TMTB Weekly - What we are watching as we head into Q1 Earnings Season / NFLX Preview + Bogeys

The QQQs had a strong week, rallying 3% following a cooler-than-expected CPI print on Wednesday. Last week, we shifted to a more neutral stance while awaiting this key inflation report, which we anticipated would have an outsized impact on the market narrative. Bulls got the result they wanted—softer inflation pushed yields lower, reset Fed expectations in a dovish direction, and reignited a Goldilocks outlook: subdued inflation, steady economic growth, a Fed easing cycle already moving in the right direction, potential deregulation, and an AI supercycle still intact.

Markets are now pricing in 40bps of Fed rate cuts in 2025, bringing expectations back to pre-Jobs report levels but still slightly below where they stood after the December FOMC meeting. The 10-year yield dipped below its April highs, a key technical level to watch in case of another yield-driven equity sell-off. Encouragingly, the 10-year also finished flat on Friday despite hotter economic data—an indication that the market may be more resilient to rate fluctuations than before.

While QQQs haven’t made new highs yet, Friday’s move broke the downward channel from mid-December and cleared the 20-day moving average, both positive near-term technical signals. However, yields remain elevated, and investors want to see further cooling in inflation data before sounding the all-clear.

So what’s next? Today, WSJ reporting that Trump won’t enact any new Tarrifs yet:

President-elect Donald Trump is planning to issue a broad memorandum Monday that directs federal agencies to study trade policies and evaluate U.S. trade relationships with China and America’s continental neighbors—but stops short of imposing new tariffs on his first day in office, as many trading partners feared.

The presidential memo directs federal agencies to investigate and remedy persistent trade deficits and address unfair trade and currency policies by other nations, two longstanding Trump irritants. And it singles out China, Canada and Mexico for scrutiny, directing agencies to assess Beijing’s compliance with its 2020 trade deal with the U.S., as well as the status of the U.S.-Mexico-Canada Agreement, or USMCA, Trump’s updated North American Free Trade Agreement, which is set for review in 2026.

But the memo doesn’t, in itself, impose any new tariffs—a momentary relief for foreign capitals bracing for Trump to immediately impose stiff levies. Instead, the trade policy memo is an indication of debates still roiling the incoming administration over how to deliver on Trump’s campaign trail promises for across-the-board tariffs on imports, and higher duties for adversaries such as China.

That tables one near-term risk. Futures are rallying and dollar is down 1% on the news—its largest decline since November 2023. A weaker dollar could provide relief for large-cap tech, particularly companies with significant international exposure that have been dealing with FX-related headwinds.

Looking ahead, the economic calendar remains relatively light this week, with only jobless claims and the University of Michigan sentiment survey (1/24) as potential catalysts before the Fed meeting on 1/29. That sets the stage for a period where the bull narrative for equities can continue to regain traction. However, after this week, macro risks increase again with the Fed on 1/29, PCE on 1/31, and ISM and payrolls in early February.

While the macro picture in 2024 generally had one high probability path with the Fed steady in their easing, for now we continue to believe certain macro releases will have an outsized influence on the markets and narrative. As we are closer to the end of the Fed easing cycle ending, we don’t think there is one high-probability path; instead, it requires a more tactical stance and constant adjustment. That means adjusting exposure more aggressively, something that worked last week.

Could Trump pressure and cooler econ data keep the Fed lower for longer while growth remains on track? Very possible. Could some hotter econ data shift the Fed back into a less dovish stance, causing yields to rise again and a correction of >10%? Very possible and likely happens at some point in 2025.

For now, we think bulls have shifted into the driver’s seat after taking a back seat for a few weeks but still think this will be a choppy ride: while yields have come down, they are still very much elevated and investors want to see more cooler data/less hawkish fed positioning before sounding the all clear. And despite fed expects shifting back into a more dovish direction, we are still closer to the end of the easing cycle vs. the beginning.

What does this mean for Tech stocks?

Despite yields coming in a bit, we’re still now in a zone where multiples start to feel pressure (see the chart below—it’s simple but historically reliable):

2024 was an ideal backdrop for momentum—rates were in a sweet spot, sentiment was euphoric, and multiple expansion was rampant. Expensive stocks kept making higher highs, dips were consistently bought, and high-multiple names like PLTR seemed untouchable as valuations stretched further. Investors saw big gains from both multiple expansion and EPS revisions, with multiples often driving more of the upside than actual earnings growth.

So far, 2025 has presented a slightly different set up where the hurdle for multiple expansion is higher due to higher rates and the fed easing cycle closer to ending. That means a greater focus on risk/reward, estimate revisions, catalysts, stretched sentiment and rate of change along with being more tactical in our set ups. These are things we always have an eye on, but we are giving them more weight so far in 2025.

We can see that playbook working so far in the leaders YTD so far:

MRVL +13% YTD (potential for significant # revisions, catalysts, rate of change),

CHWY +10.5% (reasonable valuation + estimate revisions higher),

MU +25% /UBER +12% (both had really attractive r/r’s and overly stretched sentiment to start the year)

CART +12% (estimate revisions higher)

CVNA +13% (stretched sentiment on Hindenburg short report + estimate revisions higher)

RBLX +14% (NT earnings revisions on direct monetization chg (see MS note from this week), 3p rate of change + shifting narrative).

That’s great news: stock picking is working!

We also think 2025 has the potential for better short-picking and the buckets we think are good to dig into are: High-multiple stocks with no catalysts and negative divergences, shifting or peak rate of change and fading idiosyncratic appeal, and stocks with estimate revisions lower.

However, there are certain signs animal spirits are starting to come back again - Quantum stocks had a good week, TSLA is on the move again, and just check out all the frothy meme-coin activity over the weekend. And now Trump fuels some fire with some less hawkish Tariff news. Could we be heading back to Nov/Dec levels of hype in speculative areas of the market and back to more of a 2024 type playbook of dip buying and multiple expansion? We don’t think we’re headed back there for long, but with a clear econ calendar this week and Tariff risk sidelined - it’s possible we get some of that type of px action this week.

Most important of all: we continue to think 2025 will require us to move our feet quickly, adjust priors with little hesitation, and not be afraid of changing our minds when need be.

Q1 Earnings - what’s in store for Tech:

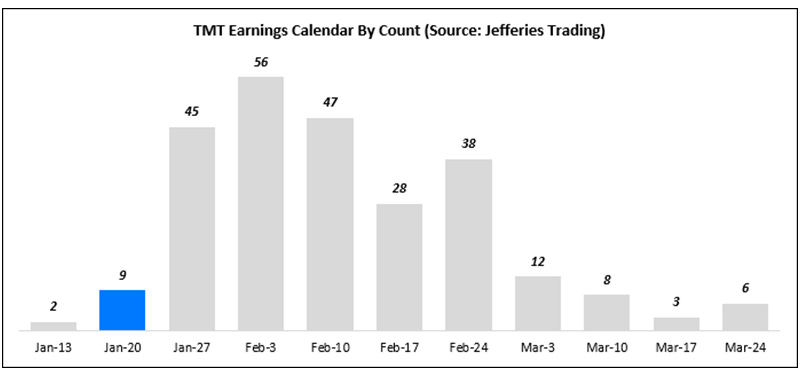

Tech earnings kick off this week with prints from NFLX and TXN. However, next week is the big week with 55% of mkt cap reporting.

Here are a few of the high-level early debates I’m watching for as we head in Q1 earnings:

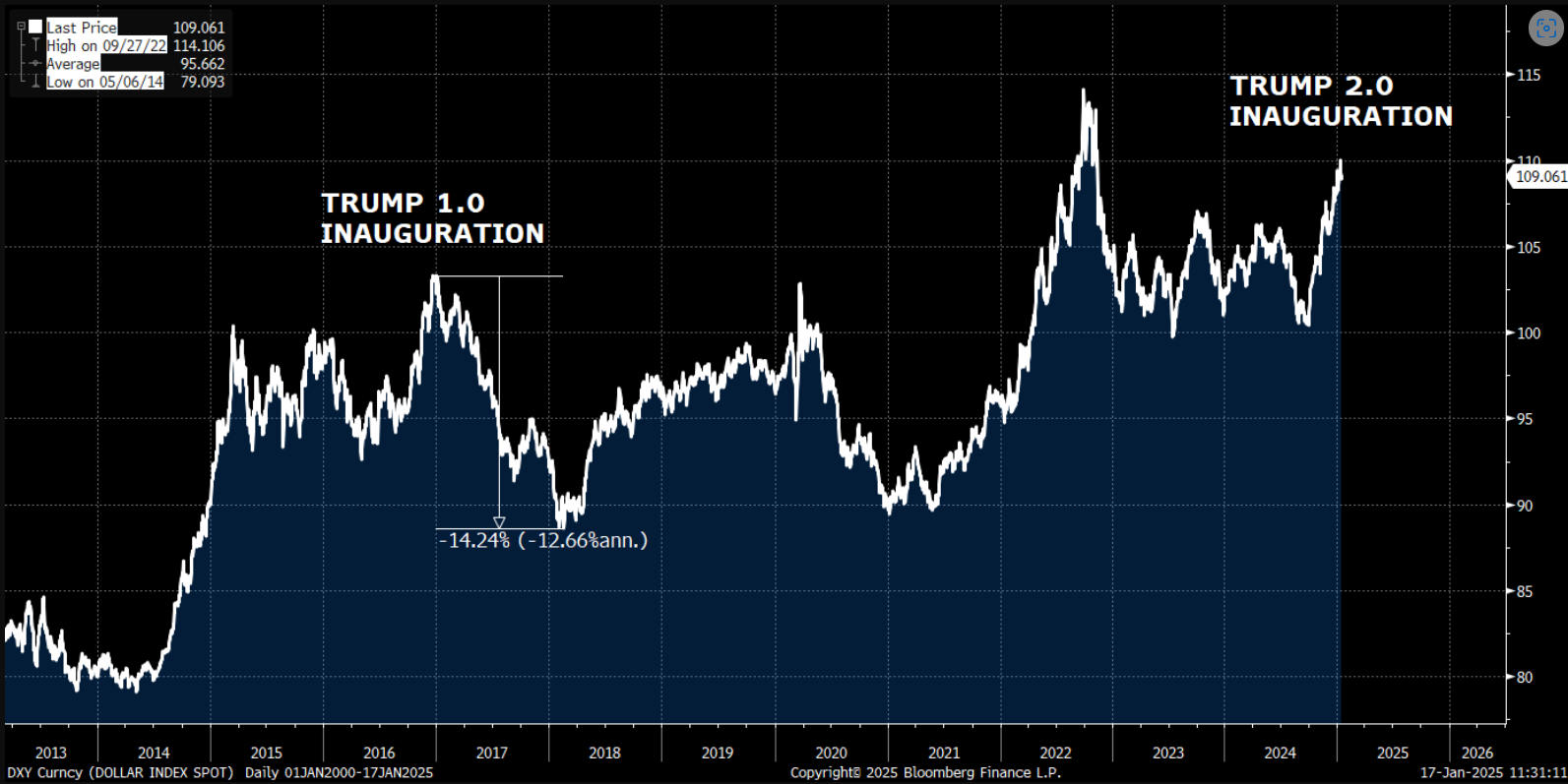

FX & Leap Year – Noise or a Real Factor? With the U.S. dollar appearing to have stabilized this week, will investors discount any currency-related headwinds, or will they penalize companies that cite FX as a drag? The lack of initial Trump Tariffs is hitting the dollar early today and let’s not forget that Trump 1.0 brought with it a weaker dollar that peaked right near inauguration:

With bulls back in the driver’s seat, the dollar headed lower, sell-side largely taken numbers down on Mega-cap because of fx, we think investors are likely to look through any impact. NFLX was the poster-stock for fx-related drag declining 10%+ on fears initial ‘25 guide would be lower because of fx. That seems pretty well telegraphed at this point. NFLX stock reaction should be a good guide to how the rest of Mega-cap will react

Hyperscale Capex Commentary: How will tech investors digest new capex guidance from CSPs? With the buy side already positioned above Street estimates, will increased spending be welcomed as a sign of strong AI demand? TSM came out swinging this week up’ing their LT AI forecast, but stock didn’t follow through…Will investors focus more on slowing rate of change of increasing capex or keep their focus on the large numbers coming out? For hyperscalers, will higher capex be viewed as a sign of good AI demand or be seen as an increasing headwind to EPS due to rising depreciation costs in 2025/26?

What will be the driving narrative for AI semis coming out of earnings season? Lots of cross currents: ASICS vs. NVDA, GB200 delays (Jefferies Fubon out this morning saying speculation is all noise), CSP capex rate of change, DeepSeek models comparable with o1 on much less compute, Axios article over the weekend hinting at some big improvements:

Architects of the leading generative AI models are abuzz that a top company, possibly OpenAI, in coming weeks will announce a next-level breakthrough that unleashes Ph.D.-level super-agents to do complex human tasks. We've learned that OpenAI CEO Sam Altman has scheduled a closed-door briefing for U.S. government officials in Washington on Jan. 30. But sources say this coming advancement is significant. Several OpenAI staff have been telling friends they are both jazzed and spooked by recent progress.

TikTok Impact: Tiktok is back on after Trump provided assurances to service providers (although the app still looks to be unavailable on the AAPL app store at the time of writing, the app and web version are still working)…China is now saying they are feeling more open as well:

It now seems increasingly likely that TikTok will remain operational in the U.S.. How will META react tomorrow? Do investors become increasingly worried about a weaker Q1 guide now?

2025 Software Guides – Patience or Punishment? How will investors react to initial 2025 software revenue guidance? Will they look past weaker outlooks given that CIO surveys signal an IT spending recovery in 2025, or will any cautious commentary be met with selling pressure? When I talk to sw investors, it seems many are waiting to buy the cut…

Analog Semis – More Downside or a Turning Point? Will analog semiconductor stocks (TXN, ADI, NXPI, ON) surprise to the downside again? ON’s been in a free fall following weaker than expected commentary at CES, but WDC — while not an analog, it’s viewed as a cyclical - was up on a neg pre announcement on Friday — is the latter a sign of how cuts will be bought this earnings season?

Improving Chinese end-market demand: What does improving Chinese smartphone demand mean for the analog players and memory players? Do we hear any more datapoints on improving end-demand given subsidies, trade-ins, and a slew of consumer positive macro policies China has announced. We think China catalyst path is good— Trump/China relations seem to be improving, March NPC meeting likely to announce $ amounts of stimulus, and already hearing signs of improving end demand. We think some exposure here makes sense and we like JD as they benefit the most from China’s national trade-in program and has best potential for upside to near-term #s vs BABA/BIDU.

Along with those high level seems, plenty of idiosyncratic debates we have our eyes on: How big will AMZN’s OP beat be and what does Jassy imply about 2025 AWS growth? What does MSFT say to get investors more confident about the upcoming “2H Azure accel”? Will the expected PINS guide down be bought? Does a bookings beat drive home the burgeoning narrative change and direct monetization tailwinds at RBLX? Will investors buy a lower NFLX guide as a U.S. price increase likely on the horizon and stock already down 10%? How will investors react to a pot’l deceleration in PLTR revs as they hit tough comps? Will the market look through an initial low DDOG guide in anticipation of acceleration in the rest of ‘25? How much upside will MRVL show and how much is enough? Will an UBER mobility and EBITDA beat help shift the narrative away from full-self driving loser? This among many others...(for more discussion around upcoming set ups, see our TMT positioning/sentiment round up from a couple weeks ago)

Does single stock volatility remain elevated? Jefferies notes that last q we saw ~38% of TMT coverage have absolute moves > 10%, the highest in > 40 Qs. Also plenty of big upside moves. Does this continue this q? Our hunch says vol will be much more compressed and evenly distributed between up and dnside moves. We’ll see…

NFLX Earnings Preview

NFLX remains a top long for investors, viewed as a secular winner with strong pricing power, subscriber momentum, and a strong 2025 content slate. However, stock has come in recently on fears of a weaker initial guide given fx headwinds - that seems well priced in at this point.

Bulls are playing for upside beyond the guided 100bps of margin expansion for 2025, though it doesn’t seem like the market is expecting an update this quarter. There is also an expectation for continued double-digit revenue growth, further margin expansion throughout the year, and increasing contributions from the advertising business as it ramps. Investors have long speculated on when the co will raise standard pricing in the US again, given that last quarter’s guide was subscriber-driven rather than price-driven and bulls are hoping for a 1H increase.

Bulls will say co is likely to raise prices, ARM/CPM will increase, especially as Netflix’s CPMs remains low relative to peers and its content pipeline continues to strengthen, and the launch of live sports/RAW will help drive incremental subscribers while there is plenty of margin upside as pricing ramps. Bears will point to a valuation that is close to full: 30x $30 EPS = $900, implying < 10% upside upside and say paid sharing tailwind is likely to abate.

Our view: We don’t have a strong view into the print and feel a bit mixed about sentiment/expectations: the increase in expects for Q4 sub add guide has us a bit nervous while the pullback on fx fears has us feeling excited as we think that is likely overdone and well-priced in. We were big bulls heading into the Q4 catalyst rich environment and that played out well for us, but the path fwd is less clear. We do think stock is likely to grind higher over the course of 2025 for the reasons mentioned above (2025 content pipeline, px’ing increases, CPM/ARM increases), but don’t see a high quality set up that excites us to take a big shot near/medium term.

BOGEYS (Lots of moving pieces given fx and lack of net add disclosure in 2025)

Q4 Sub Adds: ~13M vs street 9.2M

Q4 Revenue Growth FXN: 17-18% vs street at 17%

Q4 Revenue Growth Reported: 15%

Q4 EBIT: $2.2B, 22% margins in line with guide

Q1 Sub Adds: Street is at 5M but NFLX has said they will stop reporting net adds in 2025

Q1 Revenue Growth FXN: 16%

Q1 Revenue Growth Reported: 13% vs street at 13.5%

FY 25 Revenue Reported guide: miss on fx: 9-11% vs street at 13% (c/c 14% vs 13%)

FY25 Operating Margin: 100bps expansion vs 2024