While the market eagerly accepted the Trump Bump following election day, it has willfully had its head in the sand on potentially markets-disruptive aspects of the new US administration. Up until this weekend, the threat of new tariffs – a hallmark of Trump’s economic policy agenda – has generally been written off as a negotiating tactic or campaign bluster. That has fundamentally misunderstood the concept of a negotiating tactic, namely that the person (or nation-state) one is negotiating against needs to believe you’ll do what you say.

尽管市场在选举日后热切接受了特朗普的经济刺激,但它故意对新美国政府可能带来的市场干扰方面视而不见。直到这个周末,新关税的威胁——特朗普经济政策议程的标志——通常被视为谈判策略或竞选口号。这根本误解了谈判策略的概念,即对方(或国家)需要相信你会兑现你的承诺。

As we have said - Trump has come into this second term with plans for executing his strategies that have essentially nothing in the way of roadblocks.

正如我们所说 - 特朗普在第二任期内提出了执行其战略的计划,这些计划基本上没有任何障碍。

Even with the slide after headlines hit on Friday, there was still a distinct feeling in markets of disbelief, complacency or perhaps a combination of both. Beneath the surface of the weakening index, trading in single names did not hit obvious victims of 25% tariffs on Canada and Mexico much harder than their better insulated peers if at all.

即使在周五头条消息发布后出现下滑,市场上仍然存在明显的不信和自满感,或者可能是两者的结合。在疲软指数的表面之下,单个股票的交易并没有比更具防护能力的同行受到 25%对加拿大和墨西哥的关税明显打击得更重。

The market’s default stance seemed to be that even if tariffs were implemented, they’d be of the gradual or selective variety as suggested by Treasury Secretary Bessent or CEA Chairman appointee (and one-time CitriniResearch co-author) Stephen Miran. Perhaps U.S. trading partners were assuming the same.

市场的默认立场似乎是,即使实施关税,也会是财政部长贝森特或经济顾问委员会主席任命人(曾与 CitriniResearch 合作的)斯蒂芬·米兰所建议的逐步或选择性关税。也许美国的贸易伙伴也持有相同的假设。

This is exactly what has spurred Trump’s weekend announcement.

这正是促使特朗普周末发表声明的原因。

While ostensibly linked to the fentanyl crisis and triggered via the International Emergency Economic Powers Act (IEEPA), we think this is merely a convenient justification. The Saturday announcement of tariffs on the U.S.’s top three trading partners (25% tariffs on Mexican and Canadian goods, (10% on Canadian energy), and an incremental 10% duty on Chinese goods) is a wake up call.

虽然表面上与芬太尼危机相关,并通过国际紧急经济权力法案(IEEPA)触发,但我们认为这只是一个方便的借口。周六宣布对美国前三大贸易伙伴征收关税(对墨西哥和加拿大商品征收 25%的关税,对加拿大能源征收 10%的关税,以及对中国商品逐步征收 10%的关税)是一个警钟。

The Trade War is not an empty threat, and investors should be keenly aware that although this is certainly a negotiating tactic there is very little stopping Trump from upping the ante even further if he doesn’t get what he wants. His intent is to get the world to believe him for the rest of his term - and when you’re a U.S. trading partner, announcements that result in this kind of USD price action are hard to forget.

贸易战并不是空洞的威胁,投资者应该清楚地意识到,尽管这显然是一种谈判策略,但特朗普若得不到他想要的东西,几乎没有什么能够阻止他进一步加大力度。他的意图是让世界在他整个任期内相信他——而当你是美国的贸易伙伴时,导致这种美元价格波动的声明是很难被遗忘的。

As with all wars, this trade war will bring casualties on both sides. Unsurprisingly, retaliatory actions have already been announced. Trump, confident in his asymmetric advantage, appears ready to bear the pain. Put bluntly in the announcement:

与所有战争一样,这场贸易战将对双方造成伤害。毫不奇怪,报复行动已经宣布。特朗普对自己的非对称优势充满信心,似乎已经准备好承受痛苦。公告中直言不讳地指出:

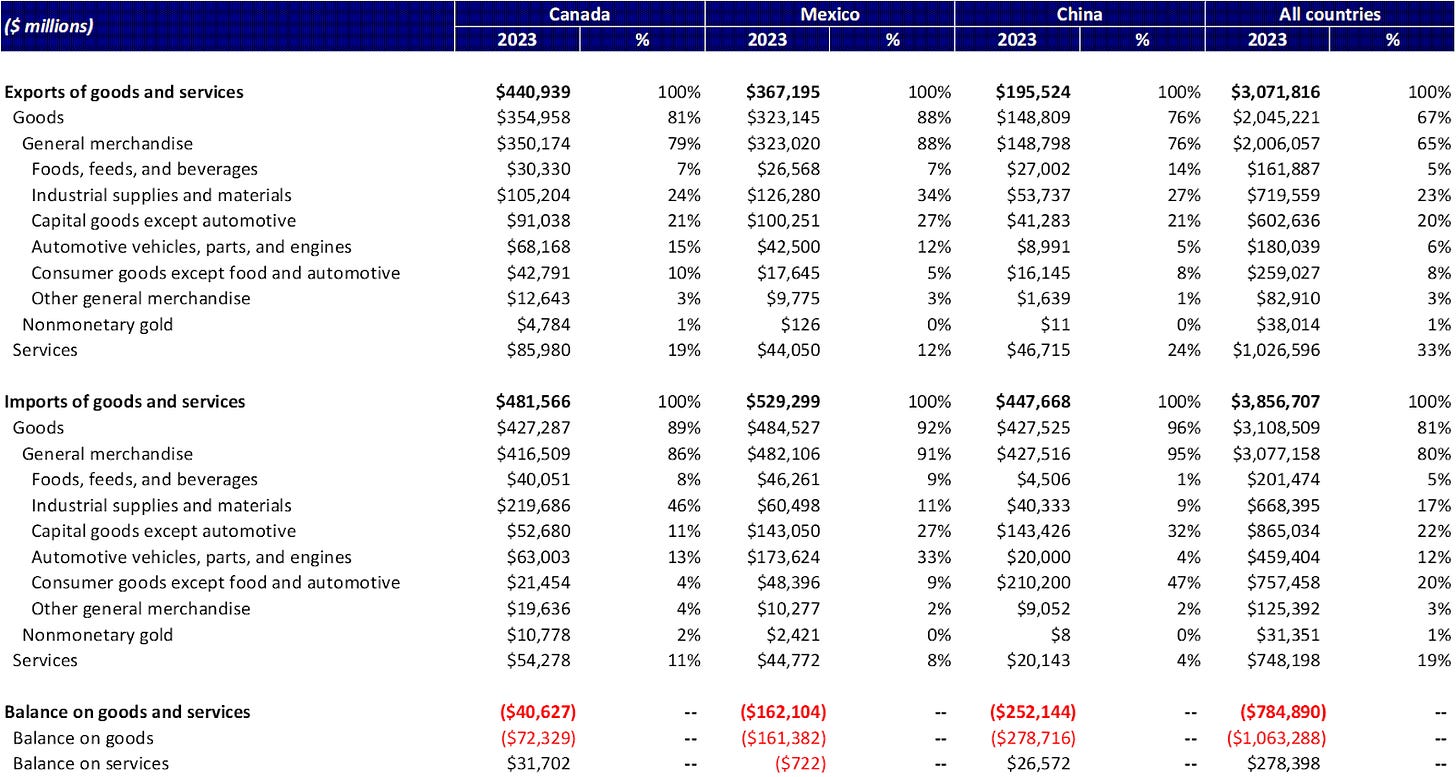

“While trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of U.S. GDP. However, in 2023 the U.S. trade deficit in goods was the world’s largest at over $1 trillion.”

“虽然贸易占加拿大 GDP 的 67%、墨西哥 GDP 的 73%和中国 GDP 的 37%,但它仅占美国 GDP 的 24%。然而,在 2023 年,美国在商品上的贸易赤字是全球最大的,超过 1 万亿美元。”

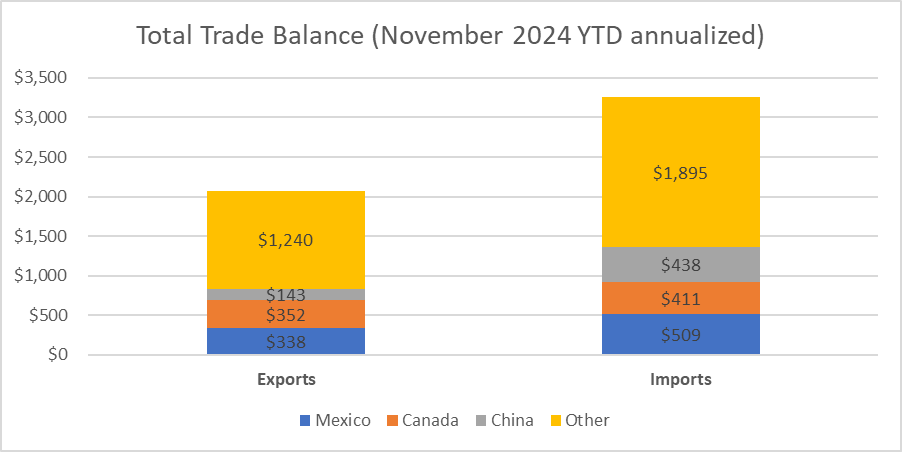

These three countries represent roughly 40% of international trade with the United States. In 2024, U.S. imports from Canada, Mexico, and China totalled $1,358 billion (42% of total), while U.S. exports totalled $832 billion (40% of total). The newly imposed tariffs would amount to over $250 billion in annualized duty on these imports, while retaliatory tariffs would add over $150 billion to exports.

这三个国家大约占美国国际贸易的 40%。在 2024 年,美国从加拿大、墨西哥和中国的进口总额为 1,3580 亿美元(占总额的 42%),而美国的出口总额为 8320 亿美元(占总额的 40%)。新征收的关税将使这些进口的年化关税超过 2500 亿美元,而报复性关税将使出口增加超过 1500 亿美元。

In short, we believe this move is an intentionally manufactured pain trade. The purpose is to cause trade, market, and FX disruption, with the expectation that effects will be felt disproportionately on the foreign side. The ambiguous pretense offers little in the way of an actual path towards appeasement for Canada or Mexico and allows Trump to offer “reprieve” at his discretion.

简而言之,我们认为这一举措是故意制造的痛苦交易。其目的是造成贸易、市场和外汇的干扰,预计影响将在外国一方上感受到不成比例。模糊的借口几乎没有提供实际的缓和途径给加拿大或墨西哥,并允许特朗普自行决定提供“缓刑”。

Motivated by a longer-term strategy of balancing trade deficits and spurring domestic industry, the short term effects will likely come with supply chain disruption, export weakness, and price pressure.

出于平衡贸易赤字和刺激国内产业的长期战略,短期内的影响可能会伴随供应链中断、出口疲软和价格压力。

While the market may take time to digest the practical impact on individual names (as well as handicapping the duration of the tariffs), we expect to see an initial knee-jerk reaction focused primarily on the most obvious first-order winners and losers.

尽管市场可能需要时间来消化对个别公司的实际影响(以及评估关税的持续时间),但我们预计会看到最初的本能反应,主要集中在最明显的第一顺序赢家和输家身上。

So, after having our weekend ruined by the market’s reaction to DeepSeek (and our insistence on being prepared), we’re running it back by preparing to trade the trade war.

所以,在我们的周末因市场对 DeepSeek 的反应而毁掉(以及我们坚持做好准备)之后,我们正在准备重新参与贸易战。

Here are some ideas we are considering in equities and macro…

以下是我们在股票和宏观方面考虑的一些想法……

My reasoning on creating this basket/watchlist is twofold.

我创建这个投资组合/观察名单的理由有两个。

First, these tariffs were largely unexpected by the market (as evidenced by the futures open), which largely believed they’d be a bluff. It became evident that they would not be on Friday when a deadline was announced, locking the administration into action that they were required to take lest they lose leverage. There may be more juice to squeeze from this, even after tomorrow’s open.

首先,这些关税在市场上是大大出乎意料的(期货开盘就证明了这一点),市场普遍认为这只是虚张声势。周五宣布的最后期限使得他们必须采取行动,否则将失去谈判筹码,这一点变得显而易见。即使在明天开盘后,这件事可能还有更多的潜力可挖。

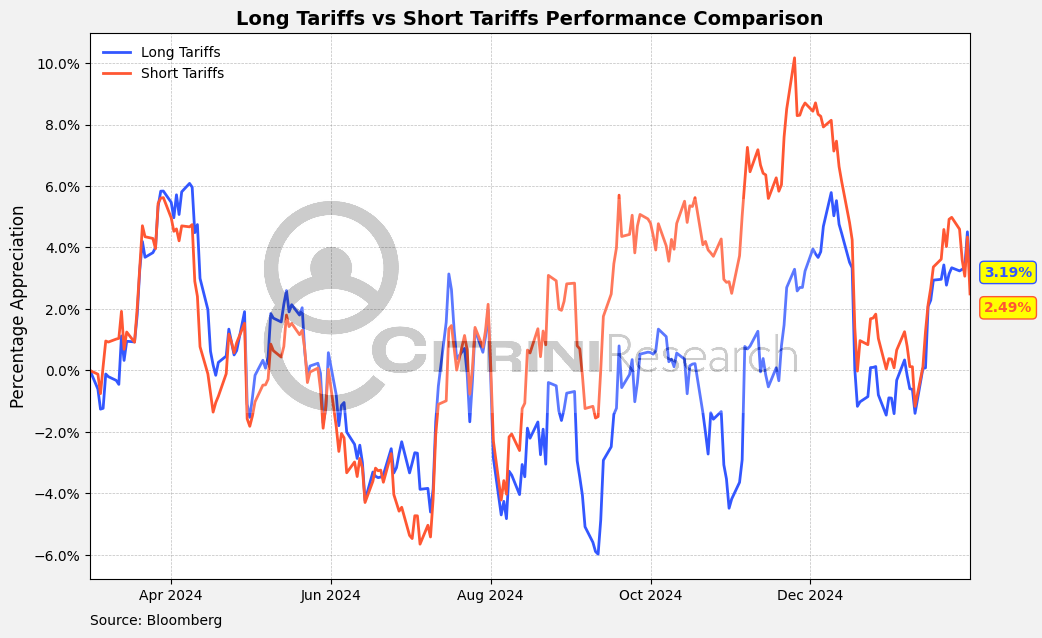

Second, one can create a collection of long/short pairs that otherwise would trade very tight but - in light of this development - could see very significant divergence. Whenever that’s the case the asymmetry makes constructing a basket worthwhile. We can observe that close correlation that could violently breakdown in the long and short side performance over the past year:

其次,可以创建一组长/短对,这些对在其他情况下会非常紧密交易,但考虑到这一发展,可能会出现非常显著的分歧。每当出现这种情况时,不对称性使得构建一个篮子变得值得。我们可以观察到,过去一年中,长短两侧的表现之间存在密切的相关性,但这种相关性可能会剧烈破裂:

Our Framework: Overview 我们的框架:概述

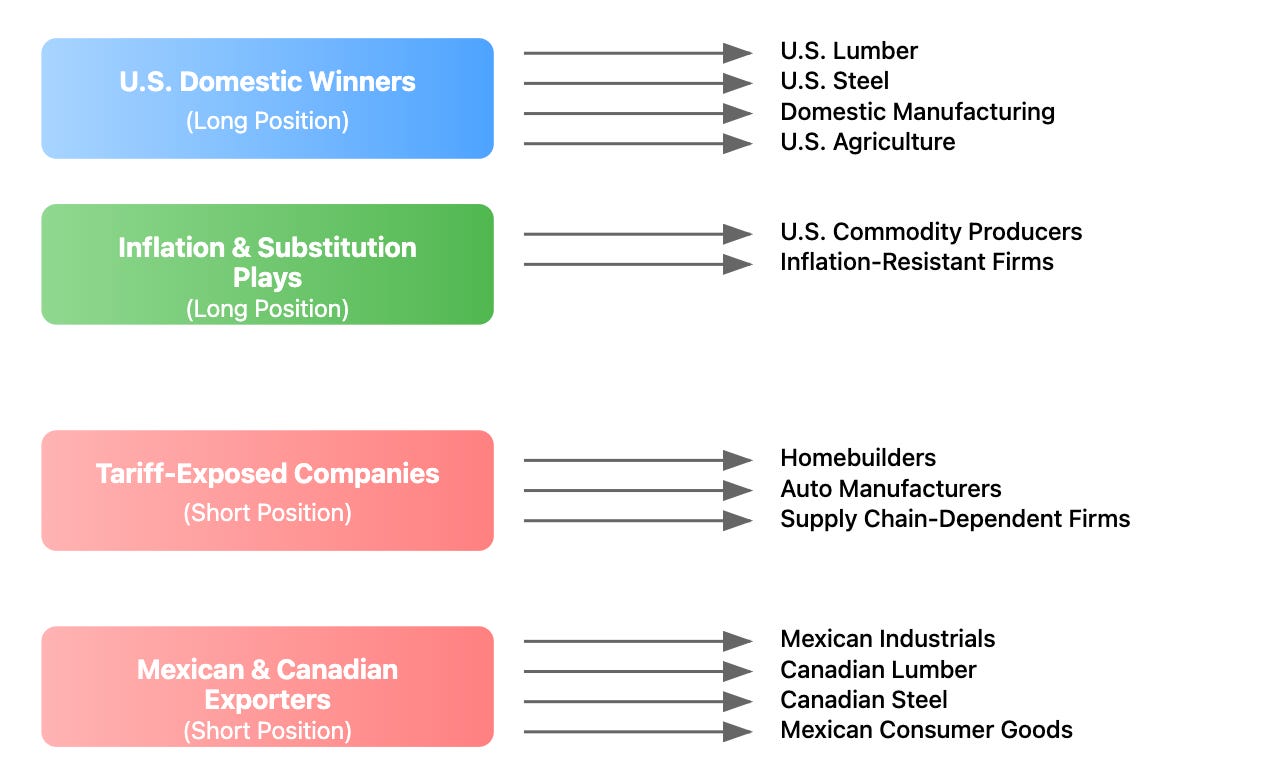

Long: Domestic Substitutes Benefiting from Tariffs

长: 受关税影响的国内替代品

U.S.-based manufacturers and suppliers that compete with Mexican and Canadian imports will gain pricing power as tariffs make foreign goods more expensive.

美国本土的制造商和供应商与墨西哥和加拿大进口商品竞争,将获得定价权,因为关税使外国商品变得更加昂贵。U.S. domestic lumber and steel producers, for example, benefit from a decline in Canadian competition, while Canadian lumber producers (and potentially domestic US companies that rely on importing Canadian lumber like homebuilders could suffer).

例如,美国国内的木材和钢铁生产商受益于加拿大竞争的下降,而加拿大木材生产商(以及可能依赖进口加拿大木材的美国国内公司,如房屋建筑商)可能会受到影响。U.S. agricultural producers could benefit if tariffs make imports from Mexico uncompetitive.

如果关税使来自墨西哥的进口失去竞争力,美国农业生产者可能会受益。

Long: Relative Pricing Power with the U.S. Consumer

长:与美国消费者的相对定价能力

Companies that can pass through higher costs to consumers will be less affected.

能够将更高成本转嫁给消费者的公司将受到的影响较小。Certain commodity producers (U.S.-based oil & gas, domestic metals, etc.) may benefit from an inflationary environment caused by supply chain disruptions.

某些商品生产商(美国的石油和天然气、国内金属等)可能会从因供应链中断而导致的通货膨胀环境中受益。

Short: Import-Dependent Companies Facing Higher Costs

短期:依赖进口的公司面临更高的成本

Companies relying on Mexican/Canadian supply chains for raw materials or intermediate goods will see input costs rise.

依赖墨西哥/加拿大供应链获取原材料或中间商品的公司将面临输入成本上升。Homebuilders are vulnerable as Canadian lumber and Mexican labor costs increase.

随着加拿大木材和墨西哥劳动力成本的增加,房屋建筑商面临脆弱局面。Auto manufacturers with North American supply chains could be hit hard (many auto parts come from Mexico).

拥有北美供应链的汽车制造商可能会受到严重影响(许多汽车零部件来自墨西哥)。

Short: Mexico/Canada-Exposed Companies Facing Demand Destruction

短期:面临需求破坏的墨西哥/加拿大暴露公司

Mexican and Canadian firms exporting to the U.S. will face volume declines and margin compression due to higher tariffs.

向美国出口的墨西哥和加拿大公司将面临销量下降和利润压缩,因为关税提高。Mexican consumer-focused companies (like Alsea SAB) may be shorted if U.S. spending on their products declines.

如果美国对其产品的消费下降,专注于墨西哥消费者的公司(如 Alsea SAB)可能会面临做空风险。Canadian steel and lumber firms may be shorted due to competitive disadvantages in the U.S. market.

加拿大的钢铁和木材公司可能会因在美国市场上的竞争劣势而受到做空。

We’ll go over some of the reasoning behind our ideas here to provide a firm framework for examining our overall basket and watchlist.

我们将在这里讨论一些我们想法背后的原因,以提供一个坚实的框架来检查我们的整体投资组合和观察名单。

Our broader watchlist of Potential Tariff Longs/Shorts in US, Mexico & Canada’s equity markets:

我们在美国、墨西哥和加拿大股票市场的潜在关税多头/空头的广泛观察名单:

Automotive and Auto Parts

汽车和汽车零部件

The modern auto supply chain, particularly for Detroit’s Big Three (General Motors, Ford, and Stellantis NV), spans both the Northern and Southern border with parts and final assembly often crossing multiple times. A 25% tariff on Mexican imports will likely inject massive cost inflation into the production process, posing the immediate threat of tighter margins or higher consumer prices—both negatives for demand. General Motors (GM) and Ford (F) have historically maintained sizable manufacturing footprints in Mexico for small cars and certain truck components, leaving them vulnerable to rising costs. Meanwhile, cross-border automotive suppliers such as Magna International (MGA), which is headquartered in Canada but manufactures heavily in both Canada and Mexico, also face the squeeze on two fronts.

现代汽车供应链,特别是底特律三大汽车制造商(通用汽车、福特和斯坦兰蒂斯),跨越北方和南方的边界,零部件和最终组装通常会多次交叉。对墨西哥进口商品征收 25%的关税可能会给生产过程注入巨大的成本通胀,立即威胁到利润空间的紧缩或消费者价格的上涨——这两者都对需求产生负面影响。通用汽车(GM)和福特(F)在墨西哥历史上一直保持着大规模的制造设施,生产小型汽车和某些卡车组件,使它们容易受到成本上升的影响。而跨境汽车供应商如麦格纳国际(MGA),总部位于加拿大,但在加拿大和墨西哥都有大量生产,也面临来自两个方面的压力。

Retaliatory tariffs imposed by Mexico or Canada on U.S.-made auto parts or finished vehicles would further challenge the entire North American ecosystem. Although these automakers could accelerate shifting production within the U.S. or to other low-cost regions (e.g., Asia), that pivot is expensive and time-consuming. As a result, those with the most entrenched cross-border supply chains (GM, Ford, and key Tier 1 suppliers like Lear Corporation) are at risk of margin compression and volume declines.

墨西哥或加拿大对美国制造的汽车零部件或成品车辆征收的报复性关税将进一步挑战整个北美生态系统。尽管这些汽车制造商可以加速在美国境内或转移到其他低成本地区(例如,亚洲)的生产,但这种转变既昂贵又耗时。因此,那些拥有最根深蒂固跨境供应链的公司(如通用汽车、福特以及像 Lear Corporation 这样的关键一级供应商)面临利润压缩和销量下降的风险。

Meanwhile, domestic-centric supply chains can sidestep many tariff costs. Tesla primarily relies on U.S.-based assembly, mitigating border taxes. Engine supplier Cummins and parts maker Dana may gain from any “reshoring” of supplier relationships as automakers seek to reduce cross-border exposure.

与此同时,以国内为中心的供应链可以避开许多关税成本。特斯拉主要依赖美国本土的组装,从而减轻边境税。发动机供应商康明斯和零部件制造商达纳可能会从任何“回流”供应商关系中受益,因为汽车制造商寻求减少跨境风险。

Trade Ideas 交易想法

LONG Insulated Supply Chains:

长期绝缘供应链:

Tesla (TSLA) 特斯拉 (TSLA)

Cummins (CMI) 康明斯 (CMI)

Dana Inc. (DAN)

SHORT Exposed Supply Chains:

短期暴露的供应链:

General Motors (GM) 通用汽车 (GM)

Ford (F) 福特 (F)

Lear Corporation (LEA)

Magna (MGA) 马格纳 (MGA)

Toyota (TM ADR) 丰田 (TM ADR)

Honda (HMC ADR) 本田 (HMC ADR)

Stellantis (STLA) 斯特兰蒂斯 (STLA)

BorgWarner (BWA) 博格华纳 (BWA)

O’Reilly Automotive (ORLY)

O'Reilly Automotive (ORLY)Genuine Parts Company (GPC)

正品配件公司 (GPC)Gentherm (THRM)

Consumer Goods and Retailers

消费品和零售商

Many large U.S. retailers rely on produce, beverages, and household goods sourced from Mexico and Canada. Walmart (WMT), Costco (COST), and Target (TGT) all feature grocery and general merchandise that flow across the southern and northern borders. A 25% tariff could quickly translate into higher input costs for items like fresh fruits, vegetables, and other consumer staples. Mexico exports a substantial share of fresh produce to the U.S., including tomatoes, avocados, and berries—staple items for companies like Dole (DOLE) and Fresh Del Monte (FDP). Producers like Calvado Growers (CVLG) are especially exposed. Retailers typically pass at least some portion of these costs on to shoppers, which risks dampening demand and squeezing margins if consumer traffic shifts to lower-priced alternatives or simply buys less.

许多大型美国零售商依赖于从墨西哥和加拿大采购的农产品、饮料和生活用品。沃尔玛(WMT)、好市多(COST)和塔吉特(TGT)都销售跨越南北边界的杂货和一般商品。25%的关税可能迅速转化为新鲜水果、蔬菜和其他日用消费品等商品的更高采购成本。墨西哥向美国出口大量新鲜农产品,包括番茄、鳄梨和浆果——这些都是像多尔(DOLE)和新鲜德尔蒙特(FDP)这样的公司的主打商品。像 Calvado Growers(CVLG)这样的生产商尤其面临风险。零售商通常会将至少一部分这些成本转嫁给消费者,这可能会抑制需求并压缩利润率,如果消费者的购买行为转向更便宜的替代品或减少购买数量。

Beer, wine, and spirits also face direct tariff exposure. Constellation Brands (STZ) relies on Mexican breweries for well-known labels like Corona and Modelo, meaning the cost to import these products may rise dramatically. Meanwhile, certain U.S.-based alcoholic beverage companies that produce stateside like Boston Beer Company (SAM), Brown-Forman (BF.B) could see incremental gains.

啤酒、葡萄酒和烈酒也面临直接的关税风险。康斯特 ellation 品牌(STZ)依赖墨西哥酿酒厂生产知名品牌如 Corona 和 Modelo,这意味着进口这些产品的成本可能会大幅上升。与此同时,某些在美国本土生产的酒精饮料公司,如波士顿啤酒公司(SAM)和布朗-福尔曼(BF.B),可能会看到增量收益。

Trade Ideas 交易想法

LONG Domestic Goods Producers:

LONG 国内商品生产商:

Boston Beer Company (SAM)

波士顿啤酒公司 (SAM)Brown-Forman (BF.B) 布朗-福曼 (BF.B)

American Outdoor Brands (AOUT)

美国户外品牌 (AOUT)Yeti Holdings (YETI)

SHORT Consumer Goods Importers:

短期消费品进口商:

Walmart (WMT) 沃尔玛 (WMT)

Home Depot (HD) 家得宝 (HD)

Lowe’s (LOW)

Constellation Brands (STZ)

康斯特 ellation 品牌(STZ)Dole (DOLE)

Fresh Del Monte Produce (FDP)

新鲜德尔蒙特农产品(FDP)Calvado Growers (CVLG) 卡尔瓦多种植者 (CVLG)

Best Buy (BBY) 百思买 (BBY)

Nike (NKE) 耐克 (NKE)

Under Armour (UAA) 安德玛 (UAA)

VF Corporation (VFC)

Dollar Tree (DLTR) 美元树 (DLTR)

Dollar General (DG) 美元通用 (DG)

TJX Companies (TJX) TJX 公司 (TJX)

Retaliation: Heavy Goods, Machinery, Agriculture,

报复: 重型货物、机械、农业、

High-profile targets like Boeing planes or Caterpillar equipment are natural choices for retaliatory measures. Canada could impose fees on heavy machinery imports, and Mexico might hit large-scale agricultural and construction equipment. These companies also sometimes rely on cross-border supply chains for components.

像波音飞机或卡特彼勒设备这样的高调目标是报复措施的自然选择。加拿大可以对重型机械进口征收费用,而墨西哥可能会对大规模农业和建筑设备采取措施。这些公司有时也依赖跨境供应链来获取组件。

Meanwhile, A 25% tariff on competing steel and aluminum imports from Mexico and Canada raises the relative attractiveness of domestic metals. Manufacturers that need steel or aluminum could look to “Buy American,” boosting these firms’ volumes and possibly allowing for some margin expansion.

与此同时,对来自墨西哥和加拿大的竞争性钢铁和铝进口征收 25%的关税,提高了国内金属的相对吸引力。需要钢铁或铝的制造商可能会选择“购买美国货”,从而提升这些公司的销量,并可能实现一定的利润扩展。

Trade Ideas 交易想法

LONG Domestic Steel: LONG 国内钢铁:

Nucor Corporation (NUE) 纽柯公司 (NUE)

Steel Dynamics, Inc. (STLD)

钢动态公司 (STLD)United States Steel Corporation (X)

美国钢铁公司 (X)

SHORT Heavy Machinery and Agriculture:

短期重型机械和农业:

Caterpillar Inc. (CAT) 卡特彼勒公司 (CAT)

Whirlpool Corporation (WHR)

惠而浦公司 (WHR)Deere & Company (DE) 迪尔公司 (DE)

Boeing Company (BA) 波音公司 (BA)

Archer-Daniels-Midland Company (ADM)

阿彻丹尼尔斯米德兰公司 (ADM)Tyson Foods, Inc. (TSN) 泰森食品公司 (TSN)

Energy: Oil Producers and Refineries

能源:石油生产商和炼油厂

Canada’s energy sector received somewhat of a reprieve, with a 10% tariff rate rather than the 25% levied on most other Canadian goods (and on Mexican energy exports). Still, the duty will tighten the differential between heavy Canadian crude (WCS) and the light, sweet crude from U.S. shale formations (WTI), broadly benefitting U.S. producers at the expense of Canadians.

加拿大的能源部门获得了一定的缓解,关税率为 10%,而不是对大多数其他加拿大商品(以及墨西哥能源出口)征收的 25%。尽管如此,这项关税将缩小重质加拿大原油(WCS)与美国页岩油田的轻质甜油(WTI)之间的差距,整体上使美国生产商受益,而加拿大生产商则受到损害。

Given the significant quantities in question, we don’t expect crude oil to stop flowing from Canada, or for refined products to stop flowing back. But even the 10% tariff (~$6/bbl) could have meaningful implications for U.S. refineries. Given that many of the larger U.S. refineries are configured for this heavy crude, it is unlikely that they will be able to immediately switch feedstocks, and could experience compressed crack spreads in the near term. Meanwhile, several smaller refiners that utilize domestic feedstock will likely benefit.

鉴于涉及的数量巨大,我们不认为原油会停止从加拿大流入,或精炼产品会停止流回。但即使是 10%的关税(约 6 美元/桶)也可能对美国炼油厂产生重要影响。考虑到许多大型美国炼油厂是为这种重质原油配置的,它们不太可能立即更换原料,可能在短期内会经历压缩的裂解价差。与此同时,几家使用国内原料的小型炼油厂可能会受益。

Trade Ideas 交易想法

LONG Domestic Producers and WTI Refiners:

LONG 国内生产商和 WTI 精炼商:

Diamondback Energy (FANG)

钻石背能源 (FANG)EOG Resources (EOG) EOG 资源公司 (EOG)

Marathon Oil (MRO) 马拉松石油 (MRO)

Pioneer Natural Resources (PXD)

先锋自然资源公司 (PXD)Devon Energy (DVN) 德文能源 (DVN)

PBF Energy (PBF)

Delek US Holdings (DK) 德莱克美国控股公司 (DK)

SHORT Canadian Producers and Heavy Refineries:

短期加拿大生产商和大型炼油厂:

Cenovus Energy (CVE)

Suncor Energy (SU) 萨克尔能源 (SU)

Canadian Natural Resources (CNQ)

加拿大天然资源公司 (CNQ)Valero Energy (VLO) 瓦莱罗能源 (VLO)

Marathon Petroleum (MPC) 马拉松石油公司 (MPC)

Phillips 66 (PSX) 菲利普斯 66 (PSX)

Homebuilders & Lumber 房屋建筑商与木材

A large fraction of U.S. softwood lumber and other building materials comes from Canada. A 25% tariff means that U.S. homebuilders will face higher raw material costs, which will further tighten profit margins that have already come under pressure due to high mortgage rates and growing inventory. With Canadian lumber slapped by a steep tariff, U.S. timber companies and sawmills may see an increase in market share and pricing power.

美国的大部分软木木材和其他建筑材料来自加拿大。25%的关税意味着美国的房屋建筑商将面临更高的原材料成本,这将进一步压缩已经因高抵押贷款利率和库存增加而受到压力的利润率。由于加拿大木材被征收高额关税,美国的木材公司和锯木厂可能会看到市场份额和定价权的增加。

Trade Ideas 交易想法

LONG Domestic Lumber: LONG 国内木材:

Rayonier Inc. (RYN) 雷昂尼尔公司 (RYN)

PotlatchDeltic Corporation (PCH)

PotlatchDeltic 公司 (PCH)UFP Industries, Inc. (UFPI)

Weyerhaeuser Company (WY)

韦尔哈泽公司 (WY)

SHORT Homebuilders and Canadian Lumber:

短期住宅建筑商与加拿大木材:

Acadian Timber (ADN CN) 阿卡迪安木材 (ADN CN)

Boise Cascade Company (BCC)

博伊西瀑布公司 (BCC)Beazar Homes (BZH)

Canfor Corporation (CFP CN)

D.R. Horton (DHI)

Lennar (LEN)

PulteGroup (PHM)

West Fraser Timber (WFG CN)

西弗雷泽木业 (WFG CN)Interfor Corporation (IFP CN)

Western Forest Products (WEF CN)

西方森林产品 (WEF CN)

Click here to view our overall basket, which touches on more broad areas than just those expanded on above.

点击这里查看我们的整体篮子,它涉及的领域比以上提到的更广泛。

Macro Commentary: Trade Update

宏观评论:贸易更新

We will discuss more on the macroeconomic implications of tariffs in our February Macro Memo, but I am offering some knee-jerk thoughts and updating a trade we already have on.

我们将在 2 月份的宏观备忘录中深入讨论关税的宏观经济影响,但我提供了一些直觉反应的想法,并更新了我们已经进行的交易。

I think that the primary framework for macro investors to use here is more similar to an increase in taxation than an increase in prices. Given that tariffs will likely represent a one-time price increase, I would lean towards their ultimate net impact being deflationary on the hit to discretionary spending and a negative to growth rather than inflationary. The immediate reaction in bonds seems to agree. However, I think for now the risk/reward is still better being in the flattener than simply being long 10s

我认为宏观投资者在这里使用的主要框架更像是税收增加,而不是价格上涨。鉴于关税可能代表一次性的价格上涨,我倾向于认为它们的最终净影响会在对可自由支配支出的打击上产生通货紧缩的效果,并对增长产生负面影响,而不是通货膨胀。债券的即时反应似乎也同意这一点。然而,我认为目前风险/收益的形势仍然更适合选择扁平化策略,而不仅仅是做多 10 年期债券。

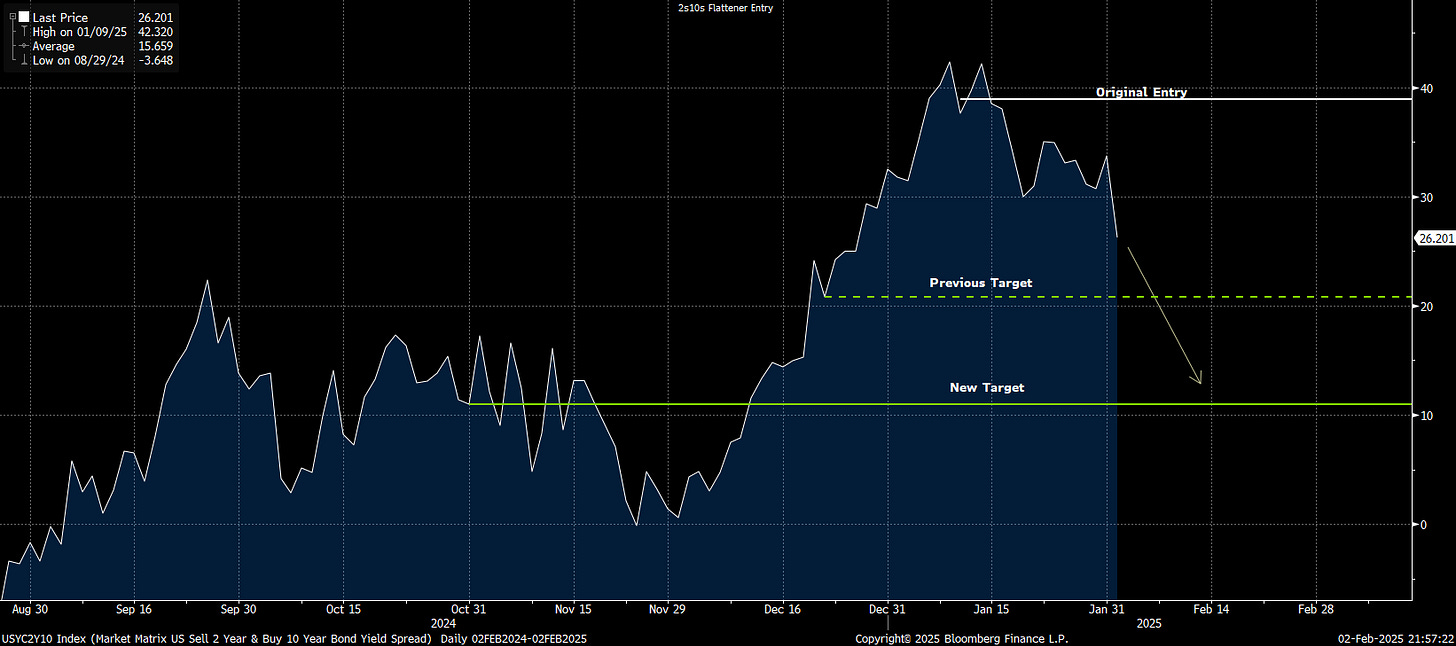

From a rates perspective, I’ll be increasing the DV01 of our 2s10s flattener we put on January 10th by 50%. We entered on 1/10/25 at +38.6bps with a target of +20bps on 2s10s - I am moving our stop down from +45.6bps to +40bps. At 2s10s = +20bps, I will cover the 2s short and be only long 10s.

从利率的角度来看,我将把我们在 1 月 10 日启动的 2s10s 平坦化工具的 DV01 提高 50%。我们在 2025 年 1 月 10 日以+38.6 个基点进入,目标为+20 个基点的 2s10s - 我将把我们的止损从+45.6 个基点下调至+40 个基点。在 2s10s = +20 个基点时,我将平掉 2s 的空头,仅持有 10s 的多头。

Original Entry: 原始条目:

Most recent macro update:

最近的宏观更新:

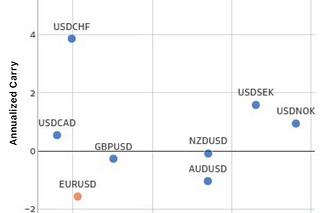

Current FX Positions: 当前外汇头寸:

Long 80% JPY + 20% BRL

多头 80%日元 + 20%巴西雷亚尔

Short 80% CHF + 20% CNH

短期 80% CHF + 20% CNH

Entry Dec 19, 2025 条目 2025 年 12 月 19 日

Current Rate Positions: 当前利率位置:

SFRM5M6 Flattener SFRM5M6 扁平化器

Entry Jan 16, 2025 进入 2025 年 1 月 16 日

2s10s Flattener 2s10s 扁平化器

Entry Jan 10, 2025 条目 2025 年 1 月 10 日

Long TLT 06/20/2025 100C 长期 TLT 06/20/2025 100C

Entry Jan 2, 2025 条目 2025 年 1 月 2 日

Current Commodity Positions:

当前商品头寸:

Long NGZ5 (Dec 25 NatGas), or NatGas Equity Basket

长 NGZ5(12 月 25 日天然气),或天然气股票篮子

Entry Jan 9, 2025 条目 2025 年 1 月 9 日

Long Lumber (Front Month) or US Lumber names (WY US, PCH US) vs Short ITB US

长木材(下一个交割月)或美国木材名称(WY US, PCH US)对短期 ITB US

Existing: Short Homebuilders Dec 19, 2024

现有:做空住宅建筑商 2024 年 12 月 19 日

New Position: Long Lumber (Today)

新头寸:多头木材(今天)

Initial Thoughts on the Fed’s Reaction

关于美联储反应的初步想法

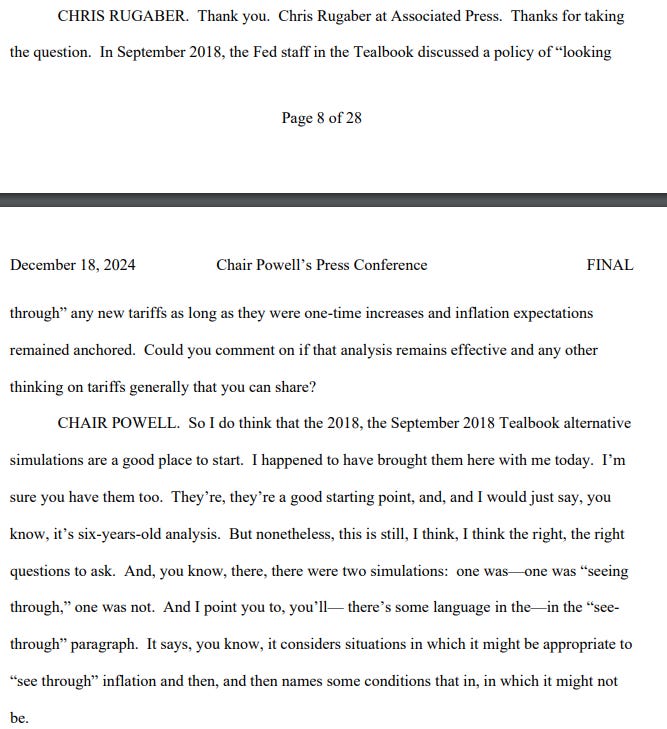

We do have an indication of how Powell & the Fed might respond to tariffs - based on his answers during the Q&A during last December’s FOMC:

我们确实有迹象表明鲍威尔及美联储可能如何对关税做出回应 - 基于他在去年 12 月 FOMC 期间问答中的回答:

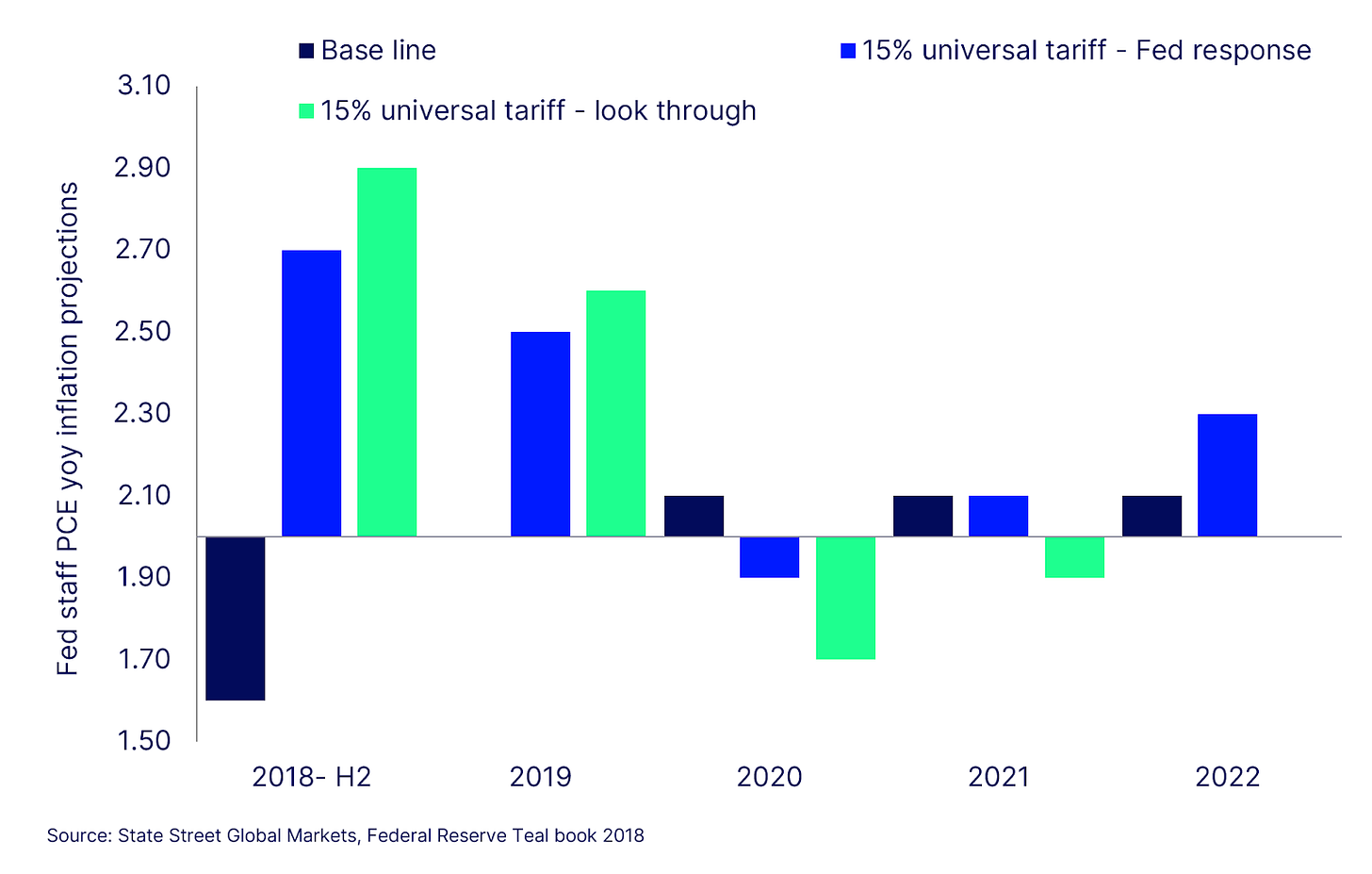

Back in 2018, the opinion of Fed staffers was that the correct course of action was to “look through” tariffs and that a Fed response (i.e. a hike) would put the economy into a recession.

在 2018 年,美联储工作人员的意见是正确的做法是“透视”关税,而美联储的反应(即加息)将使经济陷入衰退。

Perhaps the most important aspect of that report, which Powell brought with him to the December meeting (foreshadowing, much?), is the following excerpt:

或许那份报告中最重要的方面是,鲍威尔在 12 月的会议上带来了这一段摘录(暗示,很多?):

“However, the desirability of this strategy depends on firmly anchored inflation expectations and the passthrough of cost shocks into inflation being relatively short lived. If those conditions do not hold, then the alternative approach assumed in the previous scenario could be more attractive. In particular, inflation and inflation expectations might run persistently higher if the tariff hike leads workers to raise their wage demands or firms to raise their markups. These effects might be intensified in a very tight labor market. “

“然而,这一策略的可取性依赖于通胀预期的稳固,以及成本冲击对通胀的传导相对短暂。如果这些条件不成立,那么先前情景中假设的替代方法可能更具吸引力。特别是,如果关税上涨导致工人提高工资要求或企业提高加价,通胀和通胀预期可能会持续走高。这些影响在非常紧张的劳动力市场中可能会更加严重。”

In September 2018, the labor market was actually tighter than it is right now, so it seems like the default stance from which the Fed will approach this is the “seeing through”. That’s before anyone considers the potential for these tariffs and their responses internationally to actually be deflationary. Overall, I do not think this is a reason to short bonds and I would be more keen to cover the short 2s portion of our flattener than exit our long on 10s.

在 2018 年 9 月,劳动市场实际上比现在要紧张,因此美联储的默认立场似乎是“视而不见”。在考虑这些关税及其国际反应可能带来通缩的潜力之前,总体而言,我认为这不是做空债券的理由,我更倾向于对冲我们对短期 2 年期债券的空头,而不是退出我们对长期 10 年期债券的多头。

In FX, given the U.S. trade deficits with these three countries, the immediate reaction is likely to be dollar strength and foreign weakness in these FX pairs. More broadly (and somewhat ironically), uncertainty could also trigger a flight to safety – benefitting the USD vs. foreign currencies broadly, particularly if traders begin to more seriously anticipate similar tariffs on the European Union, Japan and Korea.

在外汇方面,鉴于美国与这三个国家的贸易赤字,立即反应可能是美元强劲,而这些外汇对中外币走弱。更广泛地说(有点讽刺),不确定性也可能引发资金避险——这将使美元相对于外币普遍受益,特别是如果交易员开始更认真地预期对欧盟、日本和韩国实施类似的关税。

Beyond the obvious dollar strength, one risk we’d like to flag: we would not be too surprised to see China move towards devaluing the Renminbi in response, rather than engaging in straightforward retaliatory tariffs. But we also believe that this possibility is part of the reason why the U.S. has not come out of the gate with Chinese tariffs at 25% like Mexico or China. This is unlikely to be the opening salvo by China.

除了明显的美元强势,我们想指出一个风险:我们并不会太惊讶看到中国选择贬值人民币作为回应,而不是采取简单的报复性关税。但我们也相信,这种可能性是美国没有像墨西哥或中国那样一开始就采取 25%关税的原因之一。这不太可能是中国的首轮攻势。

The Upshot 结果分析

We believe Trump has been emboldened to play hardball, even if it comes with pain for certain domestic industries, consumer prices and the stock market. The market tantrum won’t dissuade him.

我们相信,特朗普被激励去采取强硬措施,即使这对某些国内产业、消费者价格和股市带来痛苦。市场的剧烈波动不会使他退缩。

Retaliatory responses are simply the cost of leverage, one he is willing to endure to support his wider picture agenda. This weekend’s announcement will likely serve as a wake up call to investors to more seriously consider a sweeping reform of trade agreements.

报复性反应只是杠杆的代价,这是他愿意承受的,以支持他更广泛的议程。这周末的公告可能会成为投资者更加认真考虑贸易协议大规模改革的警钟。

In the short-term, we expect a knee-jerk reaction down in equities (which has begun somewhat during the writing of this piece) that we deem the “Tariff Tantrum”, a relative value flight to domestic producers vs. importers, and companies pausing OpEx while pulling forward import demand. Longer term, we expect strength in the US dollar. However, unlike our peers, we do not expect any selloff in rates due to tariff development. The threat of tariffs will be bullish for bonds.

短期内,我们预计股市会出现一种反应性下跌(在撰写本文时,已经开始出现这种情况),我们称之为“关税发脾气”,这是一种对国内生产者相对于进口商的相对价值逃避,以及企业在提前进口需求的同时暂停运营支出。长期来看,我们预计美元会走强。然而,与我们的同行不同,我们不预计因关税发展而导致利率出现任何抛售。关税的威胁将对债券形成支撑。

Let it never be said that you don't put in the work, because my goodness, you put in the work

永远不要说你不努力,因为我的天,你真是付出了很多努力

Ticker MRO no longer exists, it was bought out by Chevron a few months ago. Only MPC remains for Marathon.

股票代号 MRO 不再存在,它几个月前被雪佛龙收购了。现在只有 MPC 仍然代表马拉松。