Enterprise Credit Report

(Self-query Version)

Company Name: Zhongzheng Code:

Unified Social Credit Code:

Querying Institution:

Report Date:

Querying Institution:

Report Date:

Shandong Port Overseas Development Group Rizhao Co., Ltd.

Industrial and Commercial Bank of China Rizhao Branch

Report Explanation

1. This report is issued by the Credit Reference Center of the People's Bank of China and is generated based on the information recorded in the credit reporting system as of the report date. Except for information marked by the Credit Reference Center, all information is provided by relevant data providers and information subjects. The Credit Reference Center does not guarantee its authenticity and accuracy but commits to maintaining an objective and neutral position throughout the process of information collection, processing, and integration.

2. The basic information presented in this report is the result of integrating the same information subject's basic information from different data sources provided by the credit reporting system.

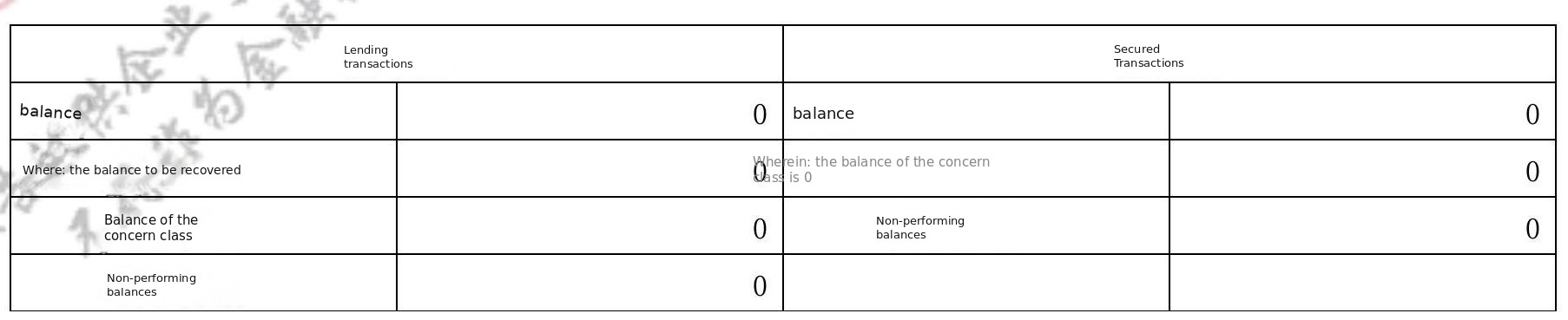

3. Credit transactions in this report include borrowing transactions and guarantee transactions.

4. Borrowing transactions in this report include various forms of loans and also include financing under various other names that are essentially borrowing behaviors, where the financing party has a clear repayment responsibility. Common product types include: loans, trade financing, bill discounting, factoring, overdrafts, financial leasing, repurchase agreements, advances, gold securities lending, corporate credit bonds, etc. 5. Guarantee transactions in this report refer to the agreement between a third party and the creditor, where the third party performs the debt when the debtor fails to fulfill the obligation. This includes behaviors where there is no nominal guarantee contract but the third party effectively compensates when the debtor defaults. Common product types include: bank acceptance bills, letters of credit, bank guarantees, guarantee services provided by financing guarantee companies, and credit guarantee insurance services provided by insurance companies.

6. Recovery business in this report refers to borrowing transactions where the remaining principal and interest are in a collection state (i.e., the creditor requests the debtor to repay all loans as soon as possible). Common product types include: debts disposed of by asset management companies, advances (including guaranteed compensation).

7. In this report, short-term loans and medium to long-term loans refer to transactions excluding recovery business, revolving overdrafts, and discounts, classified according to "loan term classification," corresponding to short-term, medium-term, and long-term respectively.

8. In this report, the normal category of loan transactions refers to transactions excluding recovery business, classified as normal or "unclassified" in the five-level classification with overdue days equal to 0; the attention category refers to transactions excluding recovery business, classified as attention or "unclassified" in the five-level classification with overdue days exceeding 90; the non-performing category refers to transactions excluding recovery business, classified as "substandard," "doubtful," "loss," "default," or "unclassified" in the five-level classification with overdue days exceeding 90.

9. In this report, the normal, attention, and non-performing categories of guarantee transactions correspond to the five-level classifications of normal, attention, and the last three categories of transactions.

10. In the summary section of this report, the historical debt information refers to debts arising from credit transactions; the total overdue amount and overdue principal refer to the total overdue amount (including interest) and total overdue principal of loan transactions excluding recovery business.

11. This report only displays settled credit information, non-credit information, and public information within a certain time frame.

12. Unless otherwise specified, the monetary data items in this report are all in ten thousand yuan.

13. Unless otherwise specified, the summarized monetary data items in this report are priced in Renminbi. The conversion of foreign currency to Renminbi is based on the exchange rate table published by the State Administration of Foreign Exchange for various currencies against the US dollar for the month.

14. If the information record is displayed in italics, it indicates that the subject of the information has objections to this record.

15. The description of the data provider is a supplementary explanation made by the reporting agency regarding the information recorded in the report or the subject of the information.

16. The explanation from the credit center is the credit center's explanation regarding the information recorded in the report or the subject of the information.

17. The statement of the information subject is a brief explanation made by the information subject regarding the information recorded by the reporting agency.

18. The information subject has the right to raise objections to the content of this report. If there are objections, they can contact the reporting agency or go to the local credit report inquiry outlet (specific address can be found on the credit center website www.pbccrc.org.cn) to submit an objection application.

19. This report is provided only to the information subject and is not for use in credit management by financial institutions. Please keep it safe. The credit center is not responsible for any information leakage caused by improper storage.

20. For more inquiries, please call the national customer service hotline at 400-810-8866. Exchange rate (USD to RMB): 7.17 Valid until: 2025-03

Identity Identification

| Company Name | Shandong Port Overseas Development Group Rizhao Co., Ltd. |

| Organization Code | MA3UGDDM5 |

Information Summary

| Year of First Credit Transaction | Number of institutions involved in credit transactions | Number of institutions with outstanding credit transactions | Year when the repayment obligation first arose |

| -- |

0 | 0 | -- |

| Non-credit transaction account number | Number of tax delinquency records | Number of civil judgment records | Number of enforcement records | Number of Administrative Penalty Records |

| 0 | 0 | 0 | 0 | 0 |

Basic Information

Overview of Basic Information

| Economic Type | Information Source Agency | -- | |

| Organization Type | Information Source Agency | -- | |

| Company Size | Information Source Agency | -- | |

| Industry | 0----- | Information Source Agency | -- |

| Year of establishment | - Information source agency | -- | |

| Expiration date of registration certificate | ---- | ) Information source agency | -- |

| Registered address | 2) Information Source Institution | -- | |

| Office/Business Address | 12th Floor, Block A, Rizhao Port International Trade Center, Shanghai Road, Donggang District, Rizhao City, Shandong Province |

Information Source Agency | Industrial and Commercial Bank of China Limited |

| Continuation Status | Information Source Agency | -- |

Public Record Details

Rain Obtained License Records

| Licensing Department | License Type | License Date | Expiration Date | License Content |

Donggang District Administrative Approval Service Bureau of Rizhao City |

Ordinary | Change |

| Donggang District Administrative Approval Service Bureau of Rizhao City | Ordinary | 2024-02-12 | 2099-12-31 | Change |

| Donggang District Administrative Approval Service Bureau of Rizhao City | Ordinary | April 28, 2023 | 2099-12-31 | Change |

| Donggang District Administrative Approval Service Bureau of Rizhao City | - Ordinary | 2023-03-29 | 2099-12-31 | Change |

| Rizhao City Administrative Approval Service Bureau | Approved | 2099-12-31 | Notice of Approval for Change Registration | |

| Rizhao City Administrative Approval Service Bureau |  |

(15 2021-06-04 | 2099-12-30 | Notice of Approval for Change Registration |

| Rizhao City Administrative Approval Service Bureau |  |

November 30, 2020 | 2099-12-31 | Notice of Approval for Change Registration |

| Rizhao City Administrative Approval Service Bureau | Approved | November 30, 2020 | 2099-12-31 | Notice of Approval for Establishment/Business Registration |