Exclusive | Made in China 2025: China meets most targets in manufacturing plan, proving US tariffs and sanctions ineffective

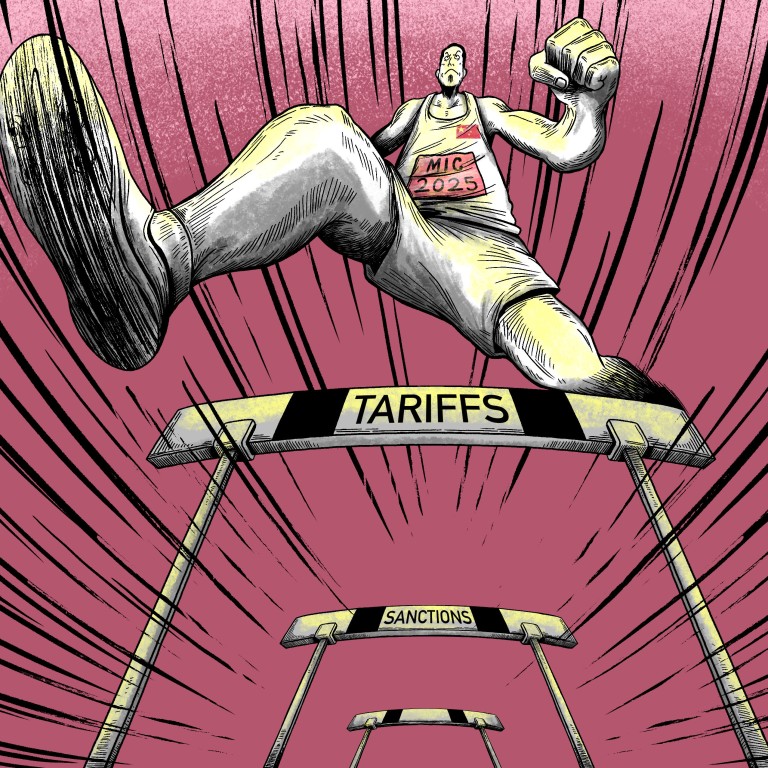

- Sanctions and tariffs implemented as part of a US-led trade war have put increased pressure on China’s manufacturing industry

- Despite that, a Post investigation can reveal a large proportion of the ‘Made in China 2025’ 10-year targets have been achieved

When the plan was first set out, most cars on Chinese roads were from Western carmakers, and the sky was dominated entirely by aircraft made by American company Boeing or European Airbus. Many Chinese factories could not operate without imported machine tools. Chips, operating systems, and software in computers and mobile phones were mostly sourced from the US. Even the databases used by banks relied on multinational corporations for coding and maintenance.

Back then, China stood at the lower end of the global industrial value chain, producing mostly cheap and technically backward products. Made in China 2025 sought to change that, allowing Chinese manufacturing, through scientific and technological advancements, to produce high-quality, hi-tech and high-value products.

But based on official books published a decade ago and other authoritative sources, the Post has compiled more than 260 goals previously proposed under the plan. These goals span 10 key areas, many involving highly specialised and complex technologies.

Some goals remain unfulfilled, including advanced photolithography technology which is used in circuit manufacturing, intercontinental passenger aircraft and broadband internet satellite networks. This year, the Chinese government has proposed another ambitious plan to develop “new productive forces”, which is seen as a continuation of the Made in China 2025 initiative.

But it is doubtful just how successful they may be. Looking at the restrictive measures the West has put in place to date, they have proven limited in their effectiveness – and sometimes even counterproductive.

One of the areas where China has faced the most roadblocks has been the information technology industry.

Despite this challenge, China has achieved most of the goals set in integrated circuits, communication equipment, operating systems, industrial software and smart manufacturing. Chinese companies can now produce high-value products including servers, desktop CPUs, solid-state drives, high-speed fibre optics, industrial operating systems and big data systems. Some of these products have captured a considerable market share.

In the field of photolithography technology, Huawei Technologies has achieved double or multiple exposure processes for high-end chip manufacturing. However, China has not yet achieved industrialisation of the most advanced EUV photolithography technology, so this goal has not been fully achieved.

The goal of autonomous measuring and detection equipment has also not been accomplished, in part because there are fewer US sanctions in this field. According to the latest industry data, most smart meters and online compositional analysis equipment used in the Chinese market are still foreign brands.

In the world of EVs, the technologically advanced vehicles produced in China have been eagerly sought by global consumers, propelling China to surpass Japan as the world’s biggest car exporter last year.

In fact, the more acclaim the Chinese EVs attract, the more sanctions they are hit with; they have become the main target of a new round of sanctions and tariffs with the US and some European countries citing Chinese government intervention as their reasons for the move.

Chinese electric vehicles are not only price-competitive but also technologically ahead of their competitors. As early as a decade ago, the Chinese government set the development of low-cost, high-performance, vehicle-mounted lidar as a national goal. This has enabled Chinese carmakers to develop more reliable and powerful intelligent driving systems than competitors like Tesla, which do not use lidar.

Nowadays, new Chinese-branded cars can connect to the internet and provide rich entertainment features – something which was also planned a decade ago.

Aerospace is one of the longest-sanctioned sectors in China. Chinese satellites and rockets cannot use American chips, components or technology. Non-Western satellites using US technology cannot be launched in China. Nasa scientists are also banned by law from any communication with their Chinese counterparts.

The strict rules meant Chinese scientists and engineers had to rely purely on their own efforts – and it has paid off. They have achieved almost all the goals, including Mars landing exploration, the global BeiDou satellite navigation system, a space station, landing on the far side of the moon and building the world’s largest commercial satellite observation network for Earth observation.

However, the speed of building a giant internet satellite constellation to compete with Starlink has been slower than expected. Also, the asteroid exploration plan originally scheduled for launch in 2023 has been postponed to 2025.

Meanwhile, in China’s power equipment technology sector, according to the Post’s investigation, the Made in China 2025 plan has seen the country transform from a follower to a leader.

They have also created the world’s most powerful hydroelectric generating units, the most efficient solar power stations, the most powerful wind turbines and the most advanced, largest-scale long-distance transmission and distribution network.

These advances have had a ripple effect, improving the global competitiveness of China’s entire manufacturing sector, and also potentially impacting future artificial intelligence (AI) competition because of AI’s high energy consumption.

The sector’s unmet goals include ultra-high-power gas turbine power generation equipment and a 2 gigawatt nuclear pressurised water reactor.

Chinese companies can independently design and manufacture the world’s most advanced superconducting magnetic resonance system, which can generate a magnetic field of 5 tesla, 70 per cent higher than the planned target. Its price is just one-tenth of similar Western products, significantly reducing the cost of hospital examinations for Chinese patients needing MRIs.

Anti-cancer drugs developed by Chinese companies have started to enter the US market, with prices just a fraction of similar drugs offered by Western pharmaceutical companies.

Technological advancements have also significantly increased China’s agricultural output. Despite limited cultivated land, China produces more than half the world’s vegetables, thanks to the use of drones, automatic seeders and biotechnology.

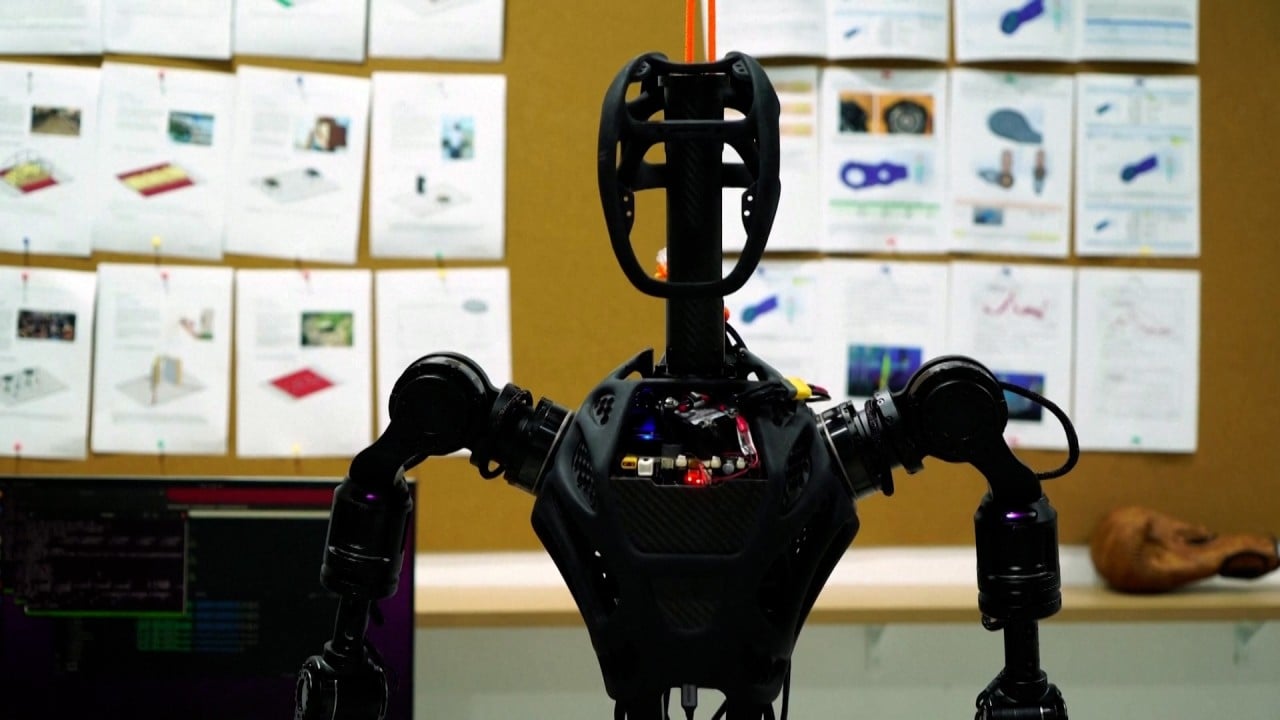

Products like robot dogs made by Chinese companies have also beaten international competitors with leading performance and low prices.

The sector with the lowest Made in China 2025 completion rate is new materials, now at only 75 per cent.

The pending targets include the industrialisation of large-size deep-ultraviolet non-linear crystals, low-cost titanium alloy powder, certain special superconducting materials, graphene electrode materials that can double the range of lithium-ion battery-powered cars, and some special chemical materials.

“China has basically achieved the vision set 10 years ago,” according to Zang Jiyuan, a scholar specialising in strategic research on China’s manufacturing sector at the Chinese Academy of Engineering (CAE).

“Manufacturing development in China has never been at a standstill, and containment by the West has been accelerating China’s efforts to achieve technological self-reliance.”

Many other countries have initiated similar plans to bolster their manufacturing sector. Germany’s “Industry 4.0”, introduced in April 2013, focused on digitising supply, manufacturing and sales data within production processes. The US launched the “Industrial Internet Revolution” at about the same time, aiming to improve industrial processes through the Internet of Things and big data technologies.

In May 2015, Japan’s Ministry of Economy, Trade and Industry initiated a plan for a digital upgrade of the manufacturing sector. France also launched its “New Industrial France” programme to adapt digitisation and smart technologies.

Since 2012, a team led by CAE researchers has been working on a scoring system to measure the performance and strength of the manufacturing sector in nine major countries. The results show that China has made significant progress over the past decade.

While total output is important, the index also measures dimensions such as the economic efficiency, innovation and industrial structure of the manufacturing sector. For example, if a country’s manufacturing sector has more globally recognised brands, higher R&D investment intensity and higher product profitability, it will receive a higher score in the system.

In 2012, China scored 89 points, placing it fourth in the world, with the United States (156), Japan (126) and Germany (119) making up the top three.

By comparison, according to the latest annual report released at the end of December last year, China was still in fourth place in 2022, but the gap between its scores and those of the other three countries had narrowed, with the United States, Germany, Japan and China scoring 182, 133, 126 and 124 respectively.

Going by this index alone, Germany and Japan have maintained a relatively stable pace, while the US is making rapid progress and is well ahead of other countries.

“The US is still the undisputed world leader in manufacturing, especially in industries such as military technology and aerospace,” Zang said.

US sanction threats against Chinese banks over Russia trade ties risk ‘gargantuan’ financial instability

- Reports suggest US has ‘preliminarily discussed sanctions on some Chinese banks’ over their trade with Russia

- Analysts say moves to remove China from the Swift interbank financial system could create a ‘huge problem’ for global trade

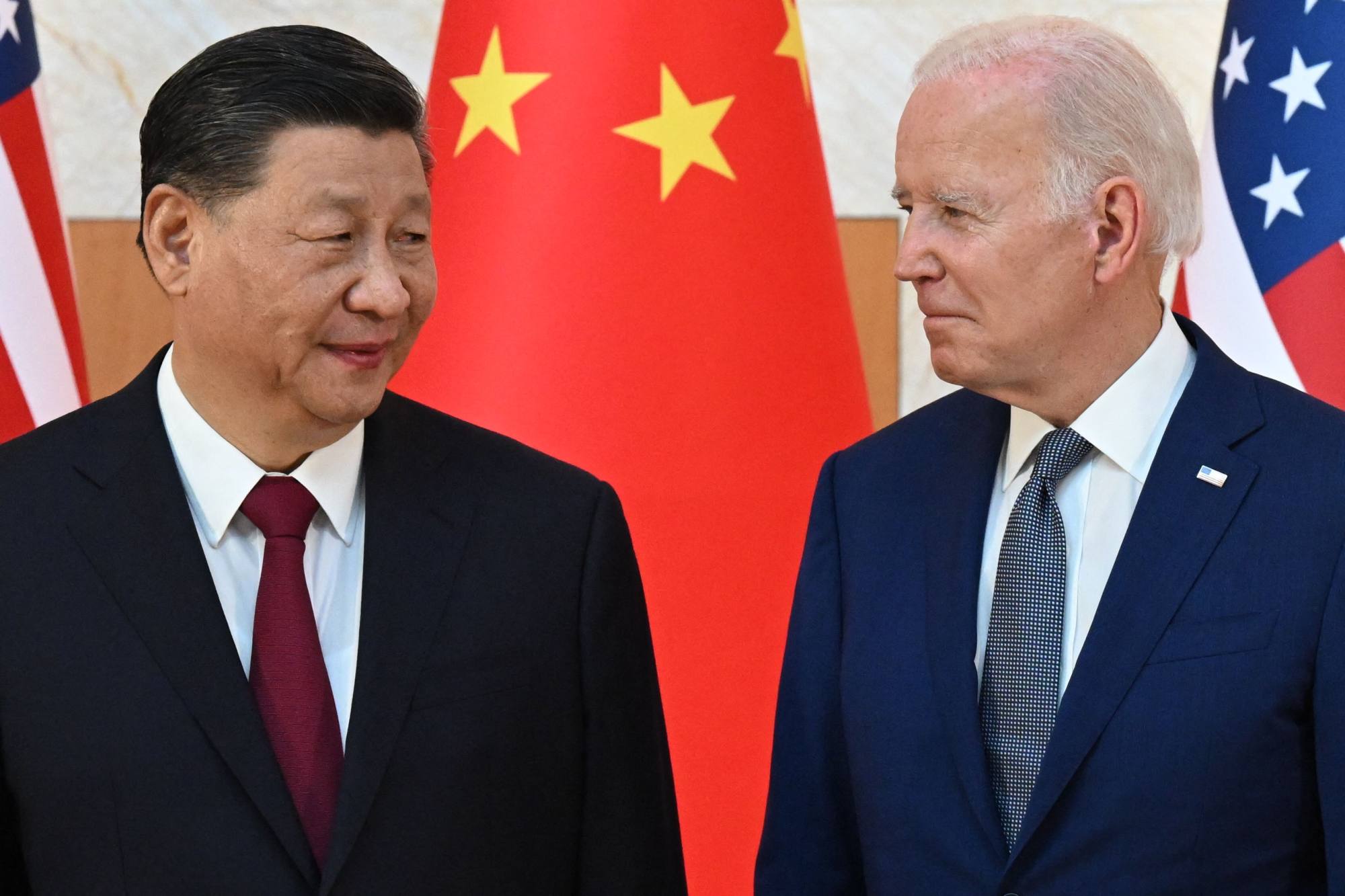

Washington would create global financial instability, while damaging the United States’ already tenuous ties with Beijing, if it carried out reported threats to sanction Chinese banks over their trade with Russia, and even cut China out of the Swift global interbank system, analysts said on Wednesday.

The Wall Street Journal reported on Monday, without elaboration, that Washington was drafting sanctions to help US Secretary of State Antony Blinken persuade Beijing to stop any commercial support for Russia’s military production.

But any financial sanctions against China as a major trading partner with much of the world would set back transactions in Europe and the US, where merchants conduct brisk business with China, the analysts said.

This could severely impede the interests of American companies and investors in China

“The US would be creating a gargantuan source of financial instability for not only China, but also itself,” said Brian Wong, a fellow at the Centre on Contemporary China and the World at the University of Hong Kong.

“This could severely impede the interests of American companies and investors in China, especially given the likely retaliation that would come either immediately, or in due course.”

And the possible removal of China from the Swift network is a “nuclear option” that would set off a “significant logjam in transactions and clearing for trade, which would culminate in cost-push inflation across the board”, Wong added.

China’s world trade reached 41.76 trillion yuan (US$5.8 trillion) in 2023, while its vast consumer market is coveted by foreign multinationals.

China’s ‘extreme’ national security focus a drag on business: US trade group23 Apr 2024

The Society for Worldwide Interbank Financial Telecommunication network, which is widely known by its Swift acronym, allows roughly 11,000 financial institutions to exchange money transfer instructions.

But to also cut China from the network would inconvenience companies abroad, especially in Europe where multinational companies trade robustly with China, said James Chin, a professor of Asian studies at the University of Tasmania in Australia.

“[Removal from Swift] will be a huge problem because China is a main trading partner for many countries around the world,” Chin said.

“I think they will face opposition from European countries and other countries that do a lot of business with China.”

What is China’s Swift equivalent and what are its origins?9 May 2022

Added to their pile of differences over trade, technology and geopolitics, the US and China differ in their approaches to Russia.

Washington has punished Moscow over the war in Ukraine, while China has taken a neutral stance and still conducts business with Russia.

And sanctions against Chinese banks would accelerate China’s efforts to craft its own intercountry transaction system and internationalise the yuan, analysts said.

It would risk causing a major bilateral crisis that would make it impossible to work constructively with China on any issue

Broader ties between China and the US would suffer if any bank sanctions took hold, said Denny Roy, senior fellow at the East-West Centre think tank in Hawaii.

“It would risk causing a major bilateral crisis that would make it impossible to work constructively with China on any issue,” he said.

In ‘no-limits’ partnership, why isn’t China letting Russia take out yuan loans?4 Mar 2024

The Reuters news agency reported on Wednesday that the US had “preliminarily discussed sanctions on some Chinese banks”, but with no short-term plan to carry out such measures.

The Reuters report, which quoted a US official speaking on condition of anonymity, said Washington hoped diplomacy would “avert the need for such action”.

Wong called exploration of bank sanctions “largely a calculated bluff” and a “signal” from the US, who want to increase pressure on China over its stance on Russia.

What if Russia’s capacity to sustain itself in the war continued unabated

Russia and China have nearly eliminated the US dollar from two-way commerce according to Russian Foreign Minister Sergey Lavrov, state-owned Russian news service TASS reported on Monday, and instead favour the yuan and rouble.

“The logical follow-up question is what the US would do about the aftermath of such sanctions,” said Zha Daojiong, an international studies professor at Peking University.

“For example, what if Russia’s capacity to sustain itself in the war continued unabated?”