基举行的《密尔沃基商业日报》2025 年年中展望活动中的一场主持问答环节。6 月 3 日,古尔斯比表示:“关于利率将走向何方的问题,取决于未来三个月通胀和就业数据的变化。”他接着说:“就我个人而言,在我们还不知道冲击有多大之前,我对断言[关税引发的通胀冲击将是暂时的]持谨慎态度。” - 02:30 PM New York Fed President Williams (FOMC voter) and Fed Governor Kugler speak: New York Fed President John Williams and Fed Governor Adriana Kugler will host a Fed Listens event at SUNY Schenectady Community College. On May 27, Williams said "You want to avoid inflation becoming highly persistent because that could become permanent, and the way to do that is to respond relatively strongly." On June 5, Kugler said, "I see greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road."

下午 02:30 纽约联储主席 Williams(FOMC 投票成员)和联储理事 Kugler 发言:纽约联储主席 John Williams 和联储理事 Adriana Kugler 将在纽约州立大学斯克内克塔迪社区学院举办一次“联储倾听”活动。5 月 27 日,Williams 表示:“你希望避免通胀变得高度持久,因为那可能变成永久性的,避免的方法是采取相对强烈的应对措施。”6 月 5 日,Kugler 表示:“我目前看到通胀存在更大的上行风险,而未来就业和产出增长存在潜在的下行风险。”

Tuesday, June 24 2024 年 6 月 24 日,星期二

- 09:00 AM FHFA house price index, April (consensus -0.1%, last -0.1%)

09:00 AM FHFA 房价指数,4 月(市场预期-0.1%,上次-0.1%) - 09:00 AM S&P Case-Shiller 20-city home price index, April (GS -0.2%, Consensus -0.2%, last -0.1%)

09:00 AM 标普凯斯-希勒 20 城市房价指数,4 月(高盛 -0.2%,市场预期 -0.2%,上次 -0.1%) - 09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak on monetary policy at the Barclays-CEPR Monetary Policy Forum 2025 in London. Speech text and Q&A are expected.

09:15 克利夫兰联储主席哈马克(FOMC 非投票成员)发言:克利夫兰联储主席 Beth Hammack 将在伦敦举行的巴克莱-CEPR 2025 货币政策论坛上就货币政策发表讲话。预计将有演讲稿和问答环节。 - 10:00 AM Conference Board consumer confidence, June (GS 100.6, consensus 99.8, last 98.0)

上午 10:00 会议委员会消费者信心指数,6 月(高盛预测 100.6,市场一致预期 99.8,前值 98.0) - 10:00 AM Fed Chair Powell Speaks: Fed Chair Jerome Powell will testify before the House Committee on Financial Services for the Federal Reserve’s Semi-Annual Monetary Policy Report. Speech text and Q&A are expected. In his press conference following the June FOMC meeting, Powell reiterated that monetary policy is “in a good place” and acknowledged the favorable recent inflation news while making it clear that he still expects to see meaningful further tariff effects on consumer prices over the summer.

上午 10:00 美联储主席鲍威尔发言:美联储主席杰罗姆·鲍威尔将出席众议院金融服务委员会,作美联储半年货币政策报告的证词。预计将有演讲稿和问答环节。在 6 月 FOMC 会议后的新闻发布会上,鲍威尔重申货币政策“处于良好状态”,并承认近期通胀数据利好,同时明确表示他仍预计夏季消费者价格将受到关税影响,出现显著进一步变化。 - 12:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks at an event organized by the Center for Economic Growth and NY CREATES in Albany, New York. Speech text and Q&A are expected.

纽约联储主席威廉姆斯(FOMC 投票成员)12:30 发言:纽约联储主席约翰·威廉姆斯将在纽约奥尔巴尼由经济增长中心和 NY CREATES 组织的活动上发表主题演讲。预计将有演讲稿和问答环节。 - 02:00 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will speak at an event co-hosted by Harvard University's Joint Center for Housing Studies and several Federal Reserve Banks. Speech text and Q&A are expected.

下午 2:00 波士顿联储主席柯林斯(FOMC 投票成员)发言:波士顿联储主席苏珊·柯林斯将在由哈佛大学住房研究联合中心和多家联邦储备银行联合主办的活动上发表讲话。预计将有演讲稿和问答环节。 - 04:00 PM Fed Governor Barr speaks: Fed Governor Michael Barr will give welcoming remarks at a Fed Listens event. Speech text and a livestream are expected.

下午 04:00 美联储理事巴尔发言:美联储理事迈克尔·巴尔将在美联储倾听活动上致欢迎辞。预计将提供演讲稿和直播。 - 08:15 PM Kansas City Fed President Schmid (FOMC voter) speaks: Kansas City Fed President Jeff Schmid will give a speech on the economic outlook at the 2025 Agricultural Summit. Speech text and Q&A are expected. On June 5, Schmid said, "While theory might suggest that monetary policy should look through a one-time increase in prices, I would be uncomfortable staking the Fed’s reputation and credibility on theory."

20:15 堪萨斯城联储主席 Schmid(FOMC 投票成员)发言:堪萨斯城联储主席 Jeff Schmid 将在 2025 年农业峰会上就经济前景发表演讲。预计将有演讲稿和问答环节。6 月 5 日,Schmid 表示:“虽然理论上货币政策应忽视一次性价格上涨,但我不愿意将美联储的声誉和信誉寄托于理论之上。”

Wednesday, June 25 2024 年 6 月 25 日,星期三

- 10:00 AM New home sales, May (GS -4.5%, consensus -6.7%, last +10.9%)

上午 10:00 新屋销售,5 月(高盛预测-4.5%,市场一致预期-6.7%,前值+10.9%) - 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will testify before the Senate Committee on Banking, Housing, and Urban Affairs for the Federal Reserve’s Semi-Annual Monetary Policy Report. Speech text and Q&A are expected.

上午 10:00 美联储主席鲍威尔发言:美联储主席杰罗姆·鲍威尔将出席参议院银行、住房和城市事务委员会,作美联储半年货币政策报告的证词。预计将有演讲稿和问答环节。

Thursday, June 26 2024 年 6 月 26 日,星期四

- 08:30 AM Advance goods trade balance, May (GS -$85.0bn, consensus -$91.0bn, last -$87.0bn)

08:30 五月预先商品贸易差额(高盛预测-850 亿美元,市场预期-910 亿美元,上次-870 亿美元) - 08:30 AM Wholesale inventories, May preliminary (last +0.2%)

08:30 批发库存,5 月初值(上次 +0.2%) - 08:30 AM GDP, Q1 third release (GS -0.2%, consensus -0.2%, last -0.2%); Personal consumption, Q1 third release (GS +1.0%, consensus +1.2%, last +1.2%); Core PCE inflation, Q1 third release (GS +3.42%, consensus +3.4%, last +3.4%): We estimate no revision on net to Q1 GDP growth, reflecting a downward revision to consumer spending (-0.2pp to +1.0%) due to softer utilities and personal home care details in the Quarterly Services Survey (QSS), an upward revision to business fixed investment (+0.1pp to +11.9%), and an upward revision to net exports.

08:30 AM GDP,第一季度第三次发布(GS -0.2%,市场预期 -0.2%,上次 -0.2%);个人消费,第一季度第三次发布(GS +1.0%,市场预期 +1.2%,上次 +1.2%);核心 PCE 通胀,第一季度第三次发布(GS +3.42%,市场预期 +3.4%,上次 +3.4%):我们估计第一季度 GDP 增长净修正为零,反映出消费者支出因季度服务调查(QSS)中公用事业和个人家庭护理细节疲软而下调 0.2 个百分点至+1.0%,企业固定投资上调 0.1 个百分点至+11.9%,净出口也有所上调。 - 08:30 AM Durable goods orders, May preliminary (GS +15.0%, consensus +8.5%, last -6.3%); Durable goods orders ex-transportation, May preliminary (GS flat, consensus flat, last +0.2%); Core capital goods orders, May preliminary (GS -0.4%, consensus -0.4%, last -1.5%); Core capital goods shipments, May preliminary (GS -0.2%, consensus -0.2%, last -0.1%): We estimate that durable goods orders jumped 15% in the preliminary May report (month-over-month, seasonally adjusted), reflecting a sharp increase in commercial aircraft orders following President Trump’s visit to the Middle East. We forecast a 0.4% decline in core capital goods orders—reflecting contractionary new orders readings for manufacturing surveys in May—and a 0.2% decline in core capital goods shipments—reflecting the decline in orders over the last month.

08:30 耐用品订单,5 月初值(GS +15.0%,市场预期 +8.5%,前值 -6.3%);耐用品订单(不含运输),5 月初值(GS 持平,市场预期 持平,前值 +0.2%);核心资本品订单,5 月初值(GS -0.4%,市场预期 -0.4%,前值 -1.5%);核心资本品出货量,5 月初值(GS -0.2%,市场预期 -0.2%,前值 -0.1%):我们估计 5 月初值耐用品订单环比季调后大幅增长 15%,反映出特朗普总统访问中东后商业飞机订单的急剧增加。我们预测核心资本品订单将下降 0.4%,这反映了 5 月份制造业调查中新订单的收缩趋势;核心资本品出货量预计下降 0.2%,反映了过去一个月订单的减少。 - 08:30 AM Initial jobless claims, week ended June 21 (GS 240k, consensus 245k, last 245k); Continuing jobless claims, week ended June 14 (consensus 1,945k, last 1,945k)

08:30 初请失业金人数,截至 6 月 21 日当周(GS 预测 24 万,市场预期 24.5 万,上期 24.5 万);续请失业金人数,截至 6 月 14 日当周(市场预期 194.5 万,上期 194.5 万) - 08:45 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will speak on the economy during an event hosted by the New York Association for Business Economics.

08:45 AM 里士满联储主席巴金(FOMC 非投票成员)发言:里士满联储主席汤姆·巴金将在纽约商业经济学会主办的活动中就经济发表讲话。 - 09:00 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will give opening remarks at a conference focused on housing, workforce and economic development hosted by the Cleveland Fed in partnership with the Federal Reserve Banks of Atlanta, Boston, Chicago, Dallas, Kansas City, New York, Philadelphia, Richmond, and St. Louis. Speech text is expected.

09:00 AM 克利夫兰联储主席 Hammack(FOMC 非投票成员)发言:克利夫兰联储主席 Beth Hammack 将在一场由克利夫兰联储与亚特兰大、波士顿、芝加哥、达拉斯、堪萨斯城、纽约、费城、里士满和圣路易斯联储共同主办的,聚焦住房、劳动力和经济发展的会议上发表开幕词。预计将公布演讲稿。 - 10:00 AM Pending home sales, May (GS +2.5%, consensus flat, last -6.3%)

上午 10:00 5 月待售房屋销售(高盛预测增长 2.5%,市场预期持平,前值-6.3%) - 01:15 PM Fed Governor Barr speaks: Fed Governor Michael Barr will discuss how community development advances the Fed's objectives at a conference focused on housing, workforce and economic development hosted by the Cleveland Fed. Speech text, Q&A and a webcast are expected.

下午 01:15 美联储理事 Barr 发言:美联储理事 Michael Barr 将在克利夫兰联储主办的以住房、劳动力和经济发展为主题的会议上讨论社区发展如何推动美联储目标。预计将有演讲稿、问答环节和网络直播。

Friday, June 27 2024 年 6 月 27 日,星期五

- 07:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will serve as chair for a session featuring keynote remarks by Professor Carmen Reinhart at the Bank for International Settlements.

07:30 纽约联储主席威廉姆斯(FOMC 投票成员)发言:纽约联储主席约翰·威廉姆斯将在国际清算银行主持一场会议,会议将由卡门·莱因哈特教授发表主题演讲。 - 08:30 AM Personal income, May (GS +0.3%, consensus +0.2%, last +0.8%); Personal spending, May (GS +0.1%, consensus +0.2%, last +0.2%) ; Core PCE price index, May (GS +0.18%, consensus +0.1%, last +0.1%); Core PCE price index (YoY), May (GS +2.63%, consensus +2.6%, last +2.5%); PCE price index, May (GS +0.14%, consensus +0.1%, last +0.1%); PCE price index (YoY), May (GS +2.29%, consensus +2.3%, last +2.1%): We estimate that personal income and personal spending increased by 0.3% and 0.1%, respectively, in May. We estimate the core PCE price index rose by 0.18% in May, corresponding to a year-over-year rate of 2.63%. Additionally, we expect that the headline PCE price index to increase by 0.14% in May, corresponding to a year-over-year rate of 2.29%. Our forecast is consistent with a 0.13% increase in our trimmed core PCE measure (vs. 0.21% in April).

08:30 个人收入,5 月(GS +0.3%,市场预期 +0.2%,前值 +0.8%);个人支出,5 月(GS +0.1%,市场预期 +0.2%,前值 +0.2%);核心 PCE 物价指数,5 月(GS +0.18%,市场预期 +0.1%,前值 +0.1%);核心 PCE 物价指数(同比),5 月(GS +2.63%,市场预期 +2.6%,前值 +2.5%);PCE 物价指数,5 月(GS +0.14%,市场预期 +0.1%,前值 +0.1%);PCE 物价指数(同比),5 月(GS +2.29%,市场预期 +2.3%,前值 +2.1%):我们预计 5 月个人收入和个人支出分别增长 0.3%和 0.1%。我们预计 5 月核心 PCE 物价指数上涨 0.18%,对应的同比增速为 2.63%。此外,我们预计 5 月整体 PCE 物价指数上涨 0.14%,对应的同比增速为 2.29%。我们的预测与修正后的核心 PCE 指标上涨 0.13%(4 月为 0.21%)一致。 - 09:15 AM Fed Governor Cook and Cleveland Fed President Hammack (FOMC non-voter) speak: Fed Governor Lisa Cook and Cleveland Fed President Beth Hammack will participate in a Fed Listens event at a conference focused on housing, workforce and economic development hosted by the Cleveland Fed in partnership with the Federal Reserve Banks of Atlanta, Boston, Chicago, Dallas, Kansas City, New York, Philadelphia, Richmond, and St. Louis. Q&A is expected. On June 3, Cook said, "As I consider the appropriate path of monetary policy, I will carefully consider how to balance our dual mandate, and I will take into account the fact that price stability is essential for achieving long periods of strong labor market conditions."

09:15 美联储理事库克和克利夫兰联储行长哈马克(FOMC 非投票成员)发言:美联储理事 Lisa Cook 和克利夫兰联储行长 Beth Hammack 将参加由克利夫兰联储主办、并与亚特兰大、波士顿、芝加哥、达拉斯、堪萨斯城、纽约、费城、里士满和圣路易斯联储合作举办的以住房、劳动力和经济发展为主题的 Fed Listens 活动。预计将有问答环节。6 月 3 日,库克表示:“在考虑适当的货币政策路径时,我将仔细权衡我们的双重使命,并且会考虑到价格稳定对于实现长期强劲劳动力市场状况的重要性。” - 10:00 AM University of Michigan consumer sentiment, June final (GS 60.7, consensus 60.3, last 60.5): University of Michigan 5-10-year inflation expectations, June final (GS 4.1%, last 4.1%)

上午 10:00 密歇根大学消费者信心指数,6 月终值(高盛 60.7,市场预期 60.3,前值 60.5):密歇根大学 5-10 年通胀预期,6 月终值(高盛 4.1%,前值 4.1%)

Source: DB, Goldman 来源:DB,高盛

More economics stories on ZeroHedge

更多 ZeroHedge 上的经济新闻

US PMIs Beat Expectations In Early June Data, But...

美国 6 月初 PMI 数据超出预期,但……

Fed Groupthink Is A Bureaucratic Disease

美联储集团思维是一种官僚病

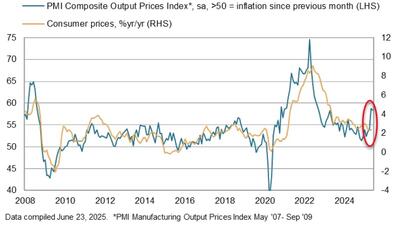

Liquidity Floodgates Open As 3 Central Banks Unexpectedly Cut Rates In Under 24 Hours

流动性闸门开启,三大央行在不到 24 小时内意外降息

NEVER MISS THE NEWS THAT MATTERS MOST

绝不错过最重要的新闻

ZEROHEDGE DIRECTLY TO YOUR INBOX

ZEROHEDGE 直接发送到您的收件箱

Receive a daily recap featuring a curated list of must-read stories.

每日接收一份精选必读故事的摘要。