TMTB EOD Wrap

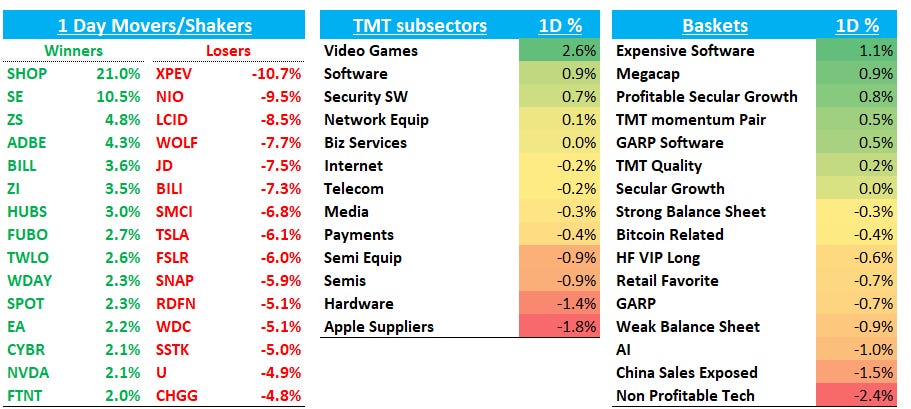

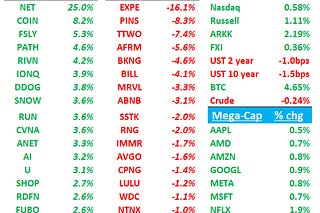

QQQs -18bps as some laggards caught a bid today and others like ARKK - 2% TSLA - 6% and non-profitable tech basket -2% gave back gains. IWM also underperformed -2% and SOX -1% continues to struggle even on a day when NVDA +2%. Yields ticked up 8-13bps across the curve. BTC rallied back to finish in the green and close to $90k. China -3.5% as market didn’t like Trump’s initial cabinet considerations which were considered more pro-tariff.

Let’s get to it…

Internet

META +25bps / SNAP -6% as WaPo said Trump will try to roll back Tiktok ban:

“He appreciates the breadth and reach of TikTok, which he used masterfully along with podcasts and new media entrants to win … There are many ways to hold China to account outside alienating 180 million U.S. users each month. Trump recognized early on that Democrats are the party of bans — gas-powered cars, menthol cigarettes, vapes, plastic straws and TikTok — and to let them own that draconian, anti-personal choice space…

The law, called the Protecting Americans from Foreign Adversary Controlled Applications Act, grants the president the power to extend the divestment deadline by 90 days if the administration sees that “significant progress” has been made toward a sale. If the deadline comes after Trump takes office and he wanted to halt the ban outright, Trump could push Congress to repeal the law or encourage his attorney general to refrain from enforcing it, according to Alan Rozenshtein, a former national security adviser to the Justice Department.

META fared better as CNBC reported Value Act has acquired a $1B stake - we’ll see if they put out a deck as Capex & reality labs in focus.

NFLX +1.6% hitting ATHS as they announced 70M ad MAUs up from 40M in May, and that it sold out all available in game inventory for two live NFL games on X-Mas day. Also rallying into Jake Paul v Tyson this weekend. Catalysts playing out as expected here…

SHOP +22% on their beat and raise as revs accelerated while guide implied mid to high twenties growth and more operating leverage

GOOGL +1% - notable strength given pullback in certain names that have rallied since Trump’s win

PINS +1% / TTD +1% / MELI +1%showing its hard to keep stocks down after misses

AMZN +90bps as Bezos gets closer to finish selling

W +5% on slightly better weekly Yipit data

CVNA -2% as 3p data showed a decel in the latest week

Housing names weak as yields climbed higher: Z -2%; OPEN -3%; RDFN -5%

UBER +20bps managed to squeeze out a green day while travel stocks were weaker: ABNB -3%; BKNG - 1%; EXPE - 1%

SE +11% on their beat

SPOT +2% quietly grinds to more ATHs

DASH +75bps as Loop raised PT to $200

Semis

MU -4% as Edgewater trimmed its NAND and DRAM price forecasts and sees MU’s outlook softening further in the first half of 2025. Cowen was also out mixed note this morning expressing near-term caution through Q2'25 but sees second-half improvement. DRAM pricing expected to decline high-single digits sequentially in Q1'25, with a smaller drop anticipated in Q2 due to non-HBM memory oversupply.

NVDA +2% ahead of Jensen and Masa 90-min pow-wow tonight at 8pm eastern - link

MRVL +25bps the other AI outperformer as the FT wrote up AMZN’s efforts in building Trainium 2

MBLY +3.5% as Loop initiated at buy seeing MBLY as “purely aligned” with deeper penetration of ADS/AV within the light and commercial vehicle markets

AMD -3% - heard rumors of several senior layoffs - not confirmed so take fwiw

Other AI names mixed: AVGO/TSM -1.5%; VRT - 2.5%; ARM - 1.5%

QCOM - 3% struggling to find a floor post earnings

WDC - 5% on weaker Edgewater checks

Software

ADBE +4.5% getting lots of questions today on outperformance, benefitting from laggard strength and investors asking “who’s next” in terms of AI beneficiary in the software space. Verdict still out on ADBE given Gen AI content generation tools, but sentiment in sw in general has shifted to a more constructive stance in terms of GenAI reward vs risks, at least in the short term.

HUBS +2.75% and BILL +3% seeing more follow through following their prints

MSFT +1.3% finally seeing a bid — we remain constructive on the name longer-term and think at some point in CYQ1, sentiment regarding co-pilot will likely shift more positive and Azure accel will be closer on the horizon. For now, stock remains in the funding short camp for many

NOW +1.3% more new highs as investors get excited about AI Agents being released later this month and Wells Fargo raised PT to $1,1150 from $1,050

MNDY -4.5% follow through from yesterday’s miss

ZS +5% - didn’t see anything here…

U -5% as Cathy (ARKK) continues to sell down her position. She’s sold over 2M since 11/6 and has 4M left.

TWLO +3% as Wells upgraded to Buy with $120 PT

OKTA -40bps on DB’s downgrade

SNOW +1.6% despite mixed UBS checks as The Information reporting that Databricks “is considering raising several billion dollars in the coming months to allow employees to cash out stock grants that begin to expire in early 2026.” It has discussed raising the money at $55B valuation - SNOW’s mkt cap $45B

Elsewhere

TSLA -6% pulling back after a massive run; Other EV/Green names weak: RIVN -4%; PLUG - 5%; RUN - 5%; FSLR - 6%; ENPH - 6%

Fintech mixed: SQ +4.5% continues to play catch up to other BTC names. This name was very correlated to BTC back in 2020/’21 - interesting to see if that correlation reestablishes itself; COIN -1.5%; UPST - 10%; AFRM - 60bps

DIS flat as WSJ reported Disney has expanded its candidates for Iger successor, mentioning Andrew WIlson (EA) & Ted Sarandos (NFLX). Initial feedback has been mixed on Wilson as a contender and most think Sarandos would be very unlikely.