TMTB Weekly

Happy Sunday. Big event this week is NVDA earnings on Wednesday although we’d argue the print is less important for the overall market then previous prints as focus has been shifting away from semis and towards Trump winners, non-tech cyclicals, and other sectors like software over the past couple months. Still, given its the largest market cap in the world and its potential to affect other semis (which have been weighing down the QQQs), everyone’s eyes will be on it.

We’ll talk briefly on the high-level, move onto some misc tech thoughts, and then wrap up with NVDA preview/bogeys.

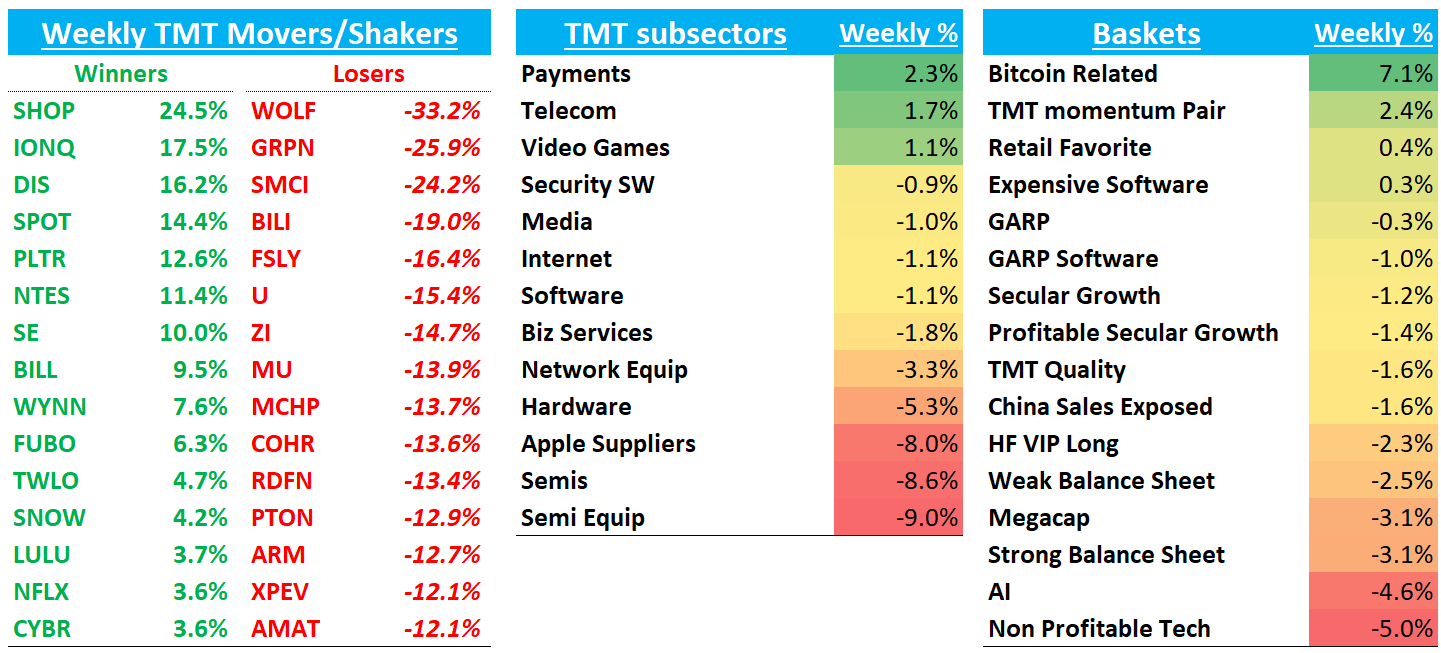

QQQs finished the week -3.4% / Spooz -2.1% while Semis continued to underperform falling 8% on the week. QQQs are only 1% above where we were pre-election while semis sit 4-5% below those levels. Some enthusiasm has come out of the sails of Trump’s win and its impact on the markets where an initial focus on deregulation and tax cuts has given way to a more balanced take and focus on tariffs/deficits/rising yields/cabinet picks. Add on that slightly more hawkish comments from Powell on Thursday and the recipe for some sort of pullback/digestion makes sense.

Our medium-term high-level view remains the same as it’s been over the course of the past several months: we continue to expect an upwards trending, but choppy market: we’re in front of powerful seasonality in Nov/Dec, econ data remains within “goldilocks”, oil has fallen below $70 (and potentially more with Trump’s new pick for Energy), and the Fed is easing.

Still, semis look weak and QQQs have dipped below previous ATHs and below 20d MAs, still holding the election gap:

Semis continue to look vulnerable as a group…Here’s the SOX:

ARKK taking a breather and now below breakout level at $54/55…

TSM below previous highs (was first AI semi leader to break to new highs in mid-Oct following earnings):

NVDA sitting at key level: which way do we break after earnings? Can a big beat get the group moving in a better direction? Can anything Jensen say alleviate concerns around scaling laws? TheInformation out with an article this week talking about over-heating issues in Blackwell’s 72-chip racks and potential delays (last time this happened was the bottom in the stock)…

ANET gap down and follow through following earnings:

MRVL still looks solid:

AVGO failed to break to new highs now rolling over…typically finds support at 150d:

Software: Gravestone Doji on the weekly pointing to more digestion? PANW SNOW ESTC NTAP ZM WDAY ADSK CRWD OKTA CRM GTLB ADBE earnings all in the next several weeks…

We think any near-term dip is buyable.

Semis have been weak for several months now and over the last week, the debate over scaling laws and its potential limits have taken over the mind-share of semi investors’ minds. It started with The Information’s article: OpenAI Shifts Strategy as Rate of ‘GPT’ AI Improvements Slows”, with A16Z execs Andreeson and Horowtiz adding fuel to the fire. Bloomberg and Reuters added their own twist on the same theme.

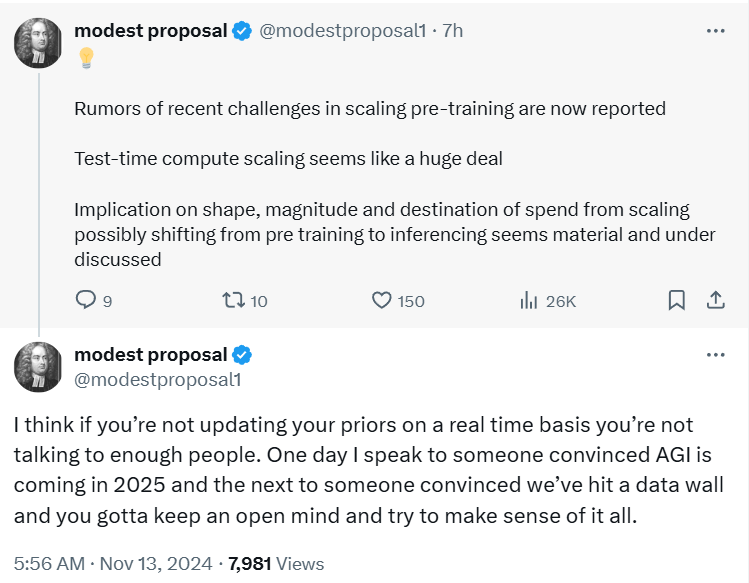

So far what we know is: Scaling drove big gains in model performance and the big LLMs are all saying we are seeing less incremental improvements right now - in other words, scaling and increasing farm sizes may no longer be a primary driver of AI model performance improvements any longer. The path forward may be more creative ways to drive improvements in models and to make intelligent use of inference and agents to increase the efficiency and efficacy of solutions. However, those are big “may’s”. As ISI points out this weekend: “the relationship between model performance and compute has held across 13 orders of magnitude increase in compute resource allocation. That is the predicted relationship between model improvements has held across a more than 10 trillion-fold increase in the compute power dedicated to model training" Models haven’t begun being trained on the largest GPU clusters yet. There could be issues in the methods of traning that are affecting this. In other words: plenty of reasons for skepticism right now. This is all very TBD…

We would point to this tweet:

The key questions are: what does this mean for hyperscaler capex in 2026? How does NVDA’s moat look like in a world of more inference vs training? Can AI Apps/AI agents ramp quick enough to make up for potential slowing of hyerpscaler capex? Does the world move towards APUs (tightly coupled set of GPU/CPUs) and what does that means for NVDA, AMD, and ASICs? What are the implications of that on the supply chain and ASPs?

Yes, the end of scaling laws would have a profound impact on AI infrastructure spend. But right now, questions are being asked and potential narratives are building, but we have no answers yet and I don’t think this is an issue that gets resolved over the next several months. To us that means we’ve likely reached the fever pitch of worries about this given all the hoopla this past week and we just have to wait and see how new models look like early in CY25 and as models are trained on larger GPU clusters (GPUs are good at matrix multiplication; GPUs scale both as a function of standalone chip performance and size of the cluster). This is all moving quick and it’s a beautiful time for those that have a flexible mind.

How is this debate affecting my positioning near-term? Last week, we wrote about scarcity becoming an increasing driver of stocks in Tech:

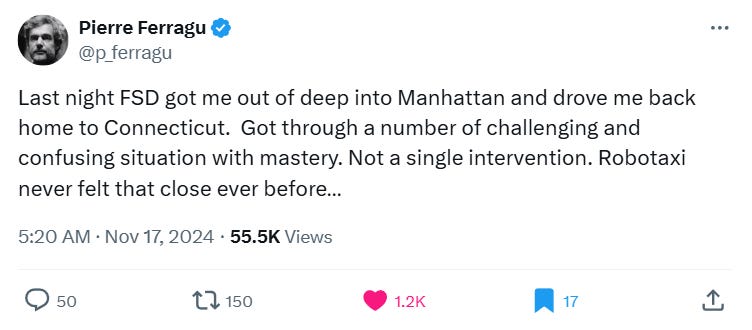

TSLA: One of only ways to play AV and Robotics (+ a good narrative with low cost model and robotaxi catalysts in 2025 along with Musk Trump Bromance). We’ve written about keeping a long-term position on here. APP/PLTR: A couple of the only mid-cap sw stocks to get exposure to application layer AI exposure. CRM: One of only ways to get exposure to AI Agents. IONQ: Only way to play Quantum. These themes (AV, robotics, AI agents, App Layer AI…I need to dig into quantum more but sounds sexy) some of my early favorites for 2025 and there isn’t a lot of market cap to go around in them so the winners here getting bought up.

We also talked up the building narrative surrounding Bitcoin. While Tech was down 2.5% on Friday, guess what those stocks did? TSLA +3%..APP +2%…PLTR +11%…IONQ…11.4%…CRM -2%…COIN +9.5%

In terms of large cap, we like TSLA and CRM the best and think some exposure to BTC is a must. We played TSLA into the robotaxi event and advocated leaving on a long-term position. We continue to believe in that and think having some sort of a position is a must as we head into 2025:

In my mind, the two main minefields Tech investors are trying to avoid right now are: 1) Potential tariffs and their impact over the medium term 2) impact of scaling laws/potential slowing of GPU spend into 2026

That means a shift into sectors/stocks that aren’t impacted by those: software and payments are the most insulated. Large cap internet is relatively insulated but META/GOOGL have Temu/Shein ad spend risk (along with Tiktok/regulatory concerns, respectively) and AMZN has Tariff risk where more than 70% of the products sold by wholesalers and retailers on Amazon are produced in China. We think the net benefit to AMZN is largely positive as in a world with Tariffs (assuming the consumer holds up) consumers will flock to the largest marketplace to find the best price and tariffs are likely to help overall ASPs. We still love AMZN as a long. NFLX/SPOT seem the cleanest stories here in that regard.

Our medium-term NFLX long has worked, but wouldn’t be shocked to see some sell the news reaction to the Paul v. Tyson as the stock rallied into the event as expected. NFLX announced 60M users watched the fight, which we think is a pretty great number (20%+ of 280M total subs). Next catalysts are NFL Live and Squid Games 2 release on Dec 25/Dec 26 and given how NFLX acted into this event and its success, we look forward to playing a 1-2 week long trade into that event as well. WWE raw starts Jan 6.

CRM continues to be our favorite large cap software stock rt now (see last week’s weekly for a discussion). The tenor of checks has surprised us positively so far, with Jefferies noting this week that Agentforce is driving bigger deals already across the board. We like the top down and bottoms up thesis on CRM which we think creates a powerful combo for re-rating higher. Top down, CRM exposed to one of our favorite 2025 themes: AI Agents and we think the ROI selling into salespeople/power users is much easier to prove than selling co-pilot to finance users. MSFT is in firmly in the “funding short” camp (see BizInsider article on Co-pilot woes this weekend) and CRM is under-owned - we think MSFT $’s will flow into CRM over the next couple months. We think agentforce tailwinds are enough to shift CRM back into a double digit grower allowing it to re-rate higher as it’s only trading at 20x Cy26 FCF. Agentforce World Tour NYC is on Wed and some on sell-side holding partner meetings with investors around this, which we think could bring another round of +ve news flow.

We think BTC is one of the most interesting assets out there now. We think the combination of BTC playing a larger role in an AI-influenced financial ecosystem coupled with Trump’s focus on BTC make for a powerful combo. We think it’s prudent to have some exposure here, especially with all the talk of corporates, govt’s and states increasing BTC holdings. Some interesting news items from the week:

Pennsylvania plans to add BTC to its government balance sheet by following Florida’s interest in BTC

MSTR plans $42B offering to buy BTC over the next few years

More public companies add BTC to their balance sheet. $TZUP $GNS $STI $SMLR

US government congress puts together BTC reserve bill to buy 1 million BTC

MSFT final vote for BTC investment in December

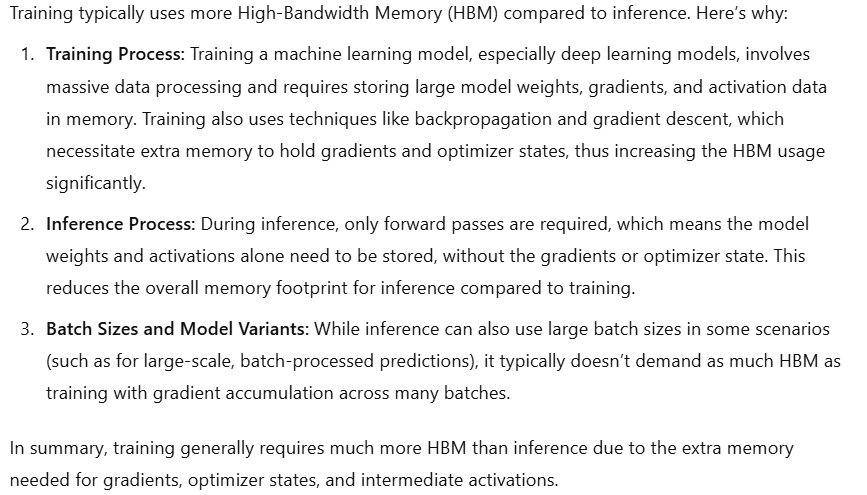

MU: We’ve talked about MU’s r/r under $105 being one of the best in Tech. While we still think this is true, we wrote this week how in a world of increasing inference vs. training, demand for HBM is less than it would be vice-versa as less HBM is needed for inference:

This has given us a bit of a pause longer-term as well as potential impact of tariffs on Build of Materials for smartphones and PCs (higher costs might mean some DRAM cuts from hardware OEMs…). Checks continue to be negative surrounding conventional DRAM as Edgewater trimmed its NAND and DRAM price forecasts and sees MU’s outlook softening further in the first half of 2025. Cowen was also out mixed note this morning expressing near-term caution through Q2'25 but sees second-half improvement.

Still, we think focus will shift to HBM demand as Blackwell ramps over the next 3 -4 months and stock has now filled the gap from its beat in late Sept. We still like the r/r here but the picture has become a bit more muddied over the last couple of weeks and we are in wait and see mode in terms of sizing it up.

NVDA Earnings Preview

Reports Wed. after the close

8.8% implied move vs 7.4% average move

+186% YTD; +12% since last earnings; -5% from ATHs

Long-term Positioning: 9 out of 10

Short-term Positioning: 8 out of 10

Bogeys:

Q3 Total Revs: $34.5B vs street at $33.2B ($2B ahead of the guide)

Q3 DC Revs: $31B vs street at $29.3B

Q3 GMs: 75%+ vs street at 75% and guide 74.4% to 75%

Q4 Total Revs: Total Rev guide $38B vs street at $37B

Q4 GMs: Inline with street at 73.3% at the midpoint

Buyside is ~$5.80 for CY25 EPS (street at $4) and $6 in CY26 EPS (street at $5)

Valuation: Trading at 24-25x buyside EPS #s

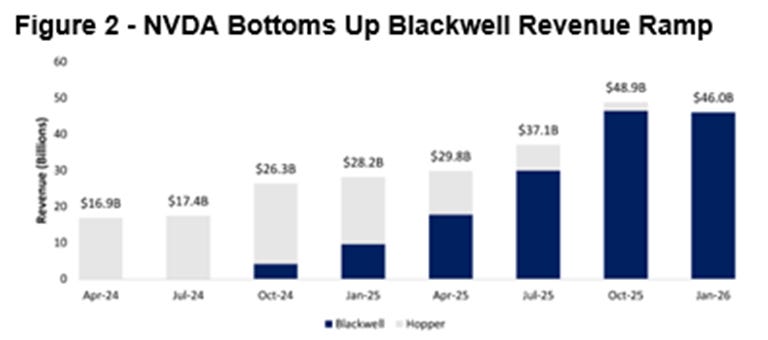

Despite all the talk surrounding scaling limits, NVDA continues to remain a crowded long among investors. On the positive side, hyperscaler capex commentary was positive from all the big players (with GPU supply still a primary constraint for cloud revenue growth). Hopper shipments remain strong and likely will be into next year even as Blackwell ramps, and we are headed into the biggest product cycle (Blackwell) in tech since the early launches of the iPhone.

However, in addition to more longer-term concerns around scaling limits and what that means for NVDA’s future (it’s a very real debate ino ur view), investors are focused on the pace of Blackwell ramp in terms of revs and what that means for GMs. While CSP commentary has been very positive, some other datapoints a little more mixed in terms of next q/BW ramp: For example, Quanta said AI server momentum is guided to slow down in Q4 and resume in late Q1’25 as mgmt expecting Q4 to be transitory between Hopper and GB200 rack. Investors also focused on ASIC competition especially ahead of Trainium’s and AVGO’s ramp next year.

Bogeys for Oct Q make sense to us: We’ve seen a pretty steady pattern of NVDA beating their guide by $2b and guiding for sequential growth of $2B-$2.5B. My issue is more on the Jan Q bogey: Street is already $2-$2.5B above vs Oct. , and given datapoints of a slightly slower ramp and supply constraints, tough to see the Q4 guide significantly above what street has already at $37B (buyside closer to $38B).

Where do we shake out? We continue to like NVDA as one of our favorite medium term AI semi plays (we rank it #2 behind MRVL, which we think is a cleaner story at the moment).

Near-term, we will likely take a small long trade into the quarter (B conviction). As mentioned above, the Jan Q buyside bogey gives us some pause so we’d like to leave some room to add. We always expected to get long NVDA for a short/medium term trade into the ramp of Blackwell. Despite concerns over scaling laws, we think that debate isn’t likely to get solved over the next 2-3 months (in fact, short-term frenzy over it probably peaked this past week) and the speculative debate for us would ring differently if NVDA were trading at an absurd multiple. It’s not - it’s sub 30x P/E. In the meantime, we get a big ramp of Blackwell while Hopper demand continues to remain strong.

Some of the best trades over the last year have been to fade extremes in sentiment and scaling law week + TheInformation article over the weekend has us feeling better into the print. In Jensen we trust.