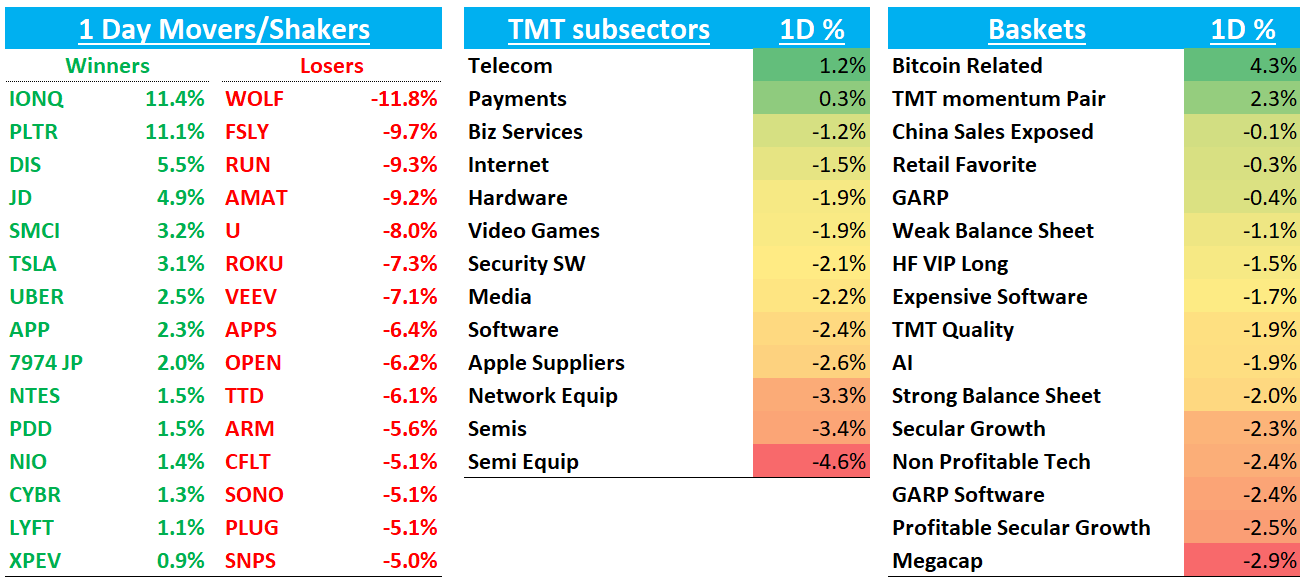

Sorry for the late start - left early to go watch the “Red One", and no I don’t mean the day we had today in Tech. (The movie had a happier ending than the markets today). QQQs -2.4% pulled back and semis -3.4% underperformed again and closed in the red for the 6th straight session, marking its longest losing streak since September 2023. IWM -1.5% and ARKK -1.3% outperformed.

Why the pullback? Heard several things called out, including doubts around Trump tariffs/deficits/cabinet picks as enthusiasm coming down to earth a bit. Market was hoping Trump’s picks would be a bit more establishment and pro-growth/pro-market than what’s been announced so far (although no economic roles have been announced to b e fair). In addition, rising odds of the Fed staying on hold next month (odds of a 12/18 cut stand at 60%, down from 80% a couple days ago), not helped by some hotter data this morning and Powell’s speech yesterday, although Fed still firmly in cutting mode. Despite this, 2 year yields still fell 4bps today. Finally, semi weakness semis to be spreading to the rest of tech not helped by AMAT’s print last night as SOX beginning to roll over:

All eyes on NVDA’s print on Wednesday - we’ll have our preview out this weekend with bogeys. QQQs now only up less than 1% from pre-election, obviously weighed down by semis which are down 4.5% since11/5.

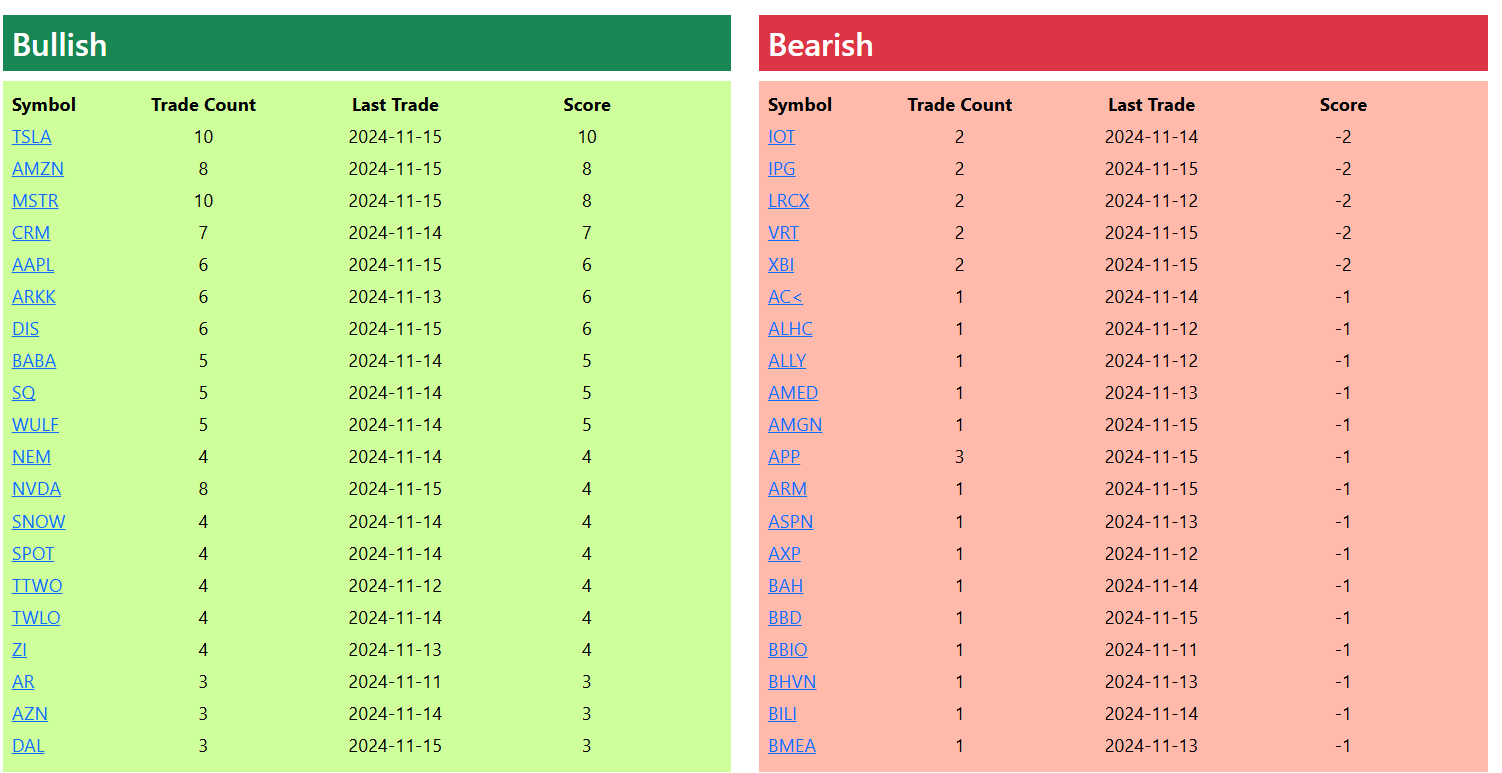

Still pockets of strength today, including in some “Trump” trades: TSLA +3%; PLTR +11%; COIN +9%, IONQ +11% which to me says animal spirits still in play…

Let’s get to the recap…On a day like today, sometimes hard to pinpoint idiosyncratic moves in specific names given broad sell off so take each with more a grain of salt than you normally would…

Internet

META - 4% as Yip said Q4 tracking to 1ppt beat but the last couple of weeks decelerated from 20% to low double digits. Weakness at other ads names following RFK appointment and implications for future ad spend (pharma/HC makes up 6-7% of online spend). BAML called this out but not sure how much I buy it. Still ads names were weaker: TTD- 6%; PINS - 4%; ROKU - 7%; RDDT -5.4%

AMZN - 4%: Got a lot of questions on this one today, but couldn’t pinpoint anything. Yip said retail was tracking 2-3 ppts above street for NA, but that wasn’t completely new. One of our readers gave feedback in TMTB chat:

NFLX - 1.6% the best large cap as hype around Tyson v. Paul builds and Yip said global net adds tracking inline to above Q3 levels (recall, Q3: 5.1M reported adds and street at 8.9M adds for Q4)

UBER +2.5% / LYFT +1% as RBC said they have more confidence TSLA could partner with the ridesharers as they roll out robotaxi

EBAY -1.4% as Yipit said GMV tracking inline with street but improved slightly from mid-Oct

CVNA +20bps and MELI +20bps a few of the other lone greens on my screen

CHWY -2% despite Barclays with some better checks aounrd spend

BABA - 2% with a slight rev miss and EBITDA slightly ahead

Software

MSFT -2.8% as Biz Insider talked up MSFT’s struggled with Co-pilot (full article worth a read…):

Now, a year after Copilot's release, the reviews — both inside and outside Microsoft — indicate that the new product is struggling to live up to the hype. While there is no single measurement of Copilot's performance, given the wide array of features it seeks to provide, many customers appear to be dissatisfied with the AI tool, complaining that it is ineffective, costly, and not secure. In October, when the management consultancy Gartner published a survey of 123 IT leaders, only four said Copilot provided significant value to their companies.

Some of Microsoft's own employees and executives are privately concerned that Copilot won't be able to deliver on its ambitions.Many of those charged with building Copilot say they harbor doubts about what it will ultimately achieve. Others in the company express serious doubts about Microsoft's immense investment in a technology that they see as unproven — and potentially unprofitable.

PLTR +11% as stock switching from NYSE to Nasdaq

APP 2.3% trying to get its groove back

U -8% as Cathy continues to sell down here position - still has 2M left

ADBE - 5% despite M-sci slightly positive

Cloud names weak after strength earlier in the week: MDB - 4.5%; CFLT - 5%; SNOW -2.5%

Other decliners: FSLY - 9.7%; APPS - 6.5% on BAML’s dg; CTSH - 4.5%; WDAY -4.5% continues to underperform; TEAM - 4%

Semis

SMCI +3% reportedly plans to submit a resolution plan by Monday to avoid delisting from Nasdaq.

AI semi names weak: TSM - 1.3%; ANET -3%; NVDA - 3%; AVGO - 3%; MRVL - 3%; ARM - 5.5%

AMT -9% on their guide down as investors didn’t like China guided to flat q/q

Elsewhere

TSLA +3% as Ron Baron was on CNBC seeing Tesla worth $5 trillion in 10 years, says Musk eyeing $30 trillion value one day (link)

AAPL - 1.4% as jefferies says AAPL margin hit may be nearly 7% if not exempt from China Tariff

Fintech strong as BTC crossed $90k: COIN +9%; AFRM +5.5%; UPST +1.5%'; SQ +1%; HOOD +30bps; PYPL flat

DIS +5% with some nice follow through following earnings